House prices “resilient” for now – but will the election throw them off course?

UK house prices are standing up to the challenge of expected ‘higher for longer’ interest rates and political uncertainty, according to the latest data.

Nationwide’s closely watched house price index showed a 0.4 per cent month on month jump in property prices in May, signalling a 1.3 per cent annual growth rate.

Whilst still lagging both inflation and historic norms, Nationwide’s chief economist Robert Gardner said the figures demonstrated a market which was not slowing down in the face of numerous headwinds.

At the start of the year many had expected interest rates to have already begun to fall by now, however stickier than expected inflation – particularly in services – has spooked the Bank of England into holding rates.

That fall would have filtered through to mortgage rates as well as consumer confidence, giving house prices a lift.

The first rate cut is now not expected until August, but markets are only fully pricing in a fall come November.

“The market appears to be showing signs of resilience in the face of ongoing affordability pressures following the rise in longer term interest rates in recent months. Consumer confidence has improved noticeably over the last few months, supported by solid wage gains and lower inflation,” Gardner said this morning.

What will the election mean for house prices?

Nationwide wonks also analysed house price data of recent general elections and the EU referendum to assess any impact on the housing market driven by Rishi Sunak’s decision to call a snap election for July 5.

The data suggests there is little impact, with sentiment and market performance driven by consumer confidence more than electoral politics.

“Past general elections do not appear to have generated volatility in house prices or resulted in a significant change in house price trends,” Gardner said.

“On the whole, prevailing trends have been maintained just before, during and after UK general elections. Broader economic trends appear to dominate any immediate election-related impacts.”

On Tuesday, Labour leader Sir Keir Starmer told the Evening Standard he would build homes at speed in London if he becomes prime minister, in efforts to ease pressures on the capital’s housing market.

Edward Heaton, founder of buying agency Heaton and Partners added: “We’d expected a short selling season this year with most transactions agreed before the summer holidays followed by a dampened autumn market because of the anticipated election. This shotgun election means we now stand a chance of having a half decent Autumn market regardless of who is elected.

House prices won’t take Corbyn hit with Starmer

“It will be fascinating to see whether buyers are willing to commit to a purchase in the next couple of months, and I suspect some of those that could be rewarded with more favourable terms than they might otherwise have expected.”

He added: “For wealthy buyers, there is certainly nothing like the fear that we witnessed in the last election with the threat of a Corbyn government. I think the domestic audience is resigned to paying higher taxes probably regardless of the outcome of the election. We anticipate many international buyers will adopt a more cautious approach until the landscape becomes clearer.”

Are Ed Davey’s stunts good branding?

Lib Dem leader Ed Davey’s madcap antics are attention-grabbing but not necessarily the best way of getting a message across, says Lucia Hodgson

On day six of the general election campaign, I started to wonder if the Liberal Democrats had any non-water themed stunts up their sleeve. We have already been treated to leader Sir Ed Davey in his first wetsuit as he toppled into Lake Windermere from a paddleboard. Next, and again sporting a second wetsuit, Davey plunged down a slip n slide, howling with laughter like a man without a care in the world – or indeed an election to win. He even conducted a Sky News interview sat in a rubber ring. Perhaps next he will challenge fellow party leaders Keir Starmer and Rishi Sunak not to a TV debate, but to a water-pistol duel.

Where his rivals have either got off to a different sort of damp start, or found themselves embroiled in slippery candidate selection dramas, the Lib Dems seem to be having lots of fun instead – and therefore, so are we. Ed Davey is not pitching himself as the next Prime Minister. His aim is very different to that of Starmer or Sunak – it is to simply be in the conversation. Despite having just 15 MPs, he’s tapped into the power of a colourful image and made himself an instant meme, and all on his own terms.

Amidst the joviality, however, stunts need to transfer into votes, and Ed Davey’s light-hearted approach to serious issues will be tested at the ballot box. I am always personally sceptical of stunts. A stunt does not a strategy make, and without a strong consistent message to follow the comedic thrills and spills, there is little left in a voters mind other than how un-serious you are. They also have a spectacular capacity to go wrong – who can forget the Ed-Stone, or the Lib Dem’s own yellow ministerial box for an alternative budget? The memory left behind is not the strong policy stance but an unfortunate blip on the electoral trail. When Boris climbed aboard a JCB digger to knock through a polystyrene wall in 2019, I may have been standing to the side, smirking with my head in my hands, but there was no doubt about why he was doing it – there couldn’t have been a better visual metaphor for smashing the parliamentary deadlock (and in hindsight, breaking through the red wall).

