Petrol retailers are not profiteering despite record prices at the pumps, say experts

Petrol retailers are not engaging in wholesale profiteering amid record forecourt prices, argued Tom Hatton, head of product management at analytics group Kalibrate.

Instead, he suggested fuel vendors were ramping up prices for consumers in line with higher wholesale costs more quickly than they did in the past, with retailers more cautious amid soaring oil prices and geopolitical volatility.

He told City A.M.: “We have not seen cumulative rises like this for years and years.”

Oil prices soared to $124 per barrel today, after breaking through the $100 milestone in March for the first time in eight years, amid rebounding post-lockdown demand across developed economies and concerns over supply shortages driven by OPEC capacity issues and Russia’s invasion of Ukraine.

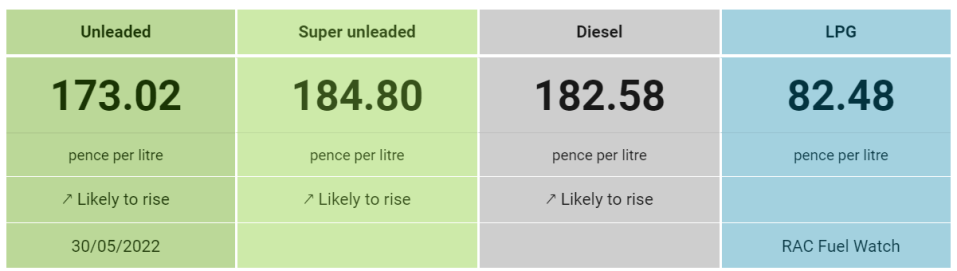

This has been reflected in record petrol prices, which reached an all-time high yesterday of 173.02p per litre for unleaded and 182.58p for diesel, according to RAC Fuel Watch data.

The record prices mean the cost of a filling a 55-litre petrol family car has climbed to £95.15 for unleaded petrol and to £100.42 for diesel.

Alongside spiking wholesale costs, Hatton suggested that rising supermarket forecourt prices – which account for around half the fuel sales across the UK – reflected changes in the retail industry.

He noted that supermarket retailers operate on “two-week out” pricing, and that conventionally they would delay price rises to ensure customers could be lured to their stores ahead of competitors.

This however, has become less of a factor for supermarkets following the arrival of challenger brands without forecourts.

Hatton explained: “Supermarkets have typically used the forecourt to bring people into the store. The longer they could have held a price difference between oil majors and themselves – the more footfall they’re driving. But now with the presence of Aldi and Lidl – stores without forecourts – many bargain hunters are shopping there and so maintaining a lower pump price would not necessarily bring back all of those customers, but it is a cost incurred against all fuel sold.”

He also expected prices to rise further across forecourts, driven upwards by the combination of increased demand this summer during the holiday season, and the EU’s finalisation of a ban on Russian oil imports.

Andrew Opie, director for food at the British Retail Consortium, told City A.M. retailers were doing “everything they can” to offer customers the best deals they can in challenging market conditions.

He said: “Global oil prices, while volatile, have soared over the last two years, and are now exacerbated by the war in Ukraine. While retailers were quick to pass on the Chancellor’s fuel duty cut, such measures are limited at a time when prices continue to climb. Retailers understand the cost pressures facing motorists and will do everything they can to offer the best value-for-money across petrol and diesel forecourts, particularly if the price of oil falls.”

Government demands fuel duty cuts at forecourts

Prime Minister Boris Johnson is reportedly preparing to name and shame petrol stations that fail to pass on the five pence fuel duty cut announced by Chancellor Rishi Sunak in the Spring Statement earlier this year.

According to The Telegraph, officials in the Department for Transport have been tasked with drawing up proposals to “expose” retailers.

The cost of living crisis has become an increasingly urgent issue for Downing Street, with Sunak last week unveiling a £15bn support package to ease record household energy bills.

Earlier this month, motoring group RAC criticised petrol retailers for taking 2p per litre more in average profit than they did before the fuel duty cut was announced in March.

RAC fuel spokesperson Simon Williams has now called on the government to cut VAT to ease the pressure on drivers.

He said: ““It seems very unfair that the Chancellor should be benefitting by around 30p a litre in VAT from sky-high pump prices when hard-pressed motorists are struggling to make ends meet. As VAT is a ‘tax on a tax’ applied on top of 53p a litre duty, it means drivers are paying 82p to the Treasury on every litre of petrol, so around £45 of the cost of filling a family car is currently tax.”