Oxford Street retailers call for ‘comprehensive’ reform to business rates

A business group that represents dozens of major retailers on London’s Oxford Street has called for a “comprehensive” reform to business rates to boost Britain’s high streets.

As part of its new manifesto for the next government, the New West End Company said it is calling for a “fairer system that does not simply shift the bill to online businesses but reflects the reality of today’s multi-channel sales model”.

A report by Atlus Group last year found that a host of retail, hospitality and leisure properties in London could be faced with an extra £575.55m in business rates next year because they were not eligible for support measures outlined by the government.

Dee Corsi, chief executive of the New West End Company, said: “As the election nears, ‘growth’ has become a buzzword for both Labour and the Conservatives.

“But if our nation’s politicians are serious about delivering for the business sector, we need to take a long-term approach that tackles unwieldy business rates, encourages innovation by reforming the rigid planning system, and keeps streets safe by remodelling police funding.”

She added: “Our manifesto, informed by the more than 600 UK and international businesses that the New West End Company represents, offers any future government a roadmap to do just that.

“In a little under four weeks the public will have decided on who they want to lead the country. When the nation has had its say, I hope that the government will look to the recommendations of the nation’s businesses so that they can deliver on the promise of growth.”.

Over the weekend, opposition party Labour promised to pull up the shutters for small businesses as part of its plan to revitalise the high street.

As part of its plan Labour said it would “replace the business rates system, with a new system that will level the playing field between the high street and online giants”.

New West End also called for the reintroduction of tax free shopping for international tourist to “restore the UK’s competitive edge”.

The government ditched the VAT refund for tourists in 2021, when Prime Minister Rishi Sunak was Chancellor, which has since been dubbed the ‘tourist tax’.

The New West End Company said: “The impact of removing tax-free shopping is clear; tourist spend has fallen across the country and is soaring in nations such as France and Italy, forcing British businesses to trade at a disadvantage.

“NWEC is calling for the reintroduction of tax-free shopping to restore the UK’s competitive edge, whilst simultaneously supporting businesses and supply chains across the nation.”

City A.M. approached both the Conservative and Labour parties for comment.

The City is where science and finance meet to solve the world’s problems

The City is bringing together investors and inventors to make sure the future of space technology is sustainable, peaceful and equitable, says Michael Mainelli

Last week, here in the City of London, the Commonwealth Secretariat launched its new space protection initiative, CommonSpace. This took place at the City’s science and innovation banquet, celebrating the City of London as a centre for science and technology, which in turn reinforces its standing as a global financial centre. This is at the heart of this year’s mayoral theme, Connect To Prosper: celebrating the knowledge miles of our Square Mile. 40 learned societies, 70 universities, and 130 research institutes surround the City of London, making this the world’s most productive concentration of knowledge networks – the world’s coffee house, where science and finance meet to solve global problems. There is no challenge more global than how we manage space.

CommonSpace integrates the Commonwealth’s plan with the principles of the Astra Carta Framework launched by His Majesty the King to help companies align their space activities with global sustainability goals. Building on the Lord Mayor’s Space Protection Initiative, launched at the International Astronautical Congress 2023, which aims to protect our planet from the growing environmental and financial problem of space junk, CommonSpace brings together 56 member states of the Commonwealth, all working to ensure the future of space is sustainable, peaceful, and equitable.

We need space for our defence, for our economic prosperity and for monitoring our environment. Defence, because we want to see what our neighbours are up to.

Economic prosperity, because from internet access to mobile phone coverage to weather data, we all depend on space technology. Global satellites underpin at least 18 per cent of UK GDP, supporting everything from mapping to weather forecasting, monitoring the power grid and enabling every single financial transaction. Indeed, the space sector is shifting from one that has been largely governmental to one increasingly commercial.

And the environment, because space is an essential part of meeting our climate change and sustainable development goals. In fact, as the UN has pointed out, nearly 40 per cent of sustainable development targets use earth observation and global navigation satellite systems. There is no way we will reach net zero with the current rate of increase of space junk. So, if we want to save our planet, we need to look beyond it.

The problem is, Earth’s orbit is becoming overcrowded, not only with new satellites, but with thousands of old ones and more than a million pieces of debris. This affects the space investment landscape and risks stifling innovation.

