Oil and gas rebound as pressure mounts on Russia

Oil and gas prices are soaring again after the West imposed stiff sanctions on Russian financial institutions yesterday, raising fears of supply shortages in already tight markets.

The US and Western allies such as the EU, UK and Canada teamed up yesterday to boot Russian banks from the SWIFT payments system and freeze the country’s central bank from its currencies, as Russia’s invasion of Ukraine entered a fifth day.

The measures could cause severe export disruptions between Russia and the West, with the Kremlin being a major producer of both oil and gas – and a key fossil fuel partner for Europe.

Russia currently accounts for around 10 per cent of global oil supply and is responsible for around 40 per cent of Europe’s natural gas supplies.

While Kremlin has committed to exporting oil and gas to world markets, and the West has avoided energy-specific sanctions, fears of conflict-driven disruption are underpinning already tight markets.

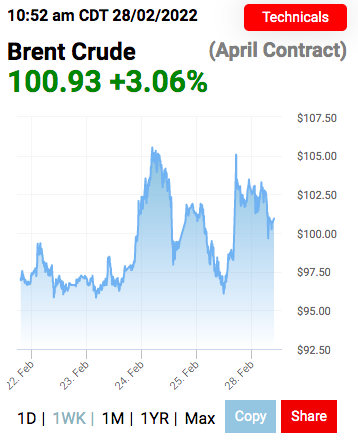

Brent Crude rallies to over $100 again

Buyers of Russian oil have been facing difficulties over payments and the availability of vessels after the imposition of sanctions, while BP has cancelled fuel oil loadings from a Black Sea port.

Amid these concerns of disruption, both major oil benchmarks have recovered from dips on Friday with Brent Crude rocketing to over $100 per barrel for the second time in five days, spiking 4.9 per cent to $102.73 per barrel.

Meanwhile, WTI Crude increased by a hefty 5.35 per cent to $96.49 – closing in on a seven-year peak.

After Russia’s invasion of Ukraine, Goldman Sachs has raised its one-month Brent price forecast to $115 a barrel from its previous $95 estimate.

The investment bank said: “We expect the price of consumed commodities that Russia is a key producer of to rally from here – this includes oil.”

This follows Bank of America forecasting that oil could reach $120 per barrel, depending on the severity of crisis.

Delegates from both Russia and Ukraine are holding talks today at the country’s border with Belarus, however it is unlikely any breakthroughs will be made today.

Craig Erlam, senior market analyst at OANDA said: “If the talks end badly today, we could see oil continue its ascent as markets factor in prolonged fighting in Ukraine and the risk of supply disruptions.”

Oil markets are being further underpinned by production shortages from OPEC+, which is due to meet tomorrow.

The group is expected to stick to plans to add 400,000 barrels per day (bpd) of supply in April, however it has consistently missed its targets with multiple members failing to reach raised production quotas.

Last month, the organisation produced 972,000 bpd less than their agreed targets.

Ahead of its latest meeting, OPEC+ also revised down its forecast for the oil market surplus for 2022 by about 200,000 bpd to 1.1m bpd, underscoring market tightness.

Commenting on current market conditions, Commerzbank analyst Carsten Fritsch said: “The sanctions and the exodus of Western oil companies are likely in the medium to long term to result in lower Russian oil and gas production because they will make investments in maintaining production and developing new sources significantly more difficult.”

Talks between Iran and US over reviving the nuclear have proved slow and gradual, but could result in a fresh influx of crude to the market – which would please US President Joe Biden who is desperate to drive down the cost of living ahead of the mid-terms.

However, whether this will offset current growth factors remains unclear.

Gas prices spike across the UK and Europe

Meanwhile gas prices have rocketed again across UK and European benchmarks.

Although Gazprom and the Kremlin have so far remained committed to world markets, with the energy giant shipping in line with requests, fears of future retaliatory measures and conflict driven disruptions in Ukrainian pipelines has buoyed markets.

UK Natural Gas Futures have skyrocketed over 13 per cent to £2.53 per therm, while Dutch TTF Futures have risen 13.8 per cent.

While prices remain below record levels reached in the run up to Christmas – with Europe gaining eleventh hour top-ups in liquefied natural gas from the US – the numbers are still historically high.

The continent’s LNG supplies are near-full, but EU Commission President Ursula von der Leyen has warned Gazprom gas supplies are at decade lows within European storage.

The trading bloc has struggled with supply shortages this winter, with Gazprom cutting export growth late lat year, and missing its output targets for Europe and Turkey.

Meanwhile the key Yamal-Europe pipeline which provides a sixth of Europe’s gas has continued to flow eastward away from Europe, reporting reverse movements since December as buyers favour contracts over spot pricing.

The European Commission has said Europe could cope with a short-term disruption to Russian gas flows, however reports from think tank Bruegel and investment bank Stifel suggest it would struggle to meet rising demand over a sustained period of time.

The decision of German Chancellor Olaf Scholz to suspend the approval process for the Nord Stream 2 pipeline has already reduced the likelihood of an influx of gas supplies in the near future.