Here are the top banks most impacted by fraud — and worst at reimbursing their customers

The UK’s payments regulator has published the first entry in a new data series tracking how individual banks have been affected by and responded to authorised push payment (APP) fraud.

The Payment Systems Regulator collected figures from the country’s 14 largest banks, as well as nine smaller firms that were among the top receivers of money from fraud.

APP scams, which involve the victim making the payment themselves, accounted for 40 per cent of fraud losses in 2022.

A report from banking trade body UK Finance last week showed Britons lost £580m to fraud during the first six months of 2023 and urged Big Tech to take more responsibility for online scams.

The PSR’s report showed TSB, Santander, Monzo, Metro and Starling were the banks most affected by fraud.

For every £1m sent by TSB customers in 2022, £348 was lost to APP fraud. Santander lost £322 per £1m, while Metro and Monzo both lost £280.

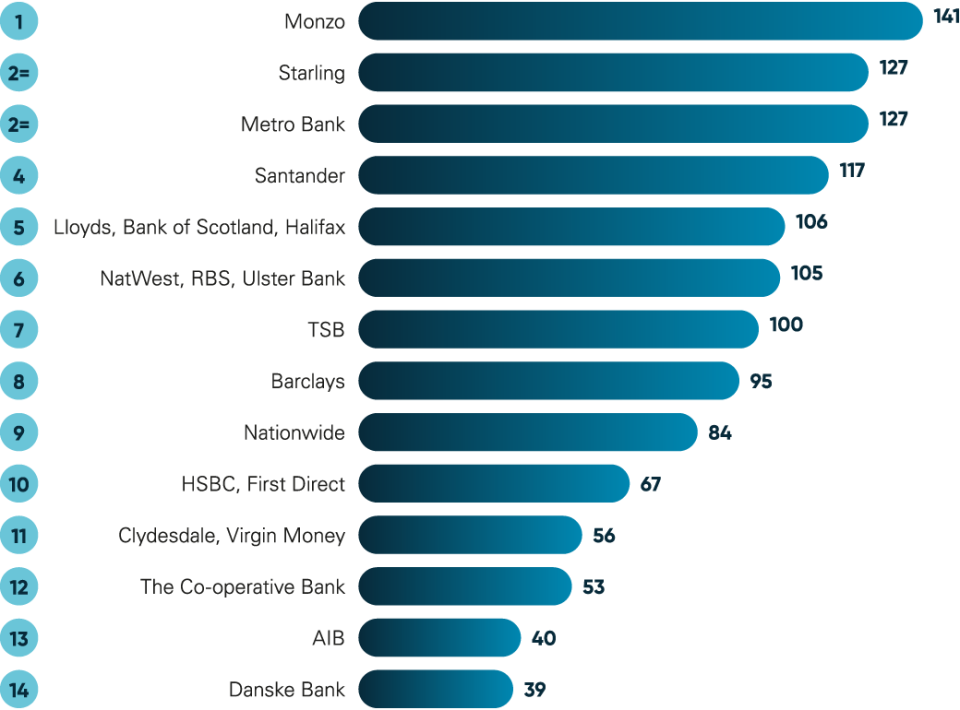

Monzo recorded the highest fraud case rate, with 141 of out every one million transactions being fraudulent. Starling and Metro both had 127, while Santander had 117.

TSB and Nationwide fully reimbursed their customers in 94 and 91 per cent of cases respectively, followed by Barclays with 79 per cent.

The report noted “inconsistent outcomes for customers”, with Monzo fully reimbursing customers in six per cent of cases despite having the highest level of fraud. Starling fully reimbursed customers in 44 per cent of cases.

As well having among the most taken through fraud, accounts with Metro, Starling, TSB and Monzo also received the most through scams of any directed firm.

Metro and TSB received £696 and £605 per £1m from APP fraud respectively.

How many APP fraud payments were sent per million transactions

Percentage of APP fraud cases that were reimbursed by each firm

“This provides better information for customers on how firms handle APP fraud and encourages these firms to take more action to tackle it,” said Chris Hemsley, managing director of the PSR.

“Our approach is working because we know there is a greater focus across many more firms on preventing fraud. Our commitment to transparency and the forthcoming mandatory rules are key to strengthening efforts to prevent these frauds from happening in the first place.”

The PSR announced in June that mandatory reimbursement requirements for victims of APP scams would come into force in 2024.

The rules will hold sending and receiving firms equally liable for reimbursing victims in nearly all cases.

UK Finance has criticised the measures, commenting: “The PSR’s proposal for reimbursement places all liability – and therefore effectively responsibility — for fraud and scams onto PSPs.

“However, there is a much wider ecosystem of firms whose platforms and infrastructure are used by criminals to target and socially engineer victims. The PSR’s proposals do not consider the liability of the technology sector controls and the sector’s role in fraud enablement.”

The PSR will keep collecting data from firms over the next 12 months and will conduct another report next year.