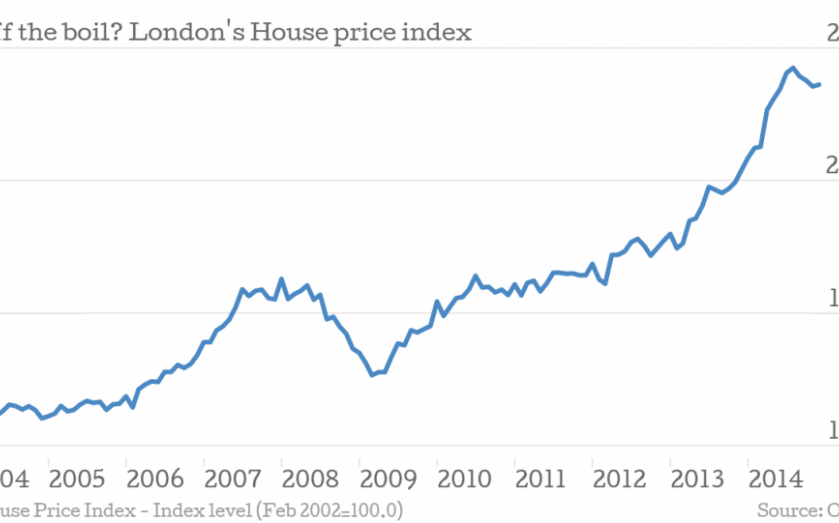

In charts: London house prices are now 2.3 per cent below their peak

London house price growth is slowing along with the UK’s, according to new data. In December, prices in the capital were 2.3 per cent below their August peak, with the rate of growth slowing from 15.3 per cent to 13.3 per cent. Back in May, London prices were on an annual growth roll of 20.1 per cent, with prices reaching their zenith three months later.

Monthly growth wasn't huge either; on a seasonally adjusted basis, average house prices increased by 0.7 per cent between November and December 2014.

The regions

According to the data, from the Office for National Statistics (ONS), London wasn’t the only region where price growth was waning. For the UK, growth slowed from 9.9 per cent in November to 9.8 per cent in December.

Despite the decline in growth rates, the figures show prices are still eye-watering in the capital, averaging at £502,000

First-time buyers

There was limited good news for first-time buyers: house price inflation for those looking to clamber onto the slippery first rung fell 1.5 percentage points, although that probably looks better on a graph than it feels in a wallet; after all slower growth is still growth. The average price paid was £208,000.

The data in context

Howard Archer of IHS Global Insight points out that although the ONS data is interesting, it lags behind other measures, and different measures have yielded different results.

It needs to be borne in mind that the ONS’ measure of house price inflation lags many of the other measures as it is based on mortgage completions.

Furthermore, the data are for December whereas there are both hard data and surveys available for January, which are somewhat mixed. Specifically, latest data from the Nationwide show annual house price inflation moderated to a 14-month low of 6.8 per cent in January from 7.2 per cent in December and a peak of 11.8 per cent in June (the highest since January 2005. House prices rose a modest 0.3 per cent month-on-month in January. However, latest Halifax data show the year-on-year increase in house prices rising back up to 8.5 per cent in the three months to January.

The market may be pulled about by the influences of stamp duty reform, low inflation, which will give consumer more to spend and the housing shortage, which may be exacerbated in April if the government’s new pension rules mean retirees are able to use their savings to invest in buy to let properties.

Nevertheless, Archer says, growth is likely to be muted in 2015:

Housing market activity is expected to be constrained by more stretched house prices to earnings ratios, tighter checking of prospective mortgage borrowers by lenders and the knowledge that interest rates will eventually start rising, albeit gradually. Many people may also be deterred from buying houses because they look pricey in a number of areas after recent sharp rises.