The City of London must take a lead in tackling this challenge. The UK is the leading destination for space investment in Europe and receives 17 per cent of all global space investment, which supports almost 50,000 jobs. We are mobilising this expertise to provide Space Debris Removal Insurance Bonds and other financial products to help companies bring space junk safely out of orbit. These insurance bonds will cover space companies with the ability to de-orbit third party space debris.

The aim is to help keep space ‘clutter-free’, seeing if we can move forward to G7 and perhaps G20 communiqués on space debris. That could, for example, involve governments requiring proof of adequate financial means for retiring unused satellite and launch vehicle materials before permitting launch, orbit, registration, or ground station use. We would like to work with the private sector to develop a market for such guarantees and require adequate financial guarantees as a condition of launch by the end of this decade.

If we would not accept waste being dumped on the street, we should not accept it in space either. Using our expertise in space and insurance, the UK has the opportunity to establish itself as a global leader in space finance, working with our fellow Commonwealth members to ensure space regains its potential to transform all our lives for the better.

Michael Mainelli is Lord Mayor if the City of London

Asda entices new boss with £10m pay package

Mohsin Issa could reportedly reward the new boss of Asda with a total pay package of up to £10m, as the billionaire businessman rushes to find someone to take charge of the supermarket.

Sources told The Telegraph, a hefty sum of between £8m and £10m has been floated in a bid to end the supermarket’s hunt for a new chief.

A senior industry source said: “There’s always been a very attractive offer for [the Asda] job in terms of financials and they interview lots of people the first time around.

“The issue has quite simply been working with Mohsin Issa and that hasn’t been overcome to date.”

Moshin has been overseeing the business since 2021 after the departure of Roger Burnley. Previous attempts to find a new chief failed in 2022.

Asda said on Friday it was “undertaking an extensive international executive search to find a permanent CEO”.

It came after Zubar Issa, the other half of the billionaire Issa brothers revealed he had sold his stake in Asda to TDR Capital, the private equity giant the pair partnered with to secure its £6.5bn takeover in 2021.

Mohsin Issa will remain a co-owner of Asda alongside TDR Capital. The move means that the private equity giant now has a stake of 67.5 per cent in the supermarket while Mohsin Issa will hold 22.5 per cent.

A further 10 per cent is held by the former owner of Walmart. The deal is expected to complete in the third quarter of 2024.

Zuber Issa, who is the co-CEO of EG Group, said at the time: “Since Mohsin and I, alongside TDR, took ownership of Asda, we have driven a period of significant investment and entrepreneurial growth activity.

“Notably, Asda acquired a market-leading UK convenience retail and foodservice store business from EG Group.”

He added: “With the divestment of my Asda shares, I will now turn my attention towards leading and managing the remaining EG UK forecourt sites that I have personally acquired, and spend more time on my charitable endeavours.

“I am pleased to see TDR increasing its investment in Asda. With Mohsin and TDR’s ongoing focus and shareholding, I am confident that Asda will achieve its growth ambitions.”

City A.M. has contacted Asda for a comment.

Shein set to miss out on FTSE 100 spot as industry body flags concerns

Fast-fashion giant Shein is set to miss out on a place in the FTSE 100, according to reports, as the incoming mega listing continues to spark debate in the City.

The Sunday Times reported that the number of shares set to be sold by the Singapore-headquartered fast-fashion giant “will fall short of the minimum required to qualify for inclusion in FTSE indices”.

London Stock Exchange rules state that companies from outside the UK must have a minimum free float of 25 per cent.

Shein is said to be valued at $66m (£52m), and surpassed $2bn (£1.6bn) profit on sales of $45bn (£35bn) last year.

Shein is expected to raise more than £1bn (£79m) from the sale of new shares, according to the report.

The prospect of Shein listing on the London Stock Exchange has divided the City, however, due to claims around how it treats its workers and its general fast-fashion business model.

The British Fashion Council, whose members include Mulberry and Burberry, flagged its listing as a “significant concern” to the City.

“At a time when global fashion leaders are rightly focused on making our sector more socially, environmentally, and economically sustainable, the Government’s courting of Shein to list on the London Stock Exchange, and Shein’s decision to do so, is of significant concern to UK fashion designers and retailers,” Caroline Rush, chief executive of the trade body, told the Mail on Sunday.

“Whilst we appreciate that Shein has committed to meeting acceptable industry standards, questions remain about the ethicality and sustainability of a business model and supply chain that consistently undercuts British designers and retailers, and these still need to be answered.”

