Raising windfall tax would be “disastrous” for Britain, says North Sea body

Expanding the windfall tax would be “disastrous” for the North Sea’s oil and gas sector, warned a leading industry group in a letter to Chancellor Jeremy Hunt.

Brindex hammered the UK as one of the most “fiscally unstable and complex regimes to do business in” and that increasing levies on producers would undermine its ability to boost the UK’s energy security with more projects and exploration.

The North Sea body represents 20 British oil and gas producers including top ten suppliers such as Harbour Energy, Ithaca Energy, and Neo Energy.

It collectively holds interests in over 400 oil and gas licenses in the UK, with provable reserves of 1.7bn barrels.

In the letter, seen by City A.M., Brindex explained that companies needed to be “certain of the fiscal regime before we start to invest.”

It said: “Windfall taxes create fiscal shock and uncertainty which, for investors, make the basin riskier, harder to predict and which negatively impact on decisions to invest in the UK.

“Windfall taxes may deliver increased short-term revenues but they negatively impact longer-term energy security and the appetite and financial ability to deliver on the energy transition.”

Brindex described the UK’s oil and gas sector as “already high-risk, high-cost and technically challenging” due to the basin’s maturity and geology, which meant investment was becoming “increasingly more difficult” compared to other countries even before the levy was brought in.

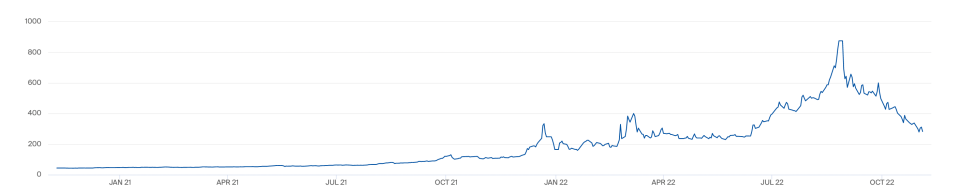

The letter follows the unveiling of the Energy Profits Levy (EPL) in May, when the former Chancellor and now Prime Minister Rishi Sunak announced a further 25 per cent tax on the profits of North Sea oil and gas producers.

This was on top of the 40 per cent special corporation tax they already pay, and was intended to fund the energy support packages for households grappling with record energy bills as fossil fuel companies enjoyed bumper profits from booming oil and gas prices.

Government grapples with North Sea dilemma

The Government has included further oil and gas exploration and development in its energy security strategy, and has encouraged further projects in the North Sea.

Nevertheless, Downing Street is widely expected to toughen the levy next week – as it grapples with a fiscal black hole, after it spent tens of billions of pounds on both the furlough scheme and support for households and businesses with their energy bills over the winter.

This could include expanding the windfall tax’s end date from 2025 to 2028, and raising the levy from 25 to 30 per cent, according to multiple media reports.

However, Brindex argues its members are not “the supermajors” who are reporting record quarterly profits – chiefly outside the UK.

It said: “Our members are being unfairly treated by the EPL which hurts us disproportionately more than the super-majors.”

Rival trade association Offshore Energies UK has also written to the Chancellor in recent days, requesting an urgent meeting.

It cited fresh data from the North Sea Transition Authority in its latest economic report, suggesting as much as 15bn barrels of oil and gas could be extracted from the continental shelf with further exploration – enough to help meet the UK’s energy needs until 2035.

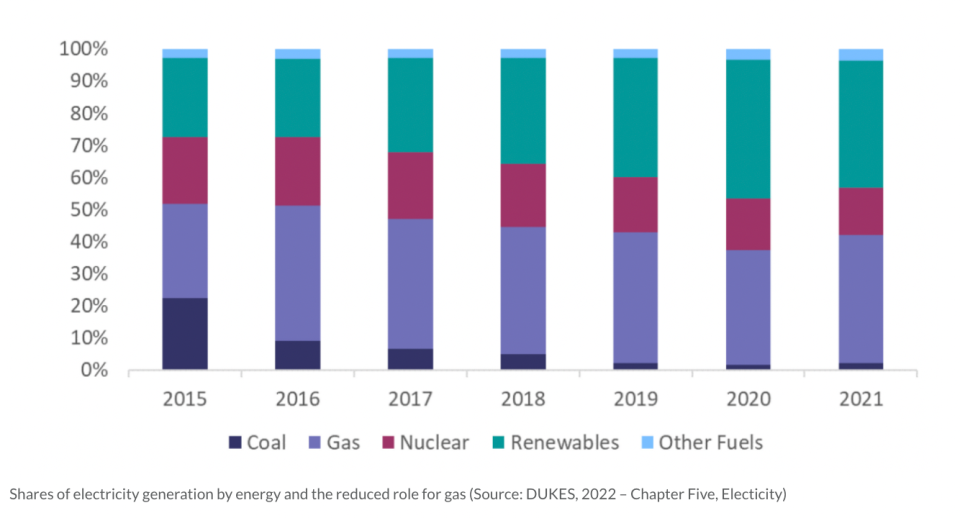

The UK produces around 45 per cent of its gas domestically – and relies on Norway as its chief overseas partner, which meets 38 per cent the country’s gas needs.

The Climate Change Committee, Westminster’s independent advisory group, predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.