Paladin gets boost from Talisman

City followers swept up British oil company Paladin’s shares after a £1.2bn bid with Canadian rival Talisman was agreed yesterday.

Shares in Paladin rocketed to close up 74.5p, or 27 per cent, at 349.5p, after the details of the deal were announced.

The deal values Paladin shares at 355p, a 17.8 per cent premium on their value on Wednesday the day before the deal was announced.

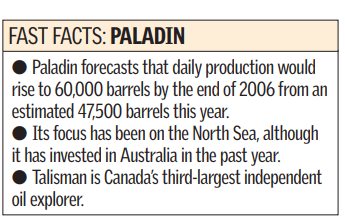

Talisman said it bought its rival to boost production and cash flows. Talisman estimates that Paladin has reserves of 190m barrels of oil, which includes the British company’s interests in the North Sea.

Dr Jim Buckee chief executive of Talisman said: “This is an attractive opportunity for Talisman. These assets materially enhance Talisman’s production growth profile and offer significant cash generation potential.”

Buckee said that the acquisition would become cash generative in 2006. He added: “It will help deliver production per share growth for Talisman, which is now expected to be in excess of 10 per cent per annum from 2006 through 2008.”

Paladin chief executive Roy Franklin said: “The offer provides Paladin shareholders with an opportunity to lock-in value at an attractive premium reflecting the quality of the Paladin business.”

Analysts agreed that Paladin achieved a great price for the company. Paladin is often referred to as a scavenger producer because, unlike other exploration and production firms, it focuses on buying proven but overlooked areas from the oil majors.