ONS: Remote working to stimulate employment among older Brits, adding billions to UK economy

Remote working could stimulate employment rates among older workers, potentially adding billions to the UK economy, according to fresh figures published today.

Data from the Office for National Statistics shows older workers who have switched to working from home entirely are more likely to retire later than those who are still working in physical work spaces.

In June and July of last year, 11 per cent of older workers who were working entirely from home were more likely to retire later, compared to five per cent of those not working from home, the ONS said.

According to the statistics agency’s estimates, if employment rates among older workers matched those aged between 35 and 49, it would add £88bn to the UK economy.

Tom Selby, head of retirement policy at AJ Bell, said: “The early exit of people aged between 50 and state pension age from the workforce has a significant impact on both individual retirement plans and the wider economy.”

“While in some cases stopping work early will be a voluntary decision – for example as a result of early retirement – in other situations it will be less voluntary, such as ill-health.”

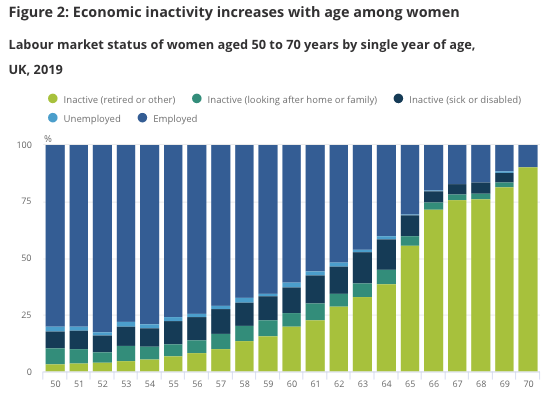

Access to remote working could narrow economic inactivity – a measure of whether people are engaged in the labour market – disparities between older men and women, the ONS study found.

“At age 50 years, 17.9 per cent of women were economically inactive compared with 9.6 per cent of men and at age 64 years, 58.6 per cent of women compared with 44.9 per cent of men,” the ONS said.

A large proportion of older female workers are economically inactive due to them being more likely to have to look after family members or their home. The ONS’s data indicates having access to remote working opportunities could enable female workers to balance home care responsibilities and their jobs.

Higher levels of economic inactivity rates among women is likely to exacerbate inequality in retirement resources between men and women.

“Women are more likely to stop working early than men, potentially further perpetuating the gap in pensions between the sexes,” Selby added.

Older workers in their 50s typically increase pensions contributions as they approach retirement due to having fewer expenditure pressures.

Selby continued: “Stopping working in your 50s – when in theory your earning power and ability to save should be at its highest – could also have a significant impact people’s retirement outcomes.”

“In many cases it will mean making your retirement income stretch for much longer, meaning you have to live for less in your later years.”