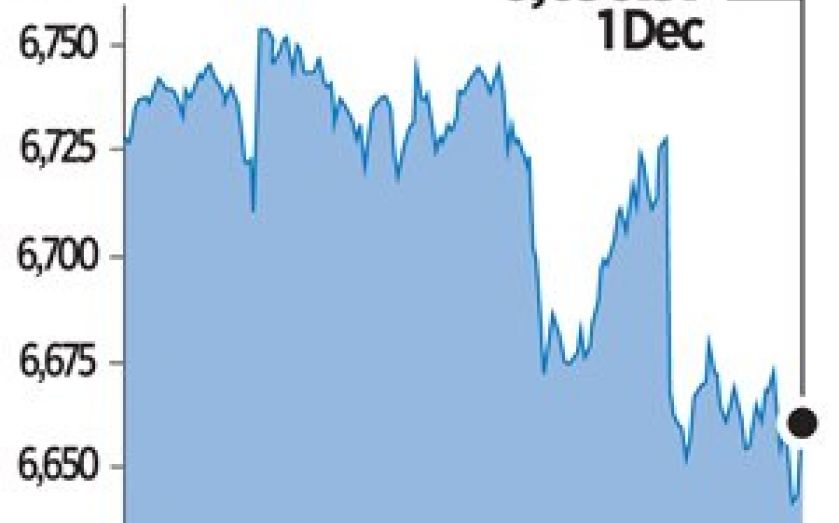

Oil and China data weigh on FTSE as it suffers 1pc fall in day – London Report

BRITAIN’S top share index yesterday dropped to its lowest in two weeks, as commodity shares slumped and Vodafone fell on speculation it is considering possible acquisitions.

The FTSE 100 closed down one per cent to 6,656.37 points, after falling as low as 6,637.39, the lowest since 17 November.

Vodafone fell 2.9 per cent to 227.20p and trimmed seven points off the index. Tullow Oil was down six per cent to 400.50p. It had fallen 8.5 per cent to a seven-year low in early trading after Citigroup and JP Morgan cut their target prices for the shares.

JP Morgan also downgraded other oil companies, including cutting Afren, down 11.77 per cent to 45.66p, from “overweight” to “underweight”.

Overall, oil, gas and mining stocks trimmed over 14 points from the index.

The falls in London were more significant, given the number of resource companies listed in the UK. So weak Chinese figures left BHP Billiton 2.18 per cent lower at 1,448p and Anglo American down 1.32 per cent to 1,304p.