Philips buyback plan shrugged off by investors

PHILIPS has raised most of its financial targets and announced plans to return €1.5bn (£1.26bn) to shareholders, saying it would reap the benefits of a two-year revamp to focus on healthcare, lighting and consumer appliances.

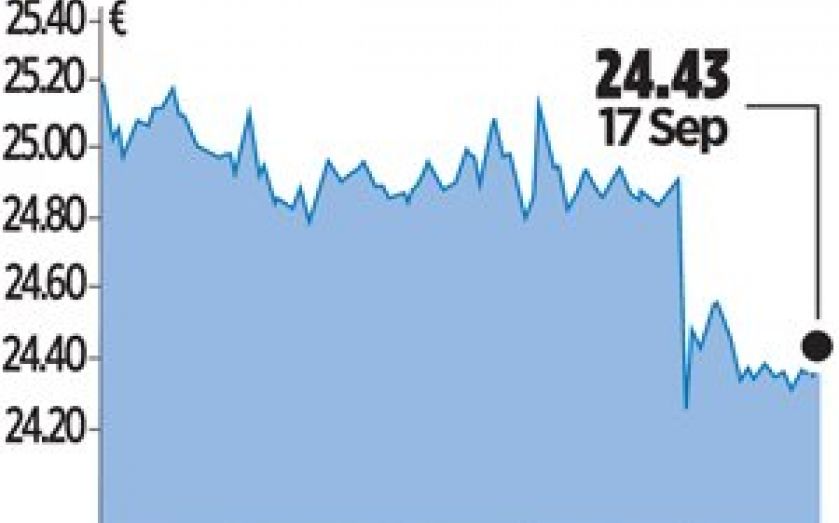

Yet the Dutch group also warned, yesterday, of tough conditions in many of its markets and the new goals fell short of some analysts’ hopes, sending its shares lower.

“[The] new targets appear a little conservative,” Morgan Stanley analysts said in a research note, adding there had been hopes for a share buyback closer to €2bn.

Over the past two years, Philips has sold off much of its consumer electronics business – divesting its television, audio and video operations where it was struggling to compete with lower-cost Asian manufacturers, to focus on more profitable home appliances such as soup mixers and electric toothbrushes, as well as lighting for homes and offices, and healthcare.

The group said it was targeting a margin of 11-12 per cent on earnings before interest, tax and amortisation (Ebita) for 2014-16, compared with the 10-12 per cent it is aiming for this financial year.

It is also targeting a return on invested capital of at least 14 per cent, compared with this year’s 12-14 per cent.

“We see substantial opportunities for profitable growth for 2016 and beyond,” said chief executive Frans van Houten.

However, the group also kept its sales growth target of four to six per cent unchanged and said it was feeling the impact of uncertainty over healthcare spending in the US.