Shein has been contacted for comment, but it told City A.M. previously “made significant progress” on improving working conditions for its factory staff.

Tesco predicted to reveal ‘another strong quarter’

Tesco is predicted to reveal “another strong quarter” next week as the supermarket giant seeks to maintain sales growth despite pressure from discounter rivals.

The UK’s largest grocery firm will update investors with a first quarter trading statement on Friday June 14.

Industry experts have predicted it will reveal another increase in sales for the period, with improving volumes of products bought by shoppers helping to offset the impact of easing inflation.

Analysts at Jefferies predicted it will report 4.3 per cent growth across its UK and Ireland retail business for the three months to May.

It would reflect a slight slowdown in growth, but this is largely expected because of the continued fall in the rate of inflation.

UK food and drink inflation peaked at 19 per cent in March 2023, according to the Office for National Statistics, but dropped to 2.9 per cent in April this year as pressures from high energy prices and supply disruptions eased.

James Grzinic of Jefferies said the retailer is on track for “another strong quarter” after Kantar “pre-emptively published impressive relative sales performance by Tesco in the UK, despite UK food CPI (consumer price inflation) slowing”.

Kantar’s latest sector data indicated that Tesco has increased its share of the UK grocery market to 27.6 per cent in May from 27.1 per cent a year earlier.

The UK’s two largest grocers – Tesco and Sainsbury’s – have solidified their position in the market by investing in pricing in order to ensure customers do not switch to discounter rivals.

As a result, they have seen growth beyond that of Asda and Aldi over the past year.

Tesco revealed in April that its adjusted operating profit grew by almost 13 per cent to £2.93 billion for the year to February on the back of the continued growth.

Last month, it said it would hand chief executive Ken Murphy a £9.93 million pay package for the past year, more than double what he received a year ago, after bonuses were boosted by the strong recent performance.

Analysts at Barclays added: “Recent market share data suggests that even if Tesco’s sales growth is slowing, its performance relative to the wider UK market continues to look very robust.

“If our forecasts are broadly correct then we would see this as a positive start to the year.”

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: “The group’s market-leading offering and market position means investors are cautiously optimistic.

“Clothing and home sales may prove trickier, despite Tesco’s efforts to streamline.

“The tougher environment is closely linked to the economic climate, and analysts would like some more details on demand expectations in the medium term.”

By Henry Saker-Clark, PA Deputy Business Editor

Renting in London might finally be about to get a bit easier

Almost everyone in London knows someone who has a horror story about the capital’s rental market. Since the pandemic, demand has skyrocketed, and so have costs.

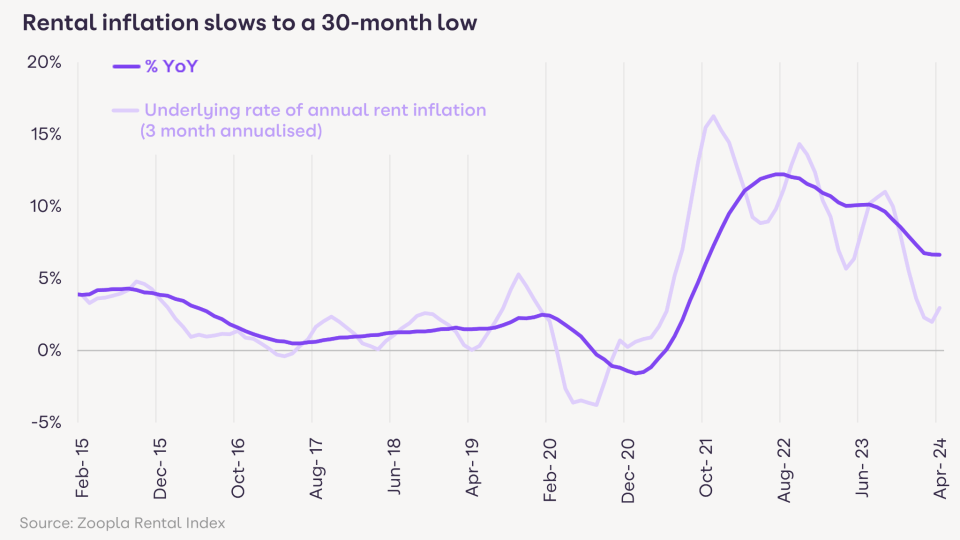

According to the data, the rate at which London rental costs are rising slowed in April, but tenants are still paying an average of £2,112 to landlords each month.

