Ofgem demands suppliers refund customers overcharged on direct debits

Ofgem has demanded six domestic energy supplies take action over customers’ direct debits, including refunding overcharged energy users.

This follows a review from the market watchdog of 17 large suppliers in the UK energy market, determining that while a majority of firms were found to only have minor issues – or no issues at all – some suppliers had ‘moderate or severe’ weaknesses in their payment processes.

This includes Ecotricity, Good Energy, Green Energy UK, TruEnergy Utilita Energy and the now collapsed UK Energy Incubator Hub.

They have also been ordered to submit action plans within two weeks to set out how they will address weaknesses in their payment systems, which Ofgem will then scrutinise for effectiveness.

If the suppliers don’t take action fast enough, Ofgem will consider enforcement action – which could include fines, enforcement orders and banning the acquisition of new customers.

| Grade | Firms |

| No significant issues | British Gas – Centrica, EDF, Scottish Power, So Energy |

| Minor issues | Bulb Energy (administration), E.ON, Octopus Energy, Outfox the Market, Ovo Energy, Shell, Utility Warehouse |

| Moderate to severe issues | Ecotricity, Good Energy, Green Energy, Utilita Energy, Tru Energy UK Energy Incubator Hub (defunct) |

More than seven million energy consumers on a Standard Variable Tariff (SVT) saw an increase in their direct debit between February and April 2022 – rising on average 62 per cent during the two month window.

Ofgem found no evidence of unjustifiably high direct debits, but has required all suppliers that have doubled their customers’ direct debits – impacting over 500,000 customers across the UK – to review them and to make repayments if necessary.

It also found evidence that some suppliers’ processes are not as robust as they could be, and that this could lead to inconsistent, incorrect or poor treatment for customers.

Ofgem chief executive Jonathan Brearley said: “Suppliers must do all they can, especially during the current gas crisis, to support customers and to recognise the significant worry and concern increased direct debits can cause. Today’s findings show that with the urgent changes we are now expecting, the current system will be much fairer for consumers. Bringing down the price of gas is not in Ofgem’s control; however, we will do all we can to have a fair system and ensure suppliers look after their customers.”

The regulator opened a review into the sector in May after Brearley revealed there were “troubling signs” concerning behaviour in the energy market.

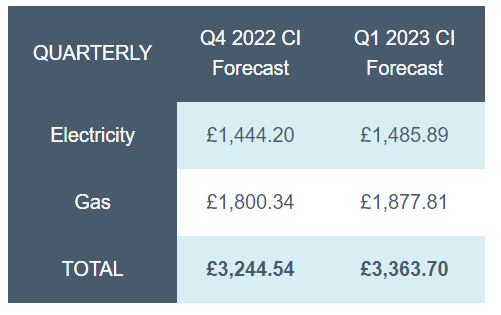

The review’s findings follow the latest gloomy forecasts from energy specialist Cornwall Insight the price cap will rise to £3,244 per year in October and climb to an eye-watering £3,363 in January during the coldest month of the year when demand is at its peak.

Energy suppliers set monthly direct debits based on predictions on how much energy the customer will use over the year – rather than being charged specifically for consumption levels.

However, there were concerns that suppliers were setting monthly charges too high – with Ofgem keen to reform the market further following a crisis that has seen 30 suppliers cease trading.

It has already brought in financial stress tests, market stabilisation charges, and fit and proper person rules.

Right to reply: Energy firms hit back at Ofgem

Ofgem revealed that the six suppliers with ‘moderate or severe’ issues had a spectrum of weaknesses in their payment systems.

This ranged from inadequately documented or embedded processes, weak governance and controls, to an overall lack of a structured approach to setting customer direct debits.

The watchdog was concerned that in some cases this could lead to customer direct debits being set incorrectly, or not being evaluated for a long time, which can cause the build-up of either unnecessarily large credit balances or debt, depending on whether the customer is under- or overpaying.

Good Energy revealed it would take swift action to address issues raised by the regulator.

A spokesperson said: “Ofgem raised just one concern about our direct debit governance. It relates to internal documentation and we are taking rapid action to address it. With rising energy costs across the industry it is understandable that this issue is receiving attention.”

“For this reason we recently took the proactive decision to conduct our own full review of our process and found that it is fair and consistent for our customers. They can rest assured that we take a proactive approach to setting their payment levels across the year, without resulting in debt or significant levels of credit.”

Meanwhile Utilita Energy (Utilita) took a more critical stance toward Ofgem’s approach, criticising the watchdog for ‘naming and shaming’ suppliers prior to any official findins.

A spokesperson said: “While we are happy to support Ofgem when the need to act publicly is clear, we disagree that at this early stage in the compliance engagement Ofgem should formally name and shame suppliers without any official finding. This sets a dangerous precedent and goes against two of the very principles of good governance, objectivity and integrity, that public bodies should uphold.”

Utilita also revealed it fully supports proposal to introduce a code of practice to govern the way energy suppliers set direct debits. It said it was clear that in the past some suppliers have used excess direct debit collections to prop up their balance sheet.

By contrast, the vast majority of Utilita’s customer base is prepay and consequently direct debit collections are not significant to its operations.

The second group, with minor weaknesses, consisted of Bulb Energy, E.ON, Octopus Energy, Outfox the Market, Ovo Energy, Shell and Utility Warehouse.

Ofgem revealed it identified some weaknesses or gaps in their processes that could lead to poor consumer outcomes.

Examples include a lack of documented policies or guidance for staff, potentially not taking account of all relevant factors when setting customer direct debits, or risks that some customers’ direct debits are not assessed when appropriate.

Octopus challenged the Ofgem’s findings, with chief executive Greg Jackson revealing on Twitter that Ofgem raised three issues with the UK’s fifth largest supplier.

Two referred to internal processes, where Octopus disputed Ofgem’s findings, while the third issue concerned direct debit payments being too low.

City A.M. understands Ofgem was concerned some Octopus customers were running the risk of accruing significant debit balances by not paying enough to cover their energy usage.

An Octopus spokesperson said: “Ofgem’s minor concern with Octopus is that customers are paying less than the regulator would expect – the opposite of the assumptions that payments are set too high. Octopus’s revolutionary balance forecaster ends the mystery of direct debit levels and truly puts customers in control. We’d love to see Ofgem make Octopus-level transparency mandatory for all energy suppliers.”

Suppliers in the top group, with no significant issues found, included British Gas, EDF, Scottish Power, and So Energy.

Ofgem’s review found that these suppliers had generally robust processes, although the regulator made recommendations for improvement.

It has now asked these firms to continue reviewing customer debits for assurance.

Speaking to City A.M., a So Energy spokesperson said: “Despite the challenges this has posed, we are pleased that Ofgem has found that So Energy has ‘no significant issues’ and that we have ‘robust processes in place’. We will continue to regularly review our customers’ direct debits, as part of our wider commitment to delivering the best possible service to our customers.”

The supplier also recognised the needed to review customers’ direct debits more frequently than normal, due to the unprecedented rise in wholesale prices, and the 54 per cent rise in the price cap earlier this year.