Ofgem risks losing public trust after British Gas’ profit bonanza

Four years of heavy losses and historic instability in the energy industry were upended last week when British Gas posted record profits, fuelling a fresh windfall for owner Centrica even as oil and gas prices eased this year.

The UK’s largest supplier – home to 7.5m household customers – raked in nearly £1bn from just six months of trading, a bottom-line global fossil fuel producers would be proud of.

This is a marked contrast from last December when British Gas consisted of just £72m of Centrica’s £3.3bn bumper global earnings amid a worldwide commodities boom, with the company now powering nearly half of its £2.1bn half-year profits with a chunky £968m contribution.

While oil and gas giants like Shell and BP rode the wave of a freak spike in energy prices last year, retail suppliers have been constrained by tight profit limits and a rigid price cap – weighed down by elevated wholesale costs which have powered the profits of producers.

This has softened scrutiny towards the industry over the past couple years, with Westminster’s crosshairs instead focused on oil and gas producers – which have posted hundreds of billions in collective earnings since Russia’s invasion of Ukraine.

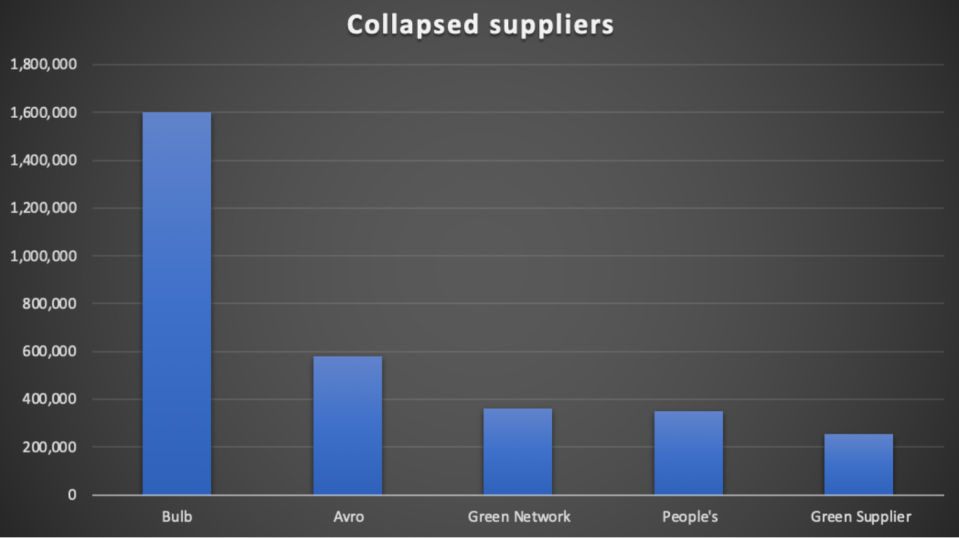

However, with rival Big Six players EDF and Scottish Power now also posting massive profits, the domestic energy crisis which saw the collapse of 30 energy firms and year-long de-facto nationalisation of Bulb has never seemed more distant.

Households suffer price cap pain

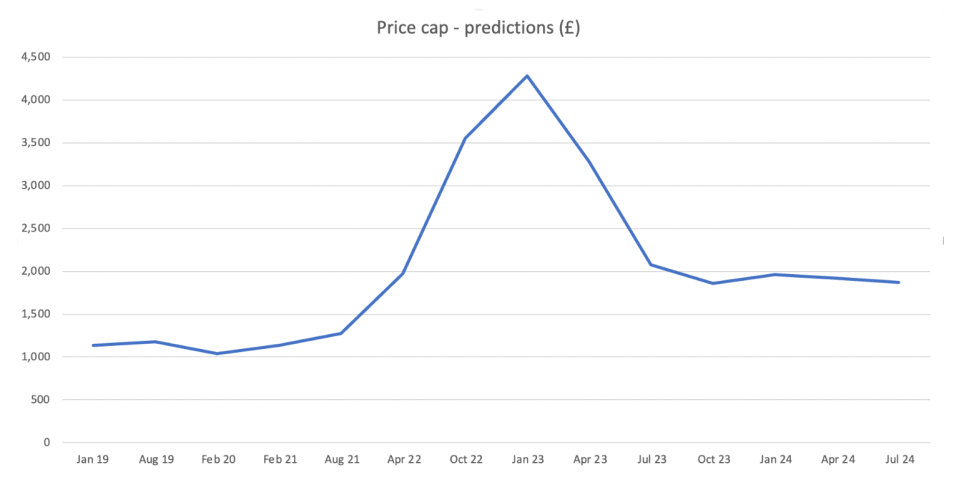

The turnaround follows Ofgem’s changes to the price cap formula this year, bringing in generous allowances to enable suppliers to recoup costs incurred from the pandemic, clawing back vast sums of money from households.

