How millennial savings app Plum could lure a new generation of DIY investors

The reason Victor Trokoudes started Plum may be a familiar story to some millennials. His dad started nagging him about putting money away after he realised he hadn’t been doing much about his savings despite working as a trader in the City.

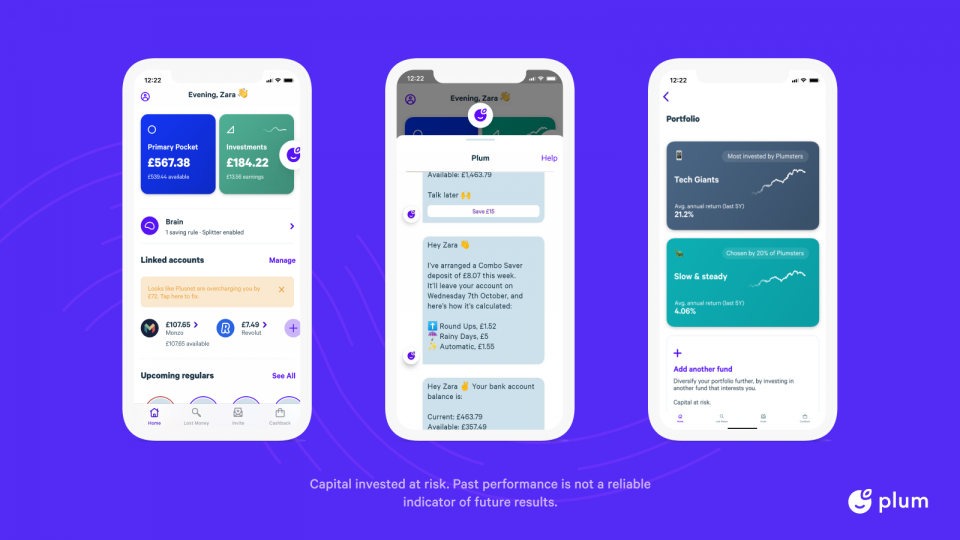

He started building Plum in 2016 with co-founder Alex Michael before its launch in 2017. Their hope was to create a money management app that could automate savings using artificial intelligence.

“People are behaviourally not wired to manage their money in the long run… What we hope is people will have 20 per cent more money without increasing salaries by cutting on bills and putting their money into savings with the algorithm,” Victor says. “I guess we think about people’s finances holistically.”

Now Plum is rivaling the cheap trading apps like Robinhood by moving into the investment space. It anticipated a growing interest among millennials around savings and investments with which has only accelerated during the pandemic.

Three quarters of Plum’s customers are under 35 and its TikTok marketing has helped grow its 18-24 customer base.

Plum has been able to capitalise on the demand: its 0.4 per cent interest rate is far more attractive than the near zero rates offered by high street banks and interest in investments is rising.

The rise of the DIY investor has been well documented: a recent survey by Nutmeg revealed 60 per cent of 25-34 year old investors have put more money in investments over the last year with 21 per cent saying they’re likely to manage it themselves.

“Everything going on with volatility in the markets and Gamestop has also educated people there’s another way to get a return on your money,” he said.

Plum launched an investment product around a year and a half and has tripled the amount of investors on the app since last January.

The startup is bullish about its growth and says it is on track for 3m UK customers by the end of the year and is confident 250,000 of these will be investors.

Customers’ risk appetite grows

Plum’s investment product currently offers customers the option to invest in broad themes, from big tech firms like Facebook and Microsoft to clean energy.

Now it’s looking to expand that offering which, while it says is not a reaction to Gamestop, will certainly be welcomed by new investors.

“Our product right now is broad-based. We’re going to move into offering single stocks because as our investor base matures they want that,” Trokoudes said.

Young investors may well be calling for riskier opportunities but is this necessarily the right thing to do? Robinhood, the free trading app used by Reddit traders at the height of the Gamestop drama, is currently facing a case brought by the Massachusetts regulator focused on the app’s gamification of trading.

“We’re conscious of negative spirals that can escalate… [but] I also believe that hopefully you open the gate for people to invest and read up on it more.”

So could that pave the way for Plum to start offering crypto? Trokoudes remains fairly tightlipped about when it could be introduced but said he was “exploring” the idea. Notably, Plum has advertised a ‘crypto product manager’ role on its website.

“Overall I think it’s a positive thing that people are being introduced to these concepts,” he added.

Plum looks to expand in Europe and beyond

Expanding the product is a natural part of the scale up process but how does Plum actually make any money?

Plum offers three types of accounts at the moment: a free basic account and ‘Plus’ and ‘Pro’ accounts which cost £1 and £2.99 a month respectively. But it may soon have to go in the same direction as other money management apps by charging customers more.

Trokoudes is adamant that unlike Plum’s peers, which have largely prioritised customer growth over profitability, “we’ve always made sure we can be a sustainable business.”

“The model is efficient, we’re using the data already in people’s bank accounts so we don’t need to build it. We have strong unit economics and are profitable on an individual customer basis.”

Perhaps most importantly to Plum, investors think it stacks up. Last summer Plum raised a $10m round led by Japan’s Global Brain and the European Bank for Reconstruction and Development.

Now it’s eyeing further growth in Europe: Trokoudes wants to move into Portugal, Germany, Austria, the Nordics “and beyond”.

If taking control of your finances was the story for millennials at the start of the pandemic Plum seems well placed to capitalise on the rise of DIY investor post-Gamestop.