Ofgem proposes price cap shake-up which could see energy bills rise four times a year

Households could see their energy bills – which have spiked to record highs – rise four times over the course of a year, with Ofgem proposing a major revamp to the consumer price cap.

The energy watchdog has announced a ‘minded-to’ consultation looking into whether it should be updated quarterly rather than twice a year.

It argues the reform could make the market fairer and more resilient, as a more frequent price cap would reflect the most up-to-date energy prices.

This would also mean when wholesale prices ease from historic highs, energy will see this reflected in their bills much sooner.

However, if wholesale prices remain historically elevated it could mean energy users face bills rise four times over the course of 12 months.

Potentially, this could include a painful price hike in January next winter, during the depths of winter when energy demand is at its highest.

That said, such a change could also help suppliers predict with greater accuracy how much energy they need to purchase for their customers – reducing the risk of further market failures which ultimately push up costs for consumers.

Ofgem’s chief executive Jonathan Brearley said: “Today’s proposed change would mean the price cap is more reflective of current market prices and any price falls would be delivered more quickly to consumers.”

“The last year has shown that we need to make changes to the price cap so that suppliers are better able to manage risks in these unprecedented market conditions.”

This statutory consultation is open until 14 June 2022, and the market regulator could bring in changes as soon as October to support the sector through a challenging winter.

City A.M. questioned Ofgem about the possibility of a frequent price hikes for consumers if the cap is more regularly updated, particularly next winter.

Deputy director Dan Norton said: “We wouldn’t necessarily want to set any expectations in terms of whether the market is going to go up or down. That will just leave this as hostage to fortune, to be honest. There are a number of events that could happen, which could cause the price to go up . By the same token, if things start settling down a bit, we could expect it to go down. I don’t think we’re in business of making it a sort of medium term forecast like that.”

However, Ofgem boss Jonathan Brearley told Sky News this morning consumers should expect a price hike at least in October, when the cap is next updated.

Peter Smith, director of policy and advocacy at fuel charity group National Energy Action (NEA) heavily criticised the proposed changes.

He warned it “opens to door to significant prices rises during the coldest months of the year.”

Commenting on the ramifications, he said: “This change has the aggregate impact of reducing protections for fuel poor households. While the UK Government has the primary responsibility for tackling the energy crisis, Ofgem shouldn’t make things worse and needs to accelerate its ideas for providing greater price protection for those on the lowest incomes.”

Ofgem moves ahead with market reforms

Today’s announcement follows Ofgem’s previous consultation on the price cap earlier this year, looking into potential medium term changes in the methodology.

Alongside reforms to the price cap, Ofgem is also considering updating the wholesale allowance to ensure that suppliers can recover backwardation costs in a reasonable period of time.

Backwardation is when the current price of an underlying asset is higher than prices trading in the futures market.

Ofgem has previously announced multiple measures to make the energy industry more resilient to future market shocks.

This includes stress tests for suppliers and more robust scrutiny of supplier business plans.

Ofgem also recently wrote to suppliers to alert them to a series of market compliance reviews to ensure they are handling direct debits fairly, and that they are held to higher standards for performance on customer service and protecting vulnerable customers.

Price cap overhaul follows market carnage and cost-of-living crisis

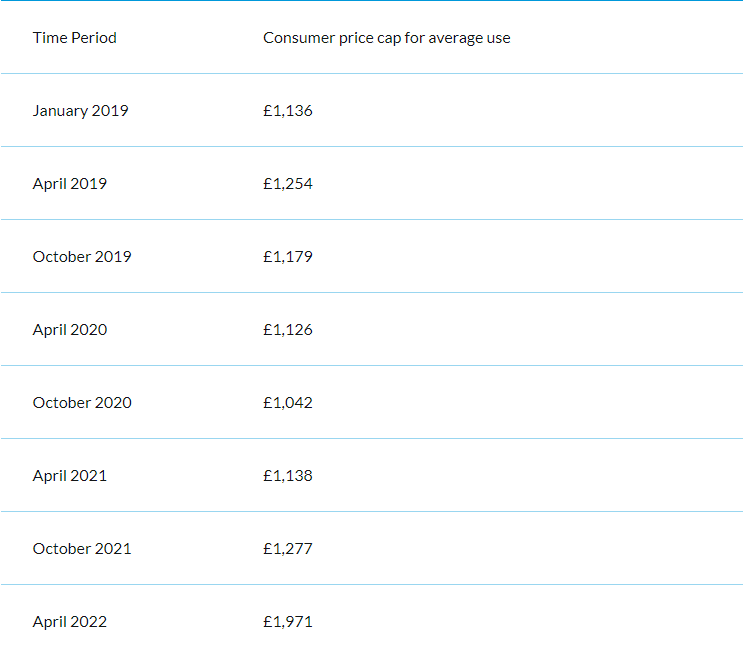

The price cap was brought in with parliamentary approval three years ago, and was designed to protect consumers from ultra-high prices and to ensure energy users that don’t switch regularly were not ripped off by their supplier.

However, the constraints of the mechanism, which was updated last October before a huge spike in wholesale prices, prevented suppliers passing on costs to consumers, making huge losses on every customer.

This, alongside insufficient hedging across the industry, led to nearly 30 suppliers collapsing since last September, directly affecting over four million customers.

Among the fallen firms was Bulb Energy, which remains propped up by public money to the tune of £2.2bn in the biggest state bailout since RBS in 2008.

The market carnage resulted in a clean-up bill of billions of pounds for energy consumers, with Ofgem also providing £1.8bn to compensate suppliers onboarding customers from fallen firms.

These eye-watering sums contributed to a painful 54 per cent spike in the price cap earlier this year, with average energy bills soaring to nearly £2,000 per year.

Cornwall Insight forecasts a further 34 per cent rise in energy bills in October, when the cap is next meant to be updated.

Spiralling energy bills have become a key feature in the deepening cost of living crisis, with households struggling amid soaring inflation.

Multiple industry leaders have called for the price cap to be reformed, with both Octopus Energy boss Greg Jackson and Scottish Power chief executive calling for a relative price cap, rather than a one-size fits all mechanism.

Commenting on the price cap earlier this year, Good Energy’s chief executive Nigel Pocklington told City A.M,: “It’s a clumsy intervention, and it’s now needed further clumsy interventions to correct the clumsy intervention. This is always what happens when governments intervene in markets.”

The cap has also been criticised by John Penrose, the MP who first called for the measure in the House of Commons.