The UBS rebrand: CMO Johan Jervoe talks art and Annie Leibovitz

Following the financial crisis, banks have struggled to clean up their public image.

But last week, the Swiss banking giant UBS began a global brand relaunch, its first since 2009.

The campaign will be 70 per cent digital, and feature photographs by American portrait photographer Annie Leibovitz, as well as a 90 second placement entitled “Asking life’s big questions, with UBS”, aiming to establish a more profound connection with customers.

Group chief marketing officer Johan Jervoe joined UBS in 2013, having held senior marketing positions at Intel and McDonald’s.

While chief marketing officer of McDonald’s Germany, he led the team behind the “I’m Lovin’ It” campaign.

He tells City A.M. why art and understanding are the key to growing a customer base.

Why is art such a good channel for marketing to UBS’s clients?

The UBS Art Collection has been around for over 50 years. We have the world’s biggest corporate collection, with more than 35,000 pieces, and a consequence of that is that we have attracted a number of clients who have a passion for art.

It’s an interest around which we can have a conversation with our clients which goes much further than just business. It is interesting for both sides, and banker and client learn a lot about each other.

But it also brings us pleasure personally. We have Lucian Freud’s on-paper works displayed in the Louisiana Museum of Modern Art in Denmark at the moment, but if the pieces aren’t being displayed in galleries, they hang in our offices for our clients and employees to appreciate.

Art is delightful to look at and improves the working environment.

What kind of pieces do you select?

Much is from the western hemisphere. North America and Europe have dominated the contemporary art scene, but we’re seeing a lot of new purchases coming out of Asia and Latin America.

It’s not a drive to penetrate new markets: UBS has been in Asia for over 50 years.

But art has the power to shift the status quo, to question, and to move society, and we want to understand the societies in these areas.

So our curators, like Stephen McCoubrey in London, handpick pieces which are culturally significant and illuminating.

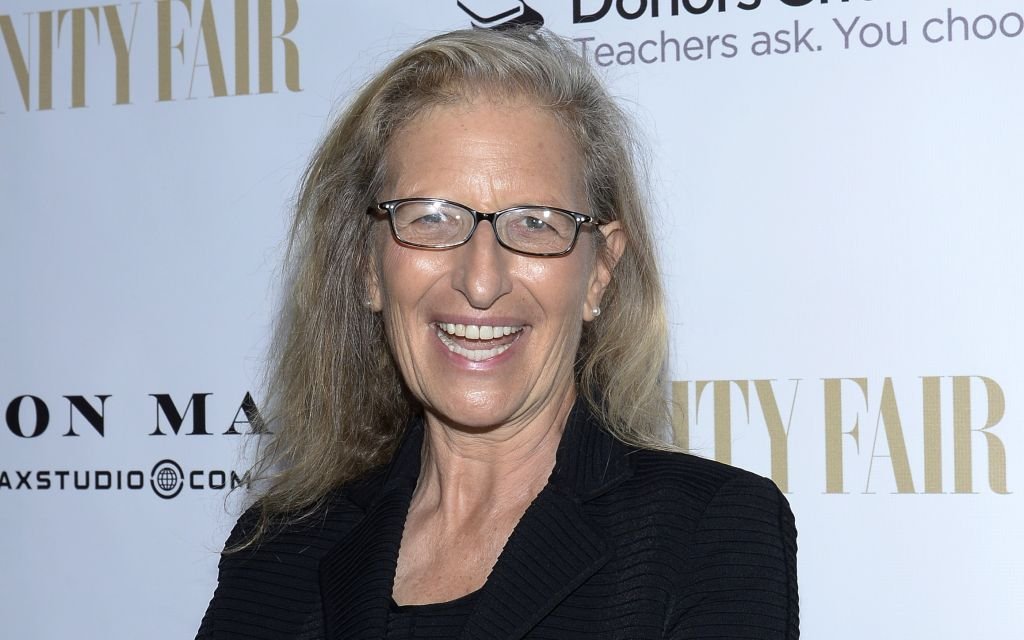

"Annie Leibovitz is excellent at taking pictures of real people in real situations" (Source: Getty)

Have banks been facing a PR crisis?

We conducted a serious consultation in 2013, interviewing 3,500 personal, corporate and institutional clients.

They told us that they were hurt, and that banks lacked an understanding of their clients.

They didn’t like the stereotype of an image of a wealthy client standing on the stairs of their Learjet with a private banker holding the signed contracts. They didn’t think it resembled them.

Clients have also been wanting more control over their finances.

They couldn’t understand the language banks have traditionally used to sound sophisticated, so we have tried to simplify all our messaging.

This campaign is about addressing the kinds of questions our clients are really asking.

Why did you choose Annie Leibovitz?

She is excellent at taking pictures of real people in real situations. And her authentic take is exactly what we wanted for this campaign.

The three subjects of her photos are real entrepreneurs, and their lives and personas fit the profile of our clients well. The questions they ask are realistic. Take Peter, for example, who asks “Am I a good father?”.

It was clear to us, and Annie, that if the man depicted wasn’t a father, he wouldn’t be right, and this vision of sincerity was shot all the way through as only Annie Leibovitz can do.

The campaign complements our existing sponsorship of the tour of her newly commissioned work, which focuses on portraits of women. The exhibition will travel to 10 global cities over 12 months, starting in London in January, and will be free to the public.

Why have you decided to throw so much weight behind digital?

There is an interesting situation in banking, where our clients are perhaps further ahead of the digital trend than the banks are.

We conducted a test campaign in the first quarter of this year, and 80 per cent of those who came in did so via mobile.

We just went where our clients are. Digital brings a potential consumer within one click from more information about our services, from more content, from contact with a banker.

That shouldn’t be underestimated.