Pensionbee targets £384m valuation as it gears up for London float

Pensionbee is targeting a valuation of up to £384m as it prepares to list on the London Stock Exchange later this month.

In a filing today the fintech firm priced its initial public offering at between 155p and 175p per share, giving a market capitalisation of between £346m and £384m.

It plans to raise £55m from the float to help fund investment in its platform, as well as in advertising and marketing activities.

Pensionbee also revealed that assets under administration grew 123 per cent year on year to £1.7bn thanks to sharp growth in customer numbers.

“An IPO has always been part of Pensionbee’s corporate trajectory, and we are extremely proud to be reaching this milestone,” said chief executive Romi Savova.

“The flotation will further our vision to help millions of consumers look forward to a happy retirement through our technology platform and dedicated customer service offering that make pensions simple.”

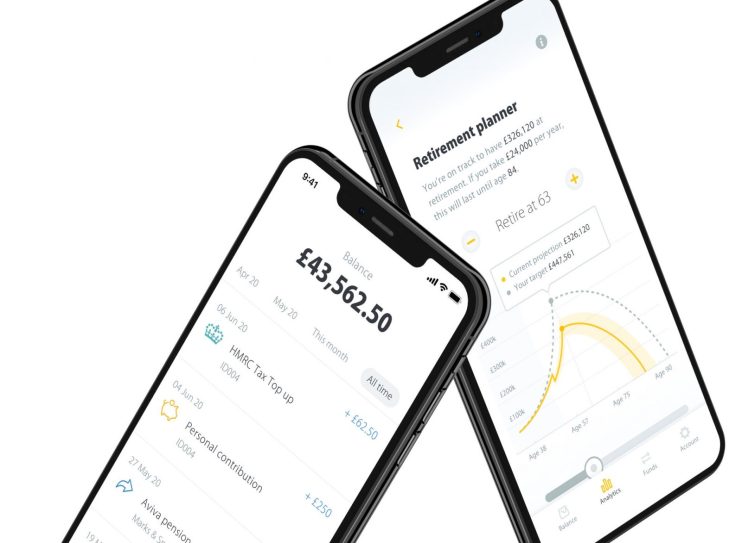

Pensionbee was founded in 2014 by Savova and its chief technology officer Jonathan Lister Parsons, with the aim of simplifying pension saving in the UK.

The float will consist of an offer to institutional investors as well as a retail offering for eligible Pensionbee customers.

The company said more than 12,000 customers had so far registered to take part in the float.

Pensionbee has committed to a 180-day lock-up period, meaning shareholders will not be allowed to sell stock immediately following the IPO. The company’s executive directors and founders have agreed to a 720-day lock-up.

Keefe, Bruyette & Woods is acting as key adviser and sole global cooordinator for the IPO.