For businesses and organisations, the same principles apply. Be as funny or eye-catching as you like, but the message you want to leave in the public’s mind has got to follow closely behind. When the Bond Street tube roundel was changed to ‘Burberry Street’, a whole host of confused tourists and disgruntled Londoners were left wondering what Transport for London were playing at. Kids opening their Tony Chocolonely advent calendar to a missing chocolate probably weren’t going to make the leap between their absent treat and the slave trade. The purpose of a gimmick needs to be immediately clear to the consumer. The simpler the idea and the lower the level of personal disruption, the more likely you are to land a successful stunt.

Stunts are a high stakes game and people will always remember a bad one. The difference between success and failure is whether your tactics are backed by strategy. A tactic – to be in the conversation, to raise a giggle or a social media share – is not the same as a strategy – a proper ‘plan’ (to borrow another favoured election slogan this year) that will win you new customers or votes. The latter is what will truly change the debate and while I am personally hoping Davey’s next feat will be a cross-channel swim, the proof of success will be whether he can convert japes into votes at the ballot box.

Lucia Hodgson is partner at Charlesbye Strategy and a former Downing Street special adviser

Trump: Republicans “don’t give a sh*t” about trial, says major donor

Major Republican donors say they are likely to keep pumping cash into supporting Donald Trump’s presidential run, excited by polls showing him in the lead and undeterred by his unprecedented criminal conviction, according to interviews with around a dozen donors and fundraisers.

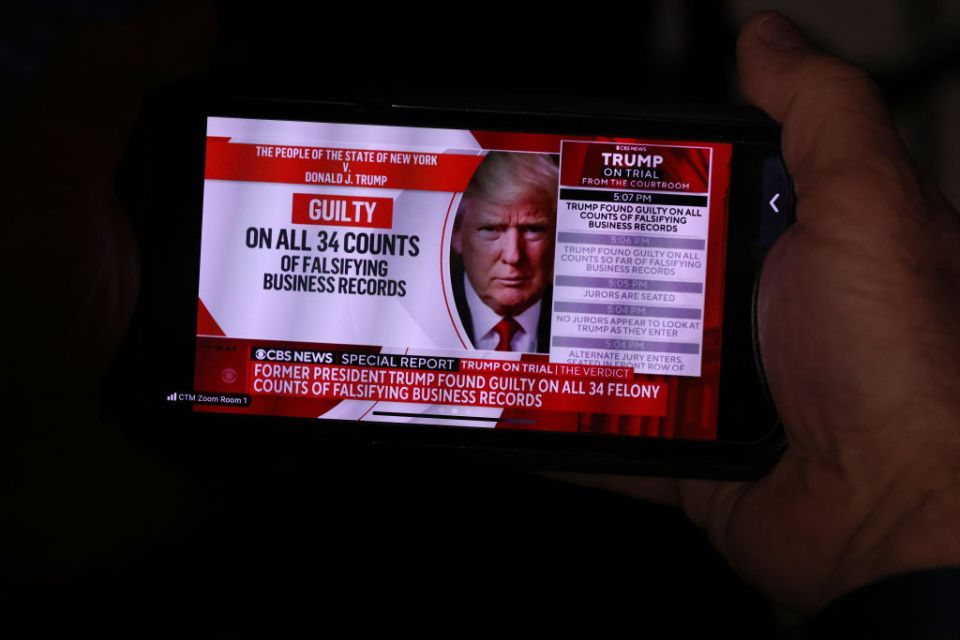

Many conservative donors already viewed the New York hush money cash as political persecution, echoing the Republican presidential candidate’s claim that Democrats are trying to weaken him ahead of the Nov. 5 election against President Joe Biden. Prosecutors have dismissed those claims as untrue. A New York jury found Trump guilty on Thursday of falsifying documents to cover up a payment to silence a porn star ahead of the 2016 election.

Republican donors are mostly eyeing a growing number of public opinion polls that put Trump ahead against Biden in some battleground states.

