Digitisation of the economy sped up PensionBee’s float plans

The transition to a digitised economy sped up PensionBee’s plans to float on the stock market, an idea it first began to mull in 2016.

This morning online pension provider PensionBee announced its intention to float on the London Stock Exchange.

The IPO would comprise an offer to institutional investor and eligible PensionBee customers. More than 8,000 customers have already registered an interest in participating in the float.

The company’s shares would be admitted to the High Growth segment of the London Stock Exchange as part of the float.

Speaking to City A.M., founder and CEO Romi Savova said the recent digitisation of the economy “made us consider [a float] earlier than we would have.”

The fintech company has around 130,000 active customers and £1.5bn assets under management.

80 per cent growth

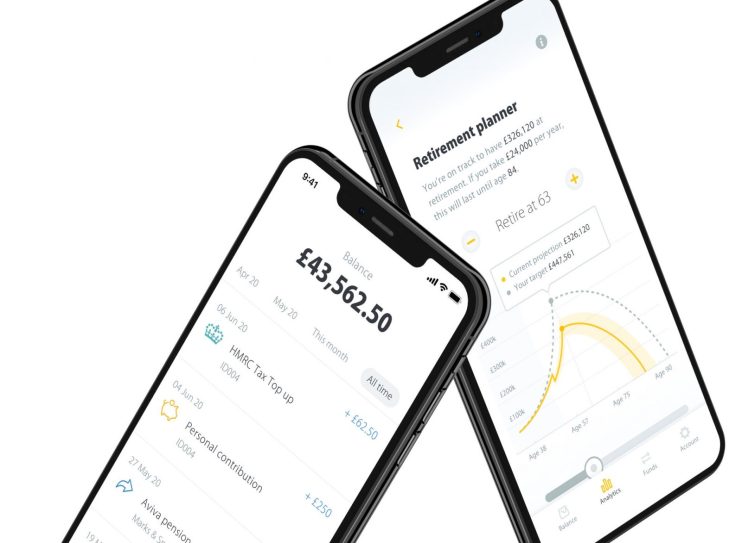

PensionBee makes use of technology that can combine customers pension pots in one place. The firm saw a sharp uptick in new customers since the onset of the pandemic in March.

Savova said some customers had used the pandemic to as an opportunity to dig out their paperwork and “sort out their pension”, while others had reduced pension contributions, having had a financially tough year.

PensionsBee was founded in 2014 by Savova and its chief technology officer Jonathan Lister Parsons, with the aim of simplifying pension saving in the UK.

Savova said the company had experienced enormous growth in a short space of time, growing as much as 80 per cent in the last year, which it why PensionBee made the decision to float.

“We’ve been around for 7 years now. A lot of what’s happened since then is that the problem we were created to solve, which is predominantly one of lost and scattered pensions, but also general pension confusion and a lack of engagement, that problem has become larger, so we’ve been able to grow because of that because we offer a really easy to use online pension solution for anyone who wants to take control of their pension.

“So the decision around the listing is really to help accelerate the growth and to maintain the company’s growth trajectory, because even though we have grown quickly, we are still a small portion of the overall pensions market, which is enormous.”

PensionBee chairman Mark Wood said: “This is a key milestone for PensionBee. Transparency and strong corporate governance are key aspects of an IPO and are core to our strategy of becoming the best universal online pension provider.

“I see significant market opportunities ahead for PensionBee – with a clear acceleration of the structural shift to online services, PensionBee is well-positioned to execute against its growth ambitions while continuing to fight for the consumer.”