Centrica calculates this has powered £500m of British Gas’ £968m mega-earnings, while EDF attributes the price cap reforms as a key factor in its collective £2bn profits, with Scottish Power also highlighting the measure in its swing from an £86m loss to being £576m in the green.

Ofgem has pledged that this situation will be a one-off, that the huge earnings from suppliers this week is a temporary adjustment, with allowances set to be tightened this year again amid the regulator’s focus on financial discipline.

To that end, the watchdog has brought in new capital adequacy rules establishing requirements for net asset value, following the introduction of ringfencing requirements for renewable payments, and a market compliance review on fiscal stability.

Chief executive Jonathan Brearley has also written to suppliers warning companies against paying out dividends if they are loss-making.

However, all eyes will now be on Ofgem from Whitehall to Fleet Street, as its latest tinkering with the price cap has placed suppliers in the same conversation as profit churning banks this week, powering a growing perception that the industry is profiting from the pain of customers

While the watchdog argues allowances have been necessary to stabilise the sector and shore up suppliers, it has also helped sustain energy bills at near double conventional levels amid a cost-of-living crisis, with British Gas expected to have made £66 per customer from the allowances regime.

This is a particular sore point, with anti-fuel poverty charities estimating households are weighed down by £2bn of energy-related debt, with an estimated 7.5m people living in fuel poverty – meaning over 10 per cent of their income is spent heating their home.

Pressure on Ofgem to ease energy bills

Centrica boss Chris O’Shea expects British Gas’ profits to ease to around £150-200m over the coming years, and has pointed to the company’s £100m support package for households – around a tenth of the supplier’s monster earnings.

Nevertheless, its key focus appears to be its shareholders, with dividends now up a third and buybacks soaring to £1bn, helping the FTSE 100 firm’s shares spike to a four year high of 133p per share.

Centrica was also exposed in January for its use of third-party agencies to forcibly install prepayment meters in vulnerable people’s homes, which also raised questions over Ofgem’s regulatory abilities.

That is not to say everyone in the industry is unaware of the challenges ahead.

Utilita Energy chief executive Bill Bullen has called for £6bn of support to shave £600 off household energy bills for up to 10m customers this winter – paid for through scrapping legacy renewable contracts in the industry.

This would be smaller in scope than the Energy Price Guarantee, but targeted at the most vulnerable customers, with millions not included in existing benefit regimes.

Whether this is viable is up for debate, but where Bullen is right is that this coming winter could be even more painful for customers.

Households face the coldest months of the year without government support packages, with an elevated price cap coming two years into a stagnant economy following the pandemic, raising expectations of people switching off energy supplies and choosing between heating and eating.

If the energy sector wants to maintain the trust of customers, it is time for suppliers to come up with a plan to support low-income households, which Ofgem should be compelling them to do.

The government has stepped in with costly multibillion pound provisions for households and businesses for nearly two years, provided to every consumer in the country.

This was driven partly by the fact suppliers could only afford so much support when suffering losses.

Now, as they return to profitability Ofgem should be pushing energy firms into finding more ambitious solutions ahead of winter for vulnerable customers.

Simply put, £100m is a scandalously low amount for Centrica to be offering .

Otherwise, Ofgem risks being accused of serving the firms it is supposed to regulate rather than customers.

This might seem like a stark call for intervention in the energy market, yet higher bills risks energy industry losing trust of customers and the regulator no longer having the confidence of government – which threatens all sorts of volatile solutions such as nationalisation or breaking up suppliers.

If the energy sector wants to head off these threats, coming up with solutions this winter is vital – and as August approaches, the clock is ticking.