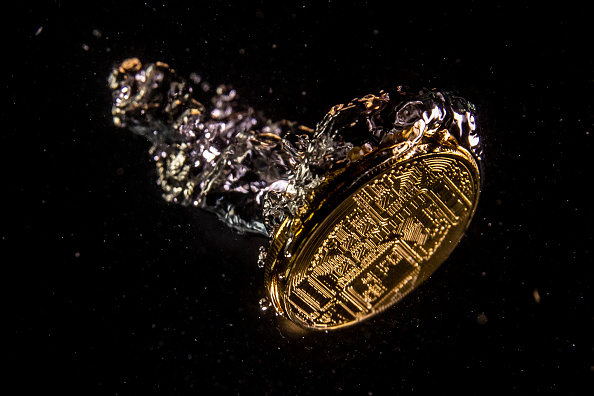

Optimism returns to crypto markets as the day is greeted by big green candles everywhere

The week in review

with Jason Deane

It’s another Friday and I find myself, yet again, writing primarily about doom and gloom in the world of finance, logistics and markets. Is anywhere safe right now?

On the face of it, no.

Yet there are some solid green candles on my screens this morning – a colour now so unusual I did a classic cartoon style double take as I shuffled into my office with my first coffee in hand. There is, it appears, the tiniest bit of optimism hanging in the air.

In part, this could be because the likely catalyst for the collapse in the crypto markets has now been fully laid bare. Much has been written about the UST and Luna debacle and no more needs to be added here (if you want a very neat explanation check this out), but getting to the bottom of any of these things often acts as a cleansing process for markets generally. It creates a sort of reset and allows a new normal to emerge.

That said, almost all markets across all categories show those welcome green numbers this morning, meaning that something else must be going on. Did we simply overdo it in an emotional panic and are now, collectively, setting new positions with a calmer disposition?

Maybe. But it’s too early to say for sure.

What we can be certain about is that the outlook generally doesn’t seem to be getting any better.

Russia’s dismal military performance continues to humiliate Putin internationally on a level that must make him furious. Finland’s decision to join NATO, almost certainly to be followed by Sweden, has provoked a new round of threatening rhetoric from the Kremlin that, well, sounds like a toddler having a meltdown.

The trouble is that this toddler still has access to substantial military might through sheer numbers (not to mention nuclear weapons) and controls enough of the world’s natural resources to cause real problems for European economies. And you just know he’ll relish the thought of damaging “unfriendly countries”. This is NOT going to be over anytime soon.

That means gas and oil prices probably have further to rise, but food supplies, especially grains and oils, are also likely to be seriously affected. And, as inflation creeps ever higher, the cost of living is becoming a real, genuine problem for ordinary folk, as I wrote about here recently.

But difficult scenarios also create opportunities. Almost all European countries have accelerated their renewable energy programs to wean themselves off petrochemicals, something that is incredibly timely given the World Meteorological Association’s recent stark warning of temperature rises. Perhaps some good will come of this mess after all.

In the meantime, Bitcoin continues to process block after block entirely uncaring of the mess we make for ourselves, while development and adoption continue unabated. At times like this, it’s worth remembering why Bitcoin is SO different from literally every other coin out there, and, while it is still being traded as a ‘risk on’ asset, I wonder how long that will be the case?

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on Wednesday May 25 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

*18+, UK resident, new to Luno only

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.289 trillion.

What Bitcoin did yesterday

We closed yesterday, May 12 2022, at a price of $29,047.75. The daily high yesterday was $30,032.44 and the daily low was $26,350.49.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $576.72 billion. To put it into context, the market cap of gold is $11.593 trillion and Tesla is $754.21 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $56.149 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 48.66%.

Fear and Greed Index

Market sentiment today is 10, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 44.62. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 33.02. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin is deliberately amoral, it has no requirements to entry and asks nothing of the user aside from a valid signature.”

Nic Carter, Partner at Castle Island Ventures

What they said yesterday

Welcome to the team Bill…

Ex-Facebook crypto chief launches Bitcoin Lightning payments start-up Lightspark…

You heard the man…

Crypto AM: Editor’s picks

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Exclusive: Fireblocks valuation climbs to $8bn in $550m funding round

Crypto crazy couple name baby after favourite digital asset

Bitcoin hashrate touches new all time high

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST