Prudential decides to keep Egg

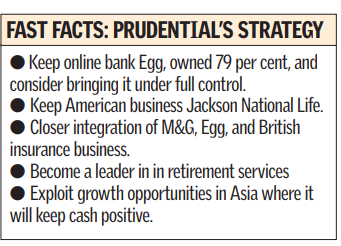

The CEO of Prudential yesterday vowed to work on closer integration of three key businesses as he revealed results of a long-awaited strategy review.

Mark Tucker said the insurer planned to integrate M&G more closely with online bank Egg and the British insurance business, raising the prospect of job cuts.

He said that closer integration could lead to enhanced purchasing power and that the plan was still a work in progress. Tucker, who took the reins of the Pru earlier this year, also confirmed plans to keep Egg, in which it owns a 79 per cent stake valued at around £650m. In addition, the insurer would be cash positive in Asia in 2006 without curtailing growth.

Shares fell by 2.5 per cent towards the end of the day amid disappointment that there had not been a more radical overhaul of the business.

Andrew Fisher, head of equity analysis at Barclays, called the third quarter new business figures that accompanied the strategy “good”. He said there had been “robust organic growth in all parts of the business, with a weaker than expected Britain and Europe offset by strong growth in Asia and America”. Fisher added that there were concerns over the Taiwan division, however. The company had a 16 per cent increase in third-quarter sales in its regions to £481m.