“I think that big donors are paying attention to the polls, not the verdict,” said oil businessman Dan Eberhart, a Trump donor who also helps raise money for the former president’s campaign. “The polls are motivating this latest round of businessmen,” Eberhart added, saying that calls from donors had picked up “considerably.”

Robert Bigelow, who is one of Trump’s top supporters having given over $9 million to an outside group supporting him, said the verdict had no impact on him. “All of the charges are contrived,” Bigelow told Reuters.

Trump convicted; what happens next?

The interviews show the depth of Trump’s donor support despite his legal woes, suggesting he will retain significant financial firepower against Biden including from Wall Street, tech and the oil sector.

The donors interviewed by Reuters were upbeat about Trump winning in November and felt the New York case against Trump was weak and designed to ensnare him.

After setting out with a major fundraising disadvantage against Biden, Trump for the first time in April outraised his Democratic rival, aided by a flurry of major fundraising events across the country. Several major donors, including casino billionaire Miriam Adelson, recently pledged support for Trump.

Andy Sabin, a metals businessman and Republican donor who supported three different candidates in the Republican presidential before settling on voting for Trump but has not donated to him so far, does not see the verdict having an impact.

“I haven’t met one donor yet that gives a shit about the trial. No matter how much they hate Trump, they think he’s getting screwed,” said Sabin, who regularly attends fundraisers and is donating to congressional candidates.

Trump can absolutely win the election, Sabin added, “as long as he keeps his mouth shut.”

In the last few weeks, the former President has hit the fundraising trail hard, hosting high-end events from Texas to New York. He is due to host three fundraisers in California next month, according to invitations seen by Reuters, including one in left-wing San Francisco hosted by tech venture capitalists.

I haven’t met one donor yet that gives a shit about the trial

Andy Sabin, Republican donor

“Every event that I’m involved with is exceeding budget,” said George Glass, a major Trump campaign fundraiser and his former ambassador to Portugal. “Most donors feel like the ‘fix’ is in,” Glass said about legal proceedings against Trump.

Some Republican donors do remain holdouts, put off by the Jan. 6, 2021 capitol riot or Trump’s brash attitude. “I’m on the sidelines,” said one donor unsure about whether to donate, mostly because of the “drama” around Trump.

Reuters

Trump found guilty. Can he pardon himself? Can he run for President? And what happens next?

Donald Trump was found guilty of 34 charges of falsifying business records last night in a bombshell New York legal case.

But with Trump running to become President of the United States in November – having also become the first US President to be convicted of a crime – what happens now?

Trump sentencing set for later in the summer

Judge Juan Merchan will kick off proceedings on Trump’s sentence on July 11. Both sides will have their moment to push their case ahead of that day.

That is only four days before the Republican national convention when he is expected – still – to be nominated as the party’s candidate for President.

The maximum sentence Trump could face would be four years in jail, though a sentence would likely be deferred if the former President – as expected – appeals the verdict.

However, as an older man with no violent convictions, it’s unlikely he would be sent to jail.

Judge Juan Merchan has not been a tremendous fan of the former President during the trial – he’s found him in contempt of court ten times.

Can Trump run for President?

Short answer: yes.

He is over 35, born in the US, and has lived there for the last 14 years.

He could still run for President even if he is in jail.

Current US President Joe Biden’s communications director Michael Tyler said Trump remains the Republican candidate and said, “There is still only one way to keep Donald Trump out of the Oval Office: at the ballot box.”

Could he pardon himself?

No. This was a state prosecution, brought by the state of New York. Presidents can only overturn federal verdicts.

However, if elected, If elected, Trump could shut down two other federal cases that accuse him of illegally trying to overturn his 2020 election loss and mishandling classified documents.

He would not have the power to stop another election rigging case taking place in Georgia, another state case.

Uncool Britannia: What is going wrong at Dr Martens, Burberry and Mulberry?

This week proved to be another challenging day for British heritage brands, with Dr Martens revealing a plummet in annual profits largely due to dwindling demand from US shoppers.

The iconic boot maker said it doesn’t expect to see recovery in its US market until the autumn seasons of 2025 and revealed it would cut up £25m in costs to help counter declining sales.

America is one of the business’s biggest markets, but it has faced a number of challenges in the region, including the hangover from bottleneck issues in its Los Angeles warehouse.

