OPEC forecasts rising demand after failing to hit output targets

OPEC has revealed oil demand could rise even more steeply this year as the global economy recovers from the pandemic.

This would likely boost prices which are already at a seven-year high, with analysts already speculating about when both benchmarks could hit $100 per barrel.

In its latest report, OPEC said it expected world oil demand to rise by 4.15m barrels per day (bpd) this year, unchanged from its forecast last month, following a steep rise of 5.7m bpd in 2021.

Commenting on 2022 demand outlook, the OPEC said: “Upside potential to the forecast prevails, based on an ongoing observed strong economic recovery with the GDP already reaching pre-pandemic levels.”

World consumption is expected to surpass the 100m bpd mark in the third quarter, in line with last month’s forecast.

On an annual basis according to OPEC, the world last used more than 100m bpd of oil in 2019.

Meanwhile, the organisation and its allies (OPEC +) have undershot a pledged oil output rise in January, with tightening supplies giving fresh impetus to booming markets this year.

OPEC+ has aimed to raise output by 400,000 bpd a month, with about 254,000 bpd of that due from 10 participating OPEC members.

However, report showed OPEC output in January rose by just 64,000 bpd to 27.98 million bpd.

Seven of the 13 OPEC members had a drop in output, among them Venezuela, Libya and Iraq.

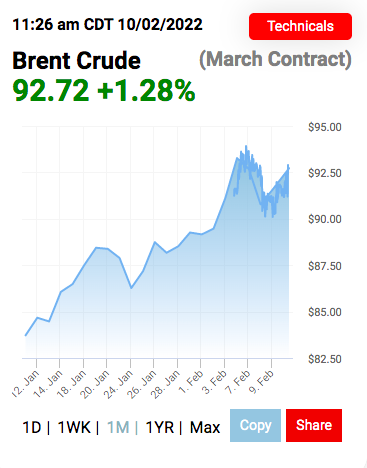

Oil prices rose on both major benchmarks following the announcement.

Brent Crude has soared 1.22 per cent to $92.67 per barrel, while WTI Crude increased 1.65 per cent to $91.14.

OPEC said it expects the world to need 28.9 million bpd from its members in 2022, up 100,000 bpd from last month and theoretically allowing further increases in output.

However, Commerzbank has suggested the rallies on both benchmarks have ran out of steam.

Analyst Barbara Lambrecht said: “Oil prices appear to have run out of steam for now. Brent is trading largely unchanged at $91.5 per barrel, while WTI is priced below $90. Though the robust US inventory data did push prices up yesterday afternoon, the upswing was comparatively subdued and already ended a short time later. A week ago, inventory data such as those published yesterday would probably have sparked a more pronounced and more lasting price surge.”