First-time buyers to borrow more and for longer this year as wage growth will fail to keep pace

First-time buyers face the biggest financial hurdle to homeownership causing them to borrow more in 2022.

However, it is existing homebuyers that are now more stretched when it comes to their earnings and the amount they are required to borrow.

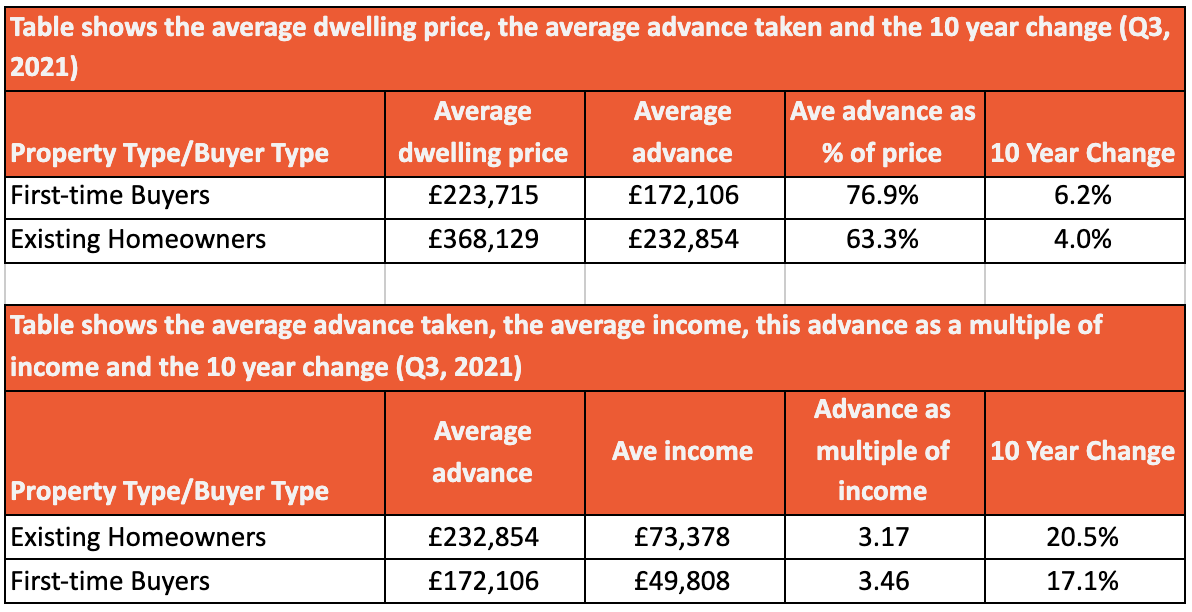

Analysing 2021 data from the Office for National Statistics, shared with City A.M. by estate and lettings agent Barrows and Forrester, the firm looked into the average cost of a property, the average advance taken on this property (amount borrowed via a mortgage), the average income of homebuyers and how it had changed over the last decade.

Advance as a percentage of property price

The research shows that currently, the average existing homebuyer takes an advance of £232,854 when purchasing a property – equivalent to 63.3 per cent of a property’s value.

In the last 10 years, the amount required as an advance has climbed by 4 per cent.

However, when it comes to first-time buyers, the average advance on a first home currently comes to £172,106 – 76.9 per cent of the total property value.

So while first-time buyers may be paying less for their home, they are required to borrow a far greater proportion of this cost.

What’s more, the size of this advancement as a proportion of total property value has increased by 6.2 per cent in the last decade, 2.2 per cent more than existing homebuyers.

Income required for property advance

Not only are we borrowing more, but a lack of wage growth is also evident when looking at the advance taken to buy a home in relation to the average income.

As a result, homebuyers are borrowing more and over longer periods in order to climb the ladder and that’s after they’ve overcome the initial barrier of a mortgage deposit.

The figures show that the advance taken by the average existing homebuyer of £232,854 is equivalent to 3.17 times their income.

However, while the advance of £172,106 taken by the average first-time buyer may be lower, it equates to 3.46 times their current income – nearly three and a half years of income.

The only silver lining for the nation’s first-time buyers is that this multiple of income has increased by 17.1 per cent over the last decade while existing homebuyers have seen an increase of 20.5%.

“The property market looks very different today compared to a decade ago and regardless of your buying position, you’re going to need to borrow a fair bit more to climb the ladder today,” commented James Forrester, managing director of Barrows and Forrester.

“Wage growth has failed to keep pace and so the sums we’re borrowing are far greater in relation to the money we earn, which means longer terms of borrowing which also come at a cost due to interest payments.”

ames Forrester

“Of course, those with a foot already on the ladder are in a far better position and I know I certainly wouldn’t want to be a first-time buyer in today’s market,” Forrester added.

“Many are forced to borrow well over three quarters of their desired property’s value and this is equivalent to nearly three and a half years income. So once they do finally realise their aspirations of homeownership, the task of clearing their debt is substantially larger than it was just 10 years ago,” he concluded.