Punch lenders reject a £2.3bn restructure plan

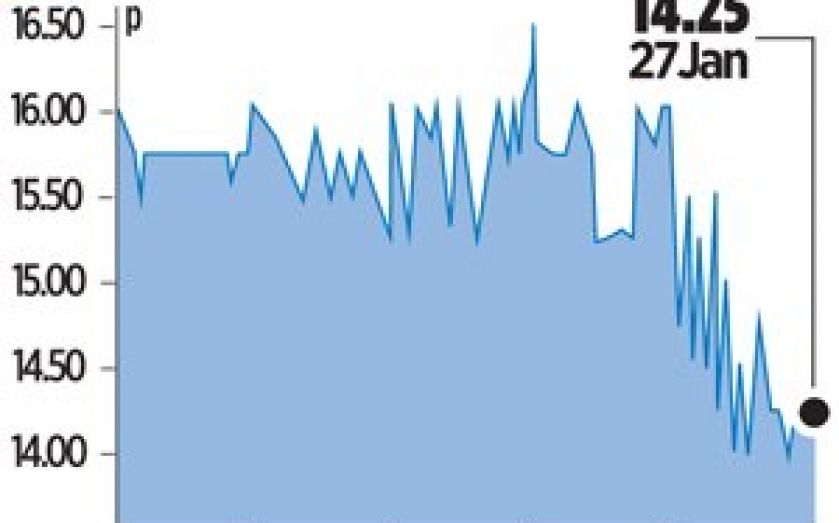

PUNCH Taverns has hit another stumbling block in its efforts to resolve its £2.3bn debt-pile after creditors said yesterday that they would not support its revised restructuring plans.

The pub group, which has over 4,000 pubs in the UK, warned on 15 January that it could be unable to continue trading unless a deal can be reached over its debt built up after an acquisition spree in the last decade.

The management, led by executive chairman Stephen Billingham, has been at loggerheads for months with a group of senior lenders represented by a special committee set up by the Association of British Insurers (ABI), which has rejected earlier proposals as too generous to shareholders and junior creditors.

Punch’s complicated debt structure is split into two securitised vehicles, Punch A and Punch B, which need regular cash injections from the parent company to keep them from breaching covenants.

Earlier this month Punch put forward a third proposal, which needs a 75 per cent approval from each of the 16 groups of lenders if it is to pass the vote on 14 February.

But bondholders are still not happy with the terms. In a statement yesterday the ABI said: “”The creditors and their advisors have carefully considered the revised proposals issued by Punch and the related legal documents made available. They are unable to support these proposals … and accordingly will vote against the proposals.”

“The creditors believe Punch should reopen negotiations,” it added.

Punch responded saying it has acknowledged the statement and would be available for discussions.