In the country, revenue declined 24 per cent to £325m due to shoppers holding off on buying the pricey shoes and issues with wholesale.

Across the whole of the group, profit before tax fell by 42 per cent on last year’s figure to £97.2m, while revenue slipped 12 per cent to £887m. It is a hefty drop from last year when it broke the £1bn barrier for the first time.

Farewell party

Dr Martens – which went public three years ago in a £3.5bn float – is also in the slow process of bidding farewell to chief Kenny Wilson.

The Aberdonian will step down after six years next April and be replaced by the business’s chief brand officer, Ije Nwokorie.

Creative, Nwokorie – who initially joined as a non-executive director- is currently shaking up the brands marketing efforts in his last run as CBO.

Dr Martens board said: “Under the direction of Ije Nwokorie, we are shifting our marketing efforts globally from storytelling focused on culture to a relentless focus on product marketing.

“Our AW24 marketing will lead and be dominated by boots and the marketing organisation has been reorganised to product-led marketing, centred around icons.”

The trading update put a ribbon on what has been a challenging year for the company, which was littered with profit warnings and calls from an activist investor to sell the company.

Jonathan DeMello, founder of JDM Retail, told City A.M. ‘Dr Martens’ results are very disappointing indeed – though not unexpected. Their profits have been impacted by a downturn in US wholesale performance, which led to their CEO deciding to step down a few months ago.

“As a brand they are reliant on the brand equity they have generated in order to stand out from the crowd – particularly via wholesale – but in the US they have significant competition for consumer ‘share of voice.’

“Their DTC strategy of branded physical stores – which as a channel now accounts for over 60 per cent of sales – should help build brand equity in the long term, alongside increased marketing specifically in the US.”

Pressure on UK luxury

The plight of Dr Martens mirrors that of other renowned British brands such as Burberry and Mulberry.

Unlike brands such as Hermes – which have outstripped rivals thanks to its recession-immune and Birkin Bag obsessed client base – Burberry’s accessibility has meant many of its customers are feeling the squeeze.

Shares in the tartan scarf maker have more than halved in the past year, leaving the stock price back near the lows plumbed during the early stages of the pandemic.

The business is currently undergoing a transformation which will focus on Burberry positioning itself as a ‘Modern British Luxury brand’.

Russ Mould, investment director at AJ Bell, said: Burberry’s shares trade at their lowest level in more than a decade, thanks to a string of profit warnings and earnings disappointments.

“The uncertain economic outlook in China is not helping here and the luxury goods industry overall is struggling to maintain the growth rates seen in the early part of this decade, especially as the combination of increased prices and the squeeze on consumers’ spending power from inflation may be pricing out more aspirational buyers of such products.”

He added: “Burberry’s shares are now valued at a huge discount relative to global peers such as Hermès, LMVH and Richemont and any sign of an upturn in trading could revive interest in the downtrodden shares.”

Trench coat inflation

Over 10 years ago, a trench coat at Burberry cost around £600, making it an accessible buy for the middle classes.

The coveted jacket now retails for upwards of a grand, leaving it out of reach and unjustifiable for many shoppers.

But that is not to say consumers won’t splurge. Parka brand Canada Goose has had little trouble shifting its £1,200 winter jackets, thanks to its appeal amongst young teenagers.

The same goes for Mulberry, the 50-year old UK designer best known for its handbags. Its full year revenue fell by four per cent in the full year due to “challenging” trading conditions for designers.

A recent study by wealth management firm Saltus showed 16.29 per cent of cash rich Brits had cut down on their personal spending due to financial pressures.

Mike Stimpson, partner at Saltus, said: “While this reduction is not limited entirely to personal spending on luxury items, it is inevitable that brands like Burberry feel the impact, although different businesses will clearly respond differently to these pressures.”

Amazon ramps up presence in takeaway market with Grubhub partnership

Amazon customers in the US can now order takeaway deliveries from Grubhub without leaving the tech giant’s app.

The state side deal is part of a deepening relationship between the tech giant and Grubhub, which is a subsidiary of Dutch owned JustEat.

Amazon customers in the US will have access to hundreds of thousands of restaurants in all 50 states with Grubhub directly on Amazon.com and in the Amazon Shopping app.

