Omicron: what it means for markets

Mark Ainsworth, Head of Data Insights: The new Covid-19 variant B.1.1.529, or Omicron, that was identified last week in southern Africa has officially been classed a “variant of concern” by the World Health Organization.

Covid-19 infections had already been on the rise in a number of countries, notably in Europe. This is due to colder winter weather, a return to more normal levels of activity with few restrictions, and some gaps in vaccination coverage.

However, what we are seeing in South Africa is much more dramatic. Europe’s case numbers had been rising by about 5% per day in recent weeks, with an R number of 1.3 (meaning each infected person infects 1.3 others).

In the last ten days, South Africa has seen cases rising by about 17% per day, which equates to an R number of 2.2. Looking just at recent days it could even be higher – the last five days of cases growth implies R of 2.6.

Data suggests new variant can evade immunity

Covid-19 had already reached endemic levels in South Africa after waves of first the Beta and then the Delta variants. Only about 24% of the population has been fully vaccinated but 80-90% of adults in urban areas will have built immunity from prior infections.

The current rise in infections in South Africa therefore suggests that the new Omicron variant is able to evade existing immunity to some degree. Its genetic profile indicates it is not simply a descendant of the Delta variant. It contains many mutations, which may make it more infectious than previous variants.

It’s too soon to say what existing levels of immunity from vaccination might offer in terms of protection from infection, hospitalisation, or mortality. Most of the hospitalisations in South Africa have been of unvaccinated patients, but then most of the population is unvaccinated.

In terms of a time frame, we would expect the leading vaccine makers (such as Pfizer and Moderna) to have data within the next fortnight about what protection is conferred by their existing jabs. Better data on transmissibility should come in the next two to four weeks, and on severity in the next one to two months.

The key metric to watch in the meantime will be data on hospitalisations and deaths in South Africa, especially the Gauteng province where most Omicron cases have so far occurred.

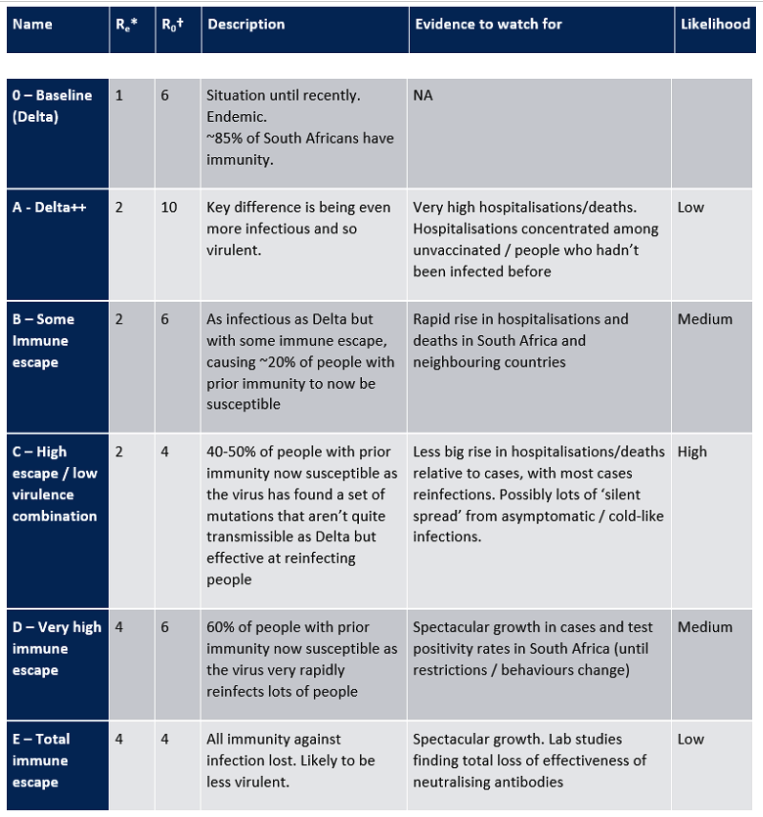

The table below offers a round-up of what we believe to be possible scenarios as to how the variant develops. At present, we see scenario C as the highest probability but it’s a situation that is still evolving and more data will be needed.

† – R0 = Fundamental R0 in urban South Africa, i.e. how good it is at spreading if everyone was susceptible and behaving normally

Source: Schroders, as at 29 November 2021

Travel restrictions too late already

Countries are already taking steps to try to limit the spread of the variant. Japan, Israel and Morocco are among those to have closed their borders to all tourists, while many countries have instituted travel bans or quarantine rules on southern Africa.

Such measures are probably already too late to have a significant impact. Omicron has been identified already in a number of countries and is likely already present everywhere that doesn’t have strict entry requirements. It will probably be spreading most rapidly in countries where Covid restrictions had already been largely lifted, such as the US, UK, South America and much of South Asia.

Discover more by visiting Schroders’ insights or click the links below:

– Read: Outlook 2022: UK equities

– Listen: How Omicron could affect markets

– Read: What analysing language tells us about inflation

Johanna Kyrklund, Chief Investment Officer:

It’s very early days in dealing with this new variant but we’re not back at square one as we were in March 2020. In the intervening time we have learnt a huge amount about the virus, the science is moving at speed, and much of the developed world at least has high levels of vaccination coverage.

I therefore don’t think it’s time for investors to be shying away from risk entirely. But the uncertainties are too great for this to be called a buying opportunity.

It’s not only Omicron; the cycle has matured

This time last year, we had the announcements of the first Covid-19 vaccines. That was the moment when being punchy proved the right strategy: big bets on cyclical assets – especially those tied into the re-opening trade – proved the right call.

However, markets have moved on since then. The economic cycle has matured and valuations are higher now. With the new variant posing an additional risk to growth, I don’t think it’s time for similarly broad macro calls. It’s time to be more nuanced.

Investors also need to bear in mind that the emergence of the new variant may see central banks delay tightening monetary policy. We already thought central banks were behind the curve in terms of reacting to higher inflation. If they further delay tightening, this could continue to support valuations.

Diversification will be important

Given both the heightened uncertainty and the late stage of the economic cycle, diversification will likely prove crucial. The role of fixed income as a diversifier in portfolios remains important, in my view.

Commodities are another area that could prove interesting. Oil remains largely driven by supply, which is quite restricted, rather than demand.

Investors may want to consider adjusting their exposure to equities, rather than moving out of shares entirely. Europe is perhaps a region where equity performance may be more challenged in the near term. Several countries were already instituting new Covid restrictions given rising infections prior to news of the variant. In terms of investment styles, growth may continue to be favoured over value, which could see the US as a relative winner.

Meanwhile, thematic investing offers options that are designed to be impervious to the wider market backdrop. “Superthemes” such as energy transition or the greater use of digital infrastructure are long-term structural changes that will continue regardless.

Not time to overreact

I’ve been asking myself: at this late stage of the cycle, what would I be doing, even if this new variant hadn’t appeared? And the answer is: increasing diversification; adjusting cyclical exposure; and moving out of “re-opening” trades. This all still holds true.

The persistence of inflationary pressures is something else that remains true. If the new variant is severe enough to see further restrictions on activity, that will only add to existing supply and labour market disruptions.

Ultimately, it is too soon to say how Omicron will affect markets longer term. We simply don’t have enough information about it yet. At the margins, taking care over cyclical exposure could be prudent in the near term but it’s too soon for a wholesale change.

Listen to Johanna’s views on the outlook for markets in the wake of Omicron by listening and subscribing to the Investor Download on Apple podcasts, Spotify, Google or wherever you get your podcasts. New shows are available every Thursday from 1700 UK time.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.