Rental inflation, the rate at which prices are rising, has cooled to 3.7 per cent compared to 13.1 per cent in the prior year period.

Richard Donnell, executive director at Zoopla, told City A.M. the fast growth in rents over the last three years has “taken the unaffordability of rented homes in London, relative to earnings, back to the highs last seen in 2014/2015”.

“This is why rental inflation is slowing, particularly in inner London where rents are highest.”

The cost of renting in the capital has skyrocketed over the last few years due to factors such as landlords selling up to avoid rising mortgage and energy rates.

Tenants are also stuck renting for a longer period of time because they can not afford rising house prices, limiting the pool of supply.

Still, green shoots have started to appear.

For example, Zoopla said rental supply in London is increasing—up by a quarter in the last year—but remains below the pre-pandemic average.

Adam Jennings, head of lettings at Chestertons, told City A.M. “Over the past weeks, we have seen an increasing number of rental properties being put on the market which has been positive news for tenants.

“Although demand still outweighs supply and tenants continue to face a competitive property search, the larger pool of properties to choose from has resulted in some landlords being more open to rent negotiations. In turn, we are seeing fewer people feeling the need to put in higher bids in order to secure a property.”

Across the wider UK, data on private landlords selling shows “a continued steady flow of homes for sale on Zoopla that were previously rented”.

This averages circa 31,000 a quarter, a level that has remained broadly constant for the last four years. Two-fifths of these homes stay in the rental market, and just over half return to home ownership.

Zoopla said current trends are expected to continue with low new investment by private landlords, meaning the stock of rented homes will remain broadly unchanged.

“Corporate landlords will continue to invest but it will take some years for this group to grow ownership levels enough to impact on supply at a macro level,” it added.

Inditex: Zara owner unfazed by wet weather as viral Tiktok clothing drives sales

The owner of Zara, Bershka and Pull and Bear, has hailed a strong start to the summer as wet weather did not seem to deter shoppers from hitting the high street.

Over the first quarter of the year, Inditex said it’s spring and summer collection flew off the shelves with sales up 7.1 per cent to €8.2bn (£6.9bn).

Cash cow Zara has remained one of the most resilient retailers in recent years, surging in popularity following the demise of Phillip Green’s Arcadia brands.

Garments the store sells regularly go viral on Tiktok, with social media stars regularly posting hauls of the latest items in stock.

Inditex, which also owns the Massimo Dutti and Stradivarius brands, also said gross profit increased 7.3 per cent to €4.9bn (£4.1bn).

Earnings before interest, taxes, depreciation, and amortisation grew eight per cent to €2.4bn (£2bn).

Commenting on the results, the board said: “Inditex continues to see strong growth opportunities.

“Our key priorities are to continually improve the fashion proposition, to enhance the customer experience, to increase our focus on sustainability and to preserve the talent and commitment of our people. Prioritising these areas will drive long-term growth.”

“To take our business model to the next level and extend our di¡erentiation further we are developing several initiatives in all key areas for the coming years.”

Inditex,runs a total of 5,698 stores globally. During the period it also reopened 19 stores across seven brands and resumed online operations in Ukraine.

Its success comes amid a challenging period for retailers, particularly in the UK, as damp weather has damaged sales.

Workspace CEO: Wework recovery poses no threat to business as firm hikes dividend

The chief executive of one of London’s biggest flexible hybrid providers, Workspace, said rival Wework has done a “lot of good things” for the sector as the chain emerges from Chapter 11 bankruptcy.

On Wednesday, the troubled co-working provider hailed the end of a restructuring of its offices in both the UK and Ireland.

The American firm, which was beloved by corporate workers for its trendy layout and office perks, has trimmed down its estate from about 50 to 40 offices across the area.

It also shut down a handful of offices in London and a flagship building in Manchester as part of the restructuring and secured new leases with landlords to whom it pays rent, according to a report in PA.

Last November, the firm filed for Chapter 11 bankruptcy in the US after racking up hefty debts but hopes to emerge from this situation by this month.

When it was founded in 2010, the company quickly grew in popularity but fell on hard times after the pandemic forced employees into remote working.

Wework’s uncertain future left many worried about the sector’s state, but fellow providers in the space assured them its wobble would not impact trade.

Outgoing boss Graham Clemett told City A.M. Wework had done a lot of good things for the flexible space market and made flexible working “much more mainstream product”.

