Plus500: Shares jump as fintech firm closes in on higher targets

Israeli fintech firm Plus500 said it was on track to hit a recently ramped up set of targets, after revenues rose over the summer on the back of a high-value customer boost.

In a trading update this morning, the London-listed trading firm said it was making “good progress” against its long-term plans as group revenue jumped five per cent on the previous quarter, with income from customer trading hitting $153.7m (£125.4m). Revenues are down 14 per cent on the same period last year, however.

Earnings before deductibles increased by 10 per cent to $80.3m between June and September as the firm widened its margins to 48 per cent, up from and 46 per cent in the second quarter.

Boss David Zruia said the firm had felt the lift of “higher-value customer acquisition, geographic expansion and product innovation” in the third quarter as it pushes ahead with a US expansion.

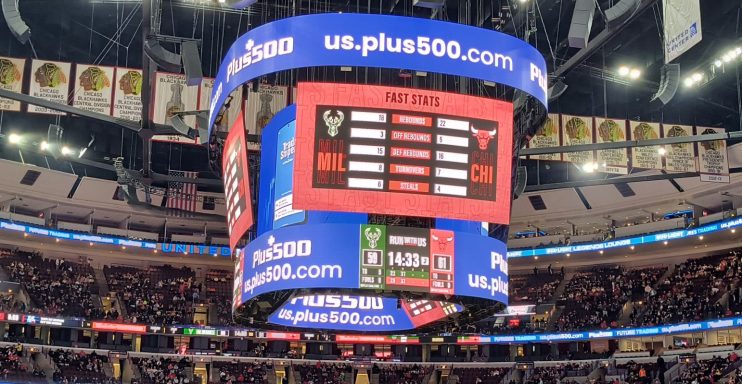

“The aim is to continue developing the group’s position as a global multi-asset fintech group, expanding its position in the US market and continuing to invest in its market leading technology,” he added.

“During the period, good progress was made with growing the US [business-to-business] and [business-to-customer] businesses, and through the successful launch of a localised trading platform tailored for the Japanese retail market.”

The firm said it had also made “good strategic progress” in the UAE after winning a regulatory licence from the Dubai Financial Services Authority (DFSA) in the first quarter if 2023.

The amount of new customers onboarded by Plus500 has slowed, but higher value customers are boosting revenues. Some 20,640 joined the platform in the third quarter, down from 22,248 in the previous three months.

Plus500 is now predicting it will deliver revenue and earnings before deductibles for the full year in-line with a recently upgraded set of market predictions.

Shares in the firm jumped beyond eight per cent in early trading in London. Despite he boost, the firm has weathered a difficult year on the market, with shares trading down over 20 per cent across 2023.

Zruia has been among a host of bosses to lament the approach of investors in London and said earlier this year that it was considering swapping London from New York in pursuit of a higher valuation.

“We estimate that the valuation would be higher within US exchanges,” Zruia told the Evening Standard. “It’s something we’ll consider when market conditions are better.”