RAB funds are on the rocks

RAB Capital, the hedge fund that was one of Northern Rock’s biggest shareholders when the bank was nationalised, yesterday reported dismal results with first half profit down 44 per cent and a decline in assets under management.

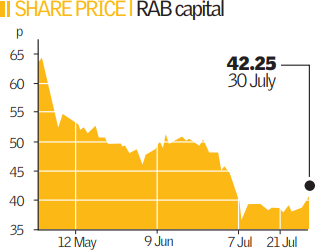

But the stock rose by 9.1 per cent to 42p on rumours that management would be willing to consider a buyout. The stock has lost 52 per cent of its value in the last twelve months.

The fund that took the biggest hit was RAB’s £700m Special Situations fund, run by chief executive Philip Richards, which slipped 23 per cent due to its investments in mining and Aim stocks.

One of its biggest investments was in African Minerals, a diamond miner that has fallen 25 per cent since June. It also holds Falkands Oil and Gas, which has lost 3 per cent this month, and Oxus Gold which has dropped 11 per cent.

The Special situations fund also held an 8 per cent holding in Northern Rock, although most of the losses from this investment were written off in previous results.

RAB is still pursuing legal action against the government for the way it took Northern Rock into public ownership.