Additionally, as long as a customer remains an Amazon Prime member, they will receive a free ongoing Grubhub+ membership worth $120 (£94) a year, without automatically renewing into a paid Grubhub+ membership.

The Jeff Bezos backed business has held a three per cent stake in Grubhub since 2022, but said this may increase to 10 per cent if the company reaches certain performance targets, such as increases in the number of customers.

Amazon once ran a delivery service similar to Deliveroo and Just Eat, but shuttered the business as it turned its focus to its physical, cashier-less supermarkets.

Just Eat has continued to perform well in the UK and Irish markets, but its American arm has lagged behind.

In the first quarter of 2024, Gross transaction value (GTV) dropped two per cent to €6.55bn (£5.58bn) as North America, Southern Europe and ANZ regions all underperformed.

The City is underpricing how likely a Kretinsky-owned Royal Mail is

British post for British doors, then, even if it arrives three days late? That certainly seems to be the Square Mile’s assumption, with shares in Royal Mail owner IDS only nibbling up 4 per cent or so yesterday despite news of a bid far north of its existing price. The working theory is that Daniel Kretinsky’s bid won’t get past regulators or government. We aren’t so sure.

The investment case at IDS is fairly straightforward. One part of its business, delivering parcels, makes a bucketload of money and is widely understood to be on its way to greater growth.

The second part of its business, Royal Mail, is obliged to drop off letters to 20-million plus households six days a week, just as letter volumes fall off a cliff. Unsurprisingly, the finances of this second bit are in notably less healthy shape.

Kretinsky’s bet is twofold: one, he can make the first bit more profitable, and two, that eventually regulators will release some of the grip it has on the Royal Mail, and allow it to turn into a business that whilst unlikely to rake it in for decades to come is at least not a dead-weight on IDS’ growth at large. The City is betting, seemingly, that he won’t get anywhere near either of those tables, and that government will block the deal.

But… why? Should regulators not change the rules on universal service obligation, then Kretinsky would be obliged to meet them. It is not as if performance can get much worse: Royal Mail as it currently stands is missing its targets with the regularity of an England penalty taker. Labour, should they take power, would also have to think hard about what blocking an EP Group takeover would look like to global investors: protectionism rarely wins friends.

The collective wisdom of markets is a powerful force. But to be frank, we see little reason why Kretinsky shouldn’t soon have his prize asset.

You couldn’t make it up: Thames Water wins regulator’s innovation competition

Thames Water, the embattled utilities outfit currently losing more than 600m litres worth of water every day and which has pumped more than 72bn-litres-worth of untreated sewage into the Thames since 2020, has won an innovation award run by the regulator.

Thames Water will receive £16.9m “to examine how technologies like robotics and trenchless repair methods could help fix leaks in the future without the need to dig trenches and all the associated disruption this causes.”

The regulator’s ‘Water Breakthrough Challenge’ dishes out £40m worth of prizes to Britain’s water companies, with the money coming from taxpayers’ pockets.

Earlier this week it was reported that Ofwat was also considering slashing the scale of fines it levies on water companies for poor performance so that financially “stressed” water companies could invest the money instead.

Feargal Sharkey, the rock star turned water campaigner, was stunned by the plan.

“Stressed? Every single river in England is polluted: that is stressed. Beaches from Blackpool to Wales to Cornwall to Kent are sewage stricken and abandoned by families: that is stressed,” he told City A.M.

“Thousands of households ordered to boil their water, children hospitalised and people gathering sea water to flush their loo: that is stressed. Should this plan come to pass, we’ll know the only thing “stressed” in the water sector is the intellect of those sat around Ofwat’s boardroom table. It has become a cathedral to mediocrity, and needs tearing down to its foundations and rebuilt.”

Thames Water is in desperate financial difficulty, but that has not stopped its parent company paying dividends to other companies within its complicated corporate structure.

Those dividends total more than £200m over the last five years. Meanwhile, the combined group is now sinking in around £14.7bn in debt.

The firm has been lobbying the regulator for the ability to charge higher bills to address its financial black hole and invest in its network.

Nevil Muncaster, Engineering and Asset Director, from Thames Water said of the breakthrough prize: “We are constantly striving to evolve our business, and find new ways to do things better for the benefit of our customers and the environment. This funding will be invaluable in helping us progress some of our most exciting and innovative ideas, ones that really could change the water industry for the better.”

