Oil lows hurt Shell but give EasyJet an easy ride on FTSE – London Report

OIL GIANT Royal Dutch Shell weighed heavily on the FTSE-100 yesterday after it missed profit expectations.

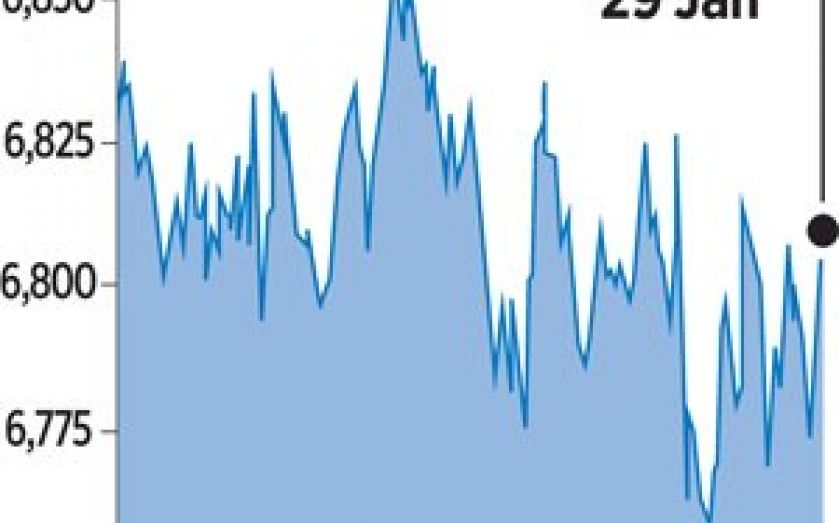

The blue-chip FTSE 100 index ended down 0.2 per cent at 6,810.60 points as Shell dropped 4.9 per cent, among the worst-performing FTSE 100 stocks in percentage terms. The company also announced a $15bn (£9.9bn) cut in spending due to the slump in oil prices.

Oil has fallen almost 60 per cent since June due to economic weakness, low global demand and a boom in US shale production.

John Smith, senior fund manager at Brown Shipley, said Shell’s update had disappointed investors. The fall in its share price also hit its rival BP, which weakened by 1.9 per cent.

“Earnings estimates look far too high. The real impact of the decline in the oil price will be felt in this year’s earnings, and the dividend will stay under pressure if oil does not see a significant recovery soon,” he said.

Other sectors, gained from lower oil prices lowering costs. The budget airline EasyJet rose 6.2 per cent.