Price cap will rise to £2,800 per year this winter warns Ofgem

Households should brace themselves for another painful hike in their energy bills this autumn, revealed Ofgem’s chief executive Jonathan Brearley.

He told the Business, Energy and Industrial Strategy (BEIS) Committee that Ofgem was expecting the cap to spike over £800 in October.

The energy boss announced he will be writing to the Chancellor later today to confirm a price cap in “the region of £2,800.”

Brearley suggested this could lead to a doubling of the number of households in fuel poverty to 12m this coming winter.

A household is considered to be in fuel poverty if it has to spend 10 per cent or more of its disposable income on energy.

The gloomy announcement follows warnings yesterday from EON boss Michael Lewis that 40 per cent of its customers could fall into fuel poverty as the cost-of-living crisis deepens.

Brearley explained: “Conditions have worsened in the global gas market following Russia’s invasion of Ukraine. Gas prices are higher and highly volatile. At times, they have now reached over ten times their normal level. I know this is a very distressing time for customers, but I do need to be clear with this committee, with customers and with the government about the likely price implications for October.”

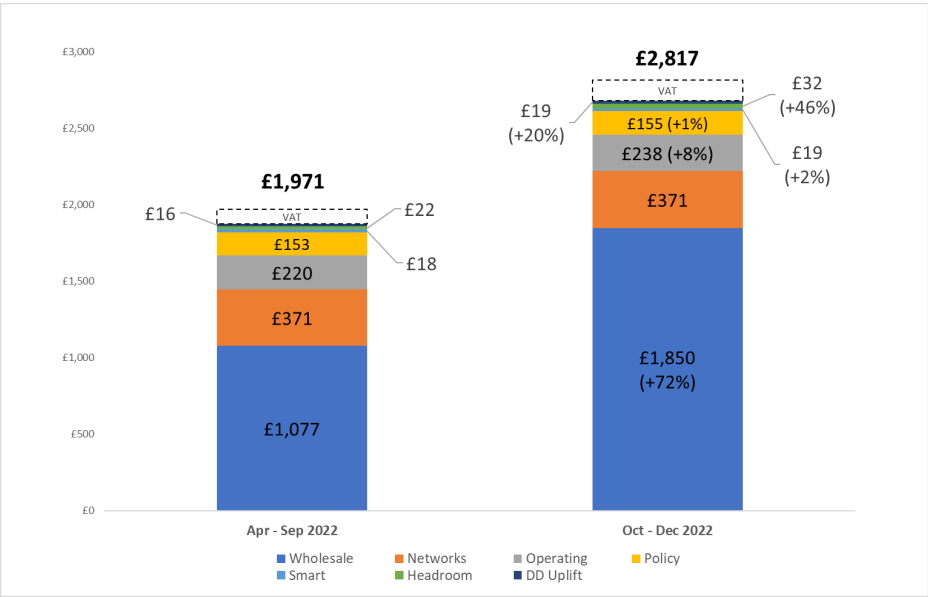

The latest predicted hike to energy bills is a 42 per cent spike on the current record level of £1,971 per year, and would mean the price cap bills would have more than doubled since last October when the cap was set at £1,277 per year.

It is also above analyst expectations of a price cap in the region of £2,600 per year this October.

Forecasting future price movements, he said prices could fall if there is a peaceful resolution to conflict in Ukraine, but that they could even rise further if Russia cuts off gas supplies into Europe.

Brearley argued the increase in the energy price cap showed that “more is needed” and called on ministers to provide further support to consumers.

Brearley also apologised for the carnage across the retail market, describing the price changes as a “genuinely a once in a generation event not seen since the 1970s.”

He recognised there were “significant lessons to be learned from this crisis” and that while there would be supplier failure regardless, had “financial controls been in place sooner” fewer suppliers would have exited the market.

Brearley said: “For that, on behalf of Ofgem and its board, I would like to apologise.”

The latest rise in energy bills will put millions of customers under more pressure this winter, with EON boss Michael Lewis fearing yesterday that 40 per cent of his firm’s customers could fall into fuel poverty.

Ofgem rolls out reforms to fix UK energy industry

Record household energy bills reflect soaring wholesale costs, which have been powered by skyrocketing gas prices amid rebounding post-pandemic demand and Russia’s invasion Ukraine.

The combination of historically high energy prices and the constraints of the price cap has resulted in 29 suppliers collapsing since September, directly affecting over four million customers.

This includes the fall of the country’s seventh biggest supplier Bulb Energy into de-facto nationalisation, where it remains propped up to the tune of £3bn in taxpayer funds to ensure its 1.7m customers can keep receiving energy.

Brearley told BEIS he is committed to “fixing this regime” and reforming the retail market at “lowest cost to consumers”.

So far, Ofgem has brought in financial stress tests and market stabilisation charges to stabilise the market and shift the energy industry from its reliance on chasing switching customers to boost revenues.

As it stands, Brearley argued the best policy energy firms could do for customers was to “hedge and hedge fully”.

Earlier this month it also unveiled proposals for a quarterly price cap, starting in January 2023.

The intention is to ensure lower energy bills will be provided to households sooner when market conditions ease.

However, with energy analysts such as Cornwall Insight forecasting high prices could be baked into the market for the next two to three years, it could mean further hikes in the depths of winter.