Clemett, who will step down as chief next January, said he does not see its rebound as a threat.

His business tends to cater to smaller companies and those in the fashion and production industries.

This means that, often, they require a physical space to carry out their job, unlike the typical office worker who would have used a Wework.

The firm, which has 78 buildings across London and the South East, upped its dividend on Wednesday as a decision to raise rents across its buildings helped push profit higher.

The value of its portfolio slumped 9.5 per cent to £2.4bn, largely due to the sale of non-core assets to strengthen its balance sheet.

Throughout the year to March, the business completed 1,238 lettings and 705 lease renewals worth £53.3m. On a like-for-like basis, the company’s rent roll jumped 9.6 per cent.

Its rent per available square foot was lifted by 10.4 per cent to £44.27.

Clemett said he expected rental growth this year to be slightly slower but noted a “vibrancy and strength of demand” for the space in its business centres across London.

Shares in Workspace added five per cent on Wednesday following the announcement.

Mark Crouch, analyst at investment platform eToro said “The commercial property market suffered more than most during the pandemic. Work from home models remained in place, and with business owners choosing to downsize to accommodate the hybrid model and cut costs, Workspace Group found themselves in a tight spot.

“Despite these challenges, demand in the capital has remained strong and although shorter leases have resulted in frequent turnover, Workspace Group have capitalised, using the breaks to nudge rents higher while maintaining an occupancy rate of 88.1 per cent.”

Boxpark sets sight on new Camden location as it takes over Buck Street Market

Boxpark will come to Camden, as the trendy hospitality firm has taken over Buck Street Market with plans for a “comprehensive renovation” of the site.

Boxpark said on Tuesday it had agreed a long-term property management deal with Places for London, Transport for London’s Property Company, for Camden’s shipping container food and retail complex, Buck Street Market.

The 12,000 square-ft site, which was bought by Places for London in October 2023, will undergo a “significant refurbishment to revitalise the space and support over 40 independent food operators and retailers”.

Subject to planning permission from Camden Council, the north London location will be its fifth site in the capital.

Simon Champion, chief of Boxpark said: “It’s an exciting challenge for Boxpark to reinvigorate an iconic destination like Buck Street Market. It’s no secret we have a love of locations beaming with culture and community, and Camden is no different.

“Camden Town boasts a world of food, music and the arts that is just so aligned with Boxpark’s movement and culture. “

“We are committed to flying the flag for independent businesses across the country, and this restoration will allow us to continue this in one of the most significant takeovers London will see this year.”

Buck Street Market currently hosts 23 retail and 23 food units, operating seven days a week.

An initial investment will refresh the site, with plans for further investment in collaboration with Places for London in the coming year following engagement with existing businesses and the local community.

Barking mad! Here is how you can get paid to go the pub

Lovers of both pints and puppies now have the opportunity to get paid to bring their dog to the pub as part of an exciting new competition to rate the most pooch-friendly pub across Britain.

Rover, the app which connects owners to dog walkers and sitters, is offering to pay 11 lucky pet owners to test 10 pubs in their region (along with their furry friend) over the course of 7 weeks.

In addition to enjoying a tipple of their choice, winners will have to visit each pub, complete a questionnaire provided by Rover and take social media-friendly photographs of their dog.

It comes as research shows some 37 per cent of pet parents say they have not returned to a pub solely due to the lack of doggy facilities,

In exchange for judging 10 pubs, Rover will pay participants £1000. This will be paid in two parts, £500 at the start of week 1 of the 7-week period, and £500 4 weeks into the 7-week period.

Adem Fehmi, Rover’s Canine Behaviourist, said: “Under appropriate conditions, taking your dog along with you to the pub can be a truly enjoyable experience for both you and your pooch – helping to socialise your dog and provide them mental stimulation.

“However, whilst many dogs are very social by nature, this is not the case for all, and you must first carefully consider if you believe your dog will be comfortable in this kind of environment and, equally, that they will not be a disturbance to others.”

How to Enter

Submit the below to rovercomps@brands2life.com:

- A 30 second video or 3-5 images explaining why you are the perfect Tavern Tester, featuring both you and your dog. This should include footage of you taking your dog to the pub, to show that it’s very much part of your routine, and something your dog is comfortable with

- Three written reasons explaining why you would be the perfect Tavern Tester. No more than 100 words each

The deadline for submissions ends on 16th June.