Oil dips as European leaders play down prospect of sanctions on Russian energy supplies

Oil prices have dipped following strong rallies this morning, with European leaders pushing back against the idea of sanctions on Russian energy supplies.

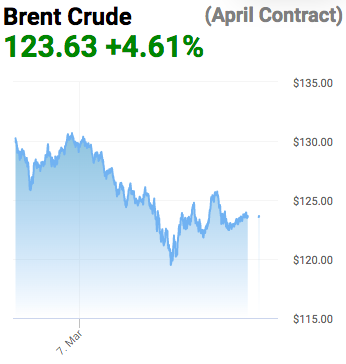

Brent Crude soared to $139 per barrel – the highest prices in 14 years – before dropping to $123 later in the day.

This followed suggestions from US Secretary of State Anthony Blinken the West could impose energy sanctions on Russian oil and gas.

Russian oil supplies have so far been exempt from waves of heavy sanctions imposed by the UK, US and EU – instead targeting the country’s central bank and financial institutions.

However, German Chancellor Olaf Scholz dismissed the prospect of energy sanctions, despite escalating conflict in Ukraine following Russia’s invasion.

He said: “The federal government has been for months working urgently with its partners in the European Union and beyond to develop alternatives to Russian energy. This cannot be done overnight.”

While Germany has suspended Nord Stream 2 and made commitments to building new LNG terminals and opened up the prospect of using more coal, the country remains highly dependent on Russian energy supplies.

The reticence to target oil supplies was echoed by Dutch Prime Minister Mark Rutte and Prime Minister Boris Johnson at a press conference in Downing Street this afternoon.

Both leaders said the EU cannot completely cut itself off from Russian hydrocarbons, in response to Vladimir Putin’s invasion of Ukraine, as the continent is far too reliant on its oil and gas.

Johnson said: “So far the success of the West has been in the unity we’ve shown and I think we’re all increasingly united in the mood that we’ve got to move away from Russian hydrocarbons, we’ve got to make sure that we have substitutes and substitute supply and that’s what we’re working on as well.”

Investec’s head of commodities Callum Macpherson told City A.M. any measures against Russian energy would be far riskier for Europe than the US.

He explained: “Fears have increased over the weekend as the US has been talking about an import ban in concert with Europe. That is a much bigger deal for Europe than it is for the US, so they may have to go it alone while Europe operates a phased approach.”

Speaking to City A.M., OANDA senior analyst Craig Erlam noted initial moves pared quite considerably over the course of the day, with prices seemingly dictated by the constant flow of headlines relating to the invasion.

Commenting on the prospect of European sanctions on Russian energy, he said: “It seems a drastic move by the EU regardless of how damaging it would be for Russia, which is obviously would be. But the two are mutually dependent and Europe simply doesn’t have an alternative in the short-term. Never say never but any move of this kind would be the biggest yet.”