Pantheon: Investment slump on Bank of England’s rate hikes will deepen UK recession

The UK recession is set to be powered by businesses slashing investment due to higher interest rates squeezing their finances, City economists have warned.

Finance chiefs are “despondent” amid a rapid acceleration in borrowing costs caused by the Bank of England scrambling to tame sky high inflation, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said in a note to clients last night.

Some nine back-to-back rate increases by Bank governor Andrew Bailey and the rest of the monetary policy committee (MPC) have raised the cost of borrowing money, making investment opportunities less affordable.

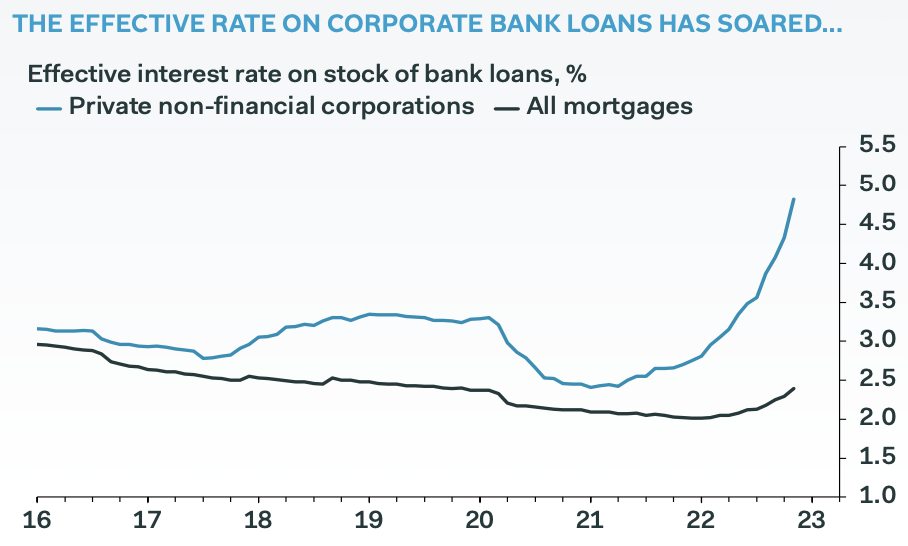

Pantheon Macroeconomics estimates around 77 per cent of the corporate debt pile is tied to floating interest rates. This means businesses’ debt servicing costs respond quickly when the Bank of England changes the UK’s official interest rate.

In fact, rates on businesses’ loans have climbed at the fastest pace on record over the last year, to 4.82 per cent in November from 2.7 per cent a year ago.

As a result of the rate jump, nearly one fifth of companies’ profits will be eaten up by repaying debt, a proportion “consistent with a double-digit percentage decline in business investment over the next year,” Tombs said.

The MPC has sent interest rates to 3.5 per cent, the highest since the financial crisis, to tame inflation, which has surged to a 40-year high of 10.7 per cent.

Tighter financial conditions are, in theory, supposed to cool price rises by sucking demand out of an economy. Most experts think inflation has passed its peak and will steadily decline this year.

The slump in business investment will “be a key driver of this year’s recession, contributing to a 1.5 per cent year-over-year fall in GDP,” Pantheon Macroeconomics forecast.

Britain has suffered from chronic under investment since the financial crisis in 2008, keeping a lid on output growth in the past decade or so.

Experts reckon weak capital spending has choked productivity growth, a key source of long-term improvements in living standards.

Pantheon’s forecasts indicate the country may be headed toward another few years of low productivity growth holding back the economy.

Economists argue real income growth has stalled over the past decade as a result of near non-existent productivity improvements, leaving households heavily exposed to the current cost of living crisis.

The Resolution Foundation earlier this week warned the country is only half way through the income squeeze. By the end of 2023, Brits will have had more than £2,000 wiped off their take home pay and real incomes will not reach pre-pandemic levels until 2028.