Rates fall again for UK’s savers and borrowers

MARKET interest rates are still falling five years after the Bank of England slashed the base rate to 0.5 per cent, official data and Goldman Sachs research showed yesterday.

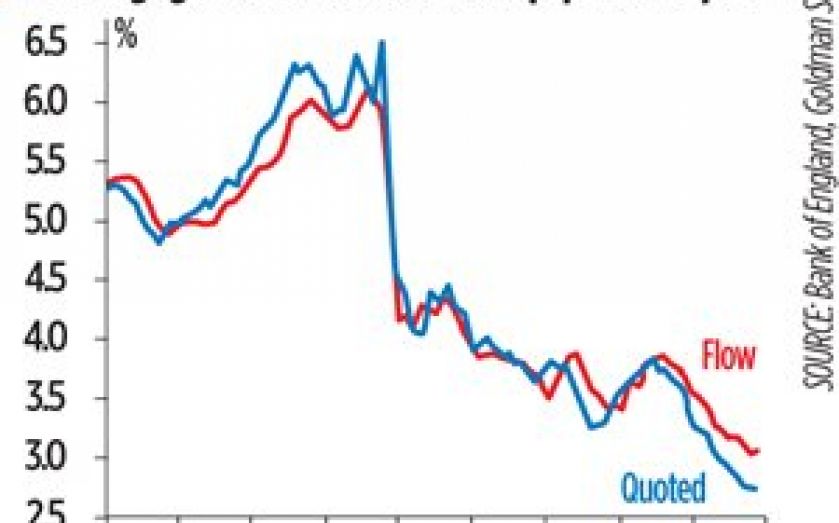

Mortgage interest rates on new loans now average around 2.75 per cent, Goldman analysts said.

The rates have fallen by more than one percentage point in the 18 months since the Funding for Lending Scheme was introduced, giving banks access to cheap Bank of England funding. And rates on home purchase loans have fallen from just above four per cent at the start of 2009 and above six per cent in 2007.

Meanwhile savers are also seeing rates fall further.

The proportion of banks cutting deposit interest rates outweighed the number increasing savings rates by a margin of 14 per cent in the last quarter of 2013.

There is no reason to expect that to come to an end – other sources of funding such as bonds and commercial paper are getting cheaper even more rapidly, according to the Bank of England’s quarterly liabilities survey.

And despite the growing economic recovery, Goldman Sachs’ economists do not expect the base rate to rise this year.

“We expect unemployment to fall to the Bank of England’s seven per cent threshold in mid-2014 but we think the monetary policy committee will not begin to raise interest rates until mid-2015,” said Kevin Daly. The economist argues the policymakers will use other tools to limit banks’ lending before hiking rates.