Helen Campbell, Senior Director, Ofwat said: “There are big challenges in the water industry that must be solved, some are well known and others are less so. In our fourth Water Breakthrough Challenge we called for solutions with potential to deliver wide-scale, transformational change for customers, society and the environment – and that’s exactly what today’s winners have done.

“From raingardens to prevent flooding to green energy from treated sewage, innovations to cut the water sector’s carbon footprint to robots that patrol the pipe network, the winners are all helping shape a more sustainable and efficient water sector,” she continued.

Nightcap ‘disappointed’ and ‘unaware’ Revolution takeover could not be delivered

The board of Nightcap said it was disappointed its takeover offer for struggling Revolution Bars was rejected and that it was unaware the deal was “incapable of being delivered.”

The statement followed a press release from London-listed Revolution on Tuesday, which said there were “a number of challenges to the delivery” of the Nightcap Proposal, and it described the deal as “highly conditional”.

The owner of Barrio and Blame Gloria chains put forward an offer for the ailing business on 17 May, but it was ultimately turned down.

Commenting at the time, Revolution said: “Following legal advice, the board has concluded that the Nightcap Proposal is incapable of being delivered, which was communicated to Nightcap last week.

“There were a number of challenges to the delivery of the Nightcap Proposal, which was a highly conditional proposal and which was subject to multiple equity fundraisings by Nightcap, assumptions regarding the support of the company’s and Nightcap’s respective lenders, material due diligence, as well as significant time, material cost and potential untested legal and procedural issues”.

However, Nightcap—which wanted to merge the two businesses—said it received legal advice at “no point” suggesting that the non-binding proposal could not be delivered.

“The non-binding proposal did not include a fixed fundraising amount as Nightcap did not receive detailed financial information to help identify the cash requirements of Revolution Bars and the enlarged business until 21 May 2024,” it said.

“The board of Nightcap believes that the Possible Offer, if it had been implemented, would have seen Revolution Bars’ highly dilutive £12.5m fundraising (announced on 10 April 2024) replaced by a merger of the two businesses, allowing for Revolution Bars’ shareholders to suffer less dilution and achieve more value from their investment.”

Revolution raised £12.5m in emergency funding to stay afloat earlier this year.

It follows what has been a challenging few months for the hospitality business, which buckled under the pressure of customers spending less on nights out.

Up to £3m of the investment is being funded by former Pizza Express and Channel 4 chairman Luke Johnson, while another £3m is coming from the German-owned Robus Recovery Fund II and £3.5m from three existing shareholders.

Nightcap added: “Nightcap respects that the board of Revolution Bars wish to pursue a different outcome and as a result Nightcap today confirms that it does not intend to make an offer for the entire issued and to be issued share capital of Revolution Bars.”

City A.M. has contacted Revolution for a comment.

Swiss rolls: Former Credit Suisse boss to leave UBS as forced merger completes

The former boss of Credit Suisse, who oversaw its untimely decline and forced sale to UBS, is set to step away from the newly enlarged bank.

Swiss-German Ulrich Korner will retire later this year, a statement from the bank said.

Korner had been serving to ensure “continuity” during the transition from two banks to one underneath UBS CEO Sergio Ermetti, who was brought in just weeks after the transaction to steer the Swiss giant.

Korner received a hospital pass in 2022, joining the bank just after a billion-euro annual loss, and most analysts believe the bank was heading for its demise even as he took the reins.

The formalities of the merger of the two entities will be signed, sealed and delivered by the end of this week, with the firm’s then joining in a single holding company in the US in June.

The Korner departure came about as part of a wider reshuffle of the top team.

Ermotti said: “Since acquiring Credit Suisse last year, we have continued to deliver on our integration priorities while staying close to our clients, positioning us well for future growth. I would like to thank (those leaving) for their exceptional contributions to the firm over the years, especially during this period of change.”

UBS has promised to launch a new share buyback programme of up to $2bn (£1.6bn) after suspending its previous plan last year following its acquisition of former rival Credit Suisse.

UBS announced last month that it would restore its repurchase programme and expected to buy back up to $1bn (£800m) in 2024.

The bank said the repurchase scheme would begin after the completion of the merger of the UBS and Credit Suisse parent companies,