Ofgem ‘failed to understand and tackle risks in the market’ argues Citizens Advice

Energy regulator Ofgem “failed to understand and tackle risks in the market” in the run-up to the industry crisis last winter, argued Citizens Advice.

Gillian Cooper, head of energy policy at the advisory group told City A.M. that Ofgem has intervened too late in the market to protect customers from spiralling bills and market carnage – which has seen household bills soar to nearly £2,000 per year.

She said: “By the time it took action, the ship had already sailed.”

Citizens Advice outlined its critical stance towards Ofgem after the watchdog published an external review from Oxera into the collapse of nearly 30 energy suppliers since last September.

The consultancy firm argued that Ofgem failed to sufficiently check the financial resilience of new suppliers to the market prior to the energy crisis – with the domestic energy sector peaking with 80 firms in 2018.

It suggested the regulator was so keen to incentivise competition in the retail sector that it gave new entrants a “free bet” — enabling them to join with minimal risk and almost no downside to exiting.

Oxera said: “Ofgem’s approach to regulating the market created the opportunity for suppliers to enter the market and grow to a considerable scale while committing minimal levels of their own equity capital. By pursuing a high-risk/high-reward business model, the suppliers would benefit from any upside, while being able to exit without any downside.”

Ofgem has accepted the findings of the report, and has recently unveiled multiple measures to reduce instability in the energy market.

This includes proposals for hedging controls and reducing the implementation of the price cap, while it has also introduced financial stress tests and temporary levies for firms taking switching customers.

However, Citizens Advice has argued these measures are too little too late, and has criticised Ofgem for the huge clean up bill for energy consumers from the instability across the energy market.

The combination of soaring wholesale costs and the constraints of the price cap resulted in 29 suppliers collapsing since last September, directly affecting over four million customers.

This includes Bulb Energy (Bulb), the UK’s seventh biggest supplier with 1.7m customers, which has been placed on life support since last November, propped up by transfusions of public money totalling £2.2bn, the biggest taxpayer bailout since RBS nearly crumbled in 2008.

Market crisis deepens ahead of Queen’s speech

When Bulb collapsed last November, it highlighted that it could only charge customers 70p per therm, although gas prices had spiked tob £4 per therm, representing huge losses from merely being in business.

Alongside Bulb falling into special administration, Ofgem has additionally provided £1.8bn in public money to surviving suppliers onboarding customers from the other 28 fallen firms during this time period.

These charges have contributed £68 per year to spiking energy bills, which soared 54 per cent to £1,971 from £1,277 per year last month.

Cooper said: “It’s totally unacceptable that customers are picking up the tab for collapsed suppliers as a result.”

Commenting on potential measures to ease the crisis, she added: “To make sure we never repeat this chaos again, Ofgem should raise market standards with a new consumer duty. It must also properly enforce its own rules to hold suppliers to account.”

A consumer duty would mean firms would have a requirement of care towards customers, in line with similar proposals put forward by the Financial Conduct Authority for the investment industry.

The report also revealed that many firms had failed to hedge properly, and that many sunk suppliers shared similar problems, such as negative equity balances, an over-reliance on customer credit balances to finance operations and a lack of sufficient hedging.

Ofgem said it accepted the findings and recommendations, including the need for tougher checks on companies as well as protecting customer credit balances and increasing the financial requirements for new entrants to the market.

It said: “The board will ensure all recommendations are carried out to further strengthen the regulatory regime, building on work by colleagues across the organisation to ensure that through robust regulation, Ofgem does the best it possibly can for consumers up and down the country.”

The criticisms of the regulator from Citizens Advice follow its report on the market last December, where it criticised the lack of active management and enforcement of existing rules to ensure the energy sector was resilient to future shocks.

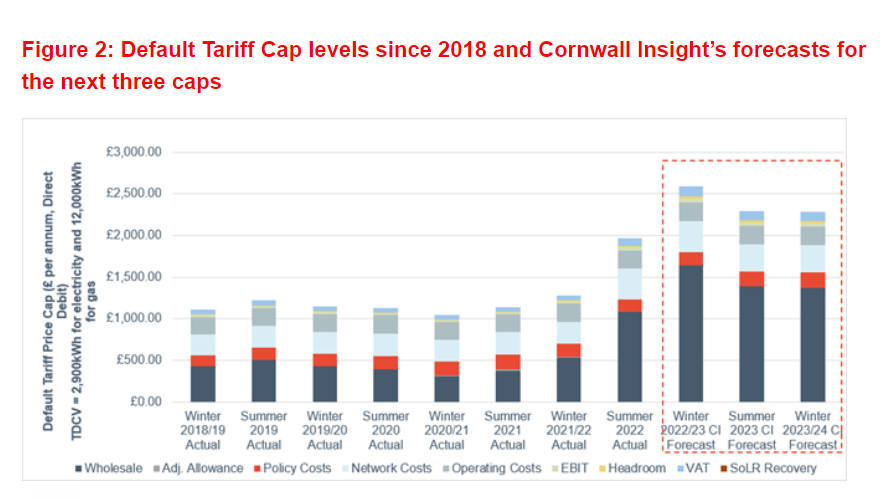

Meanwhile, energy specialist Cornwall Insight has forecast ahead of the Queen’s Speech tomorrow that energy bills could spike to nearly £2,600 per year in October – intensifying the cost of living crisis to millions of households.

It is widely expected an energy bill will be included in the speech, with the government under increasing pressure to propose measures the ease the cost of living crisis.