Ofgem boss to face grilling from MPs as price cap comes under fresh scrutiny

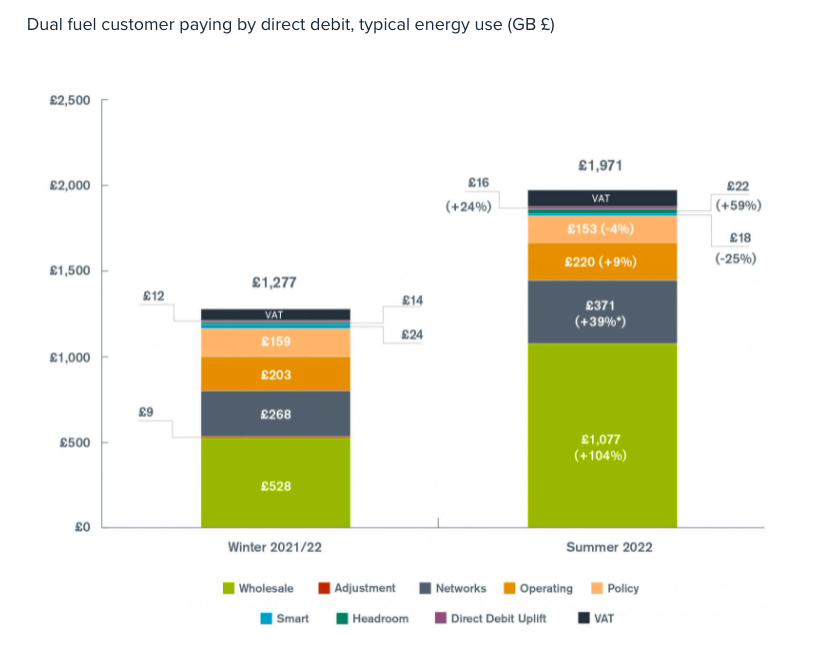

MPs will put the consumer price cap under fresh scrutiny today, following Ofgem’s decision to hike household bills to nearly £2,000 per year from April.

The market regulator’s chief executive Jonathan Brearley will be one of several leading industry voices facing probing questions from the Business, Energy and Industrial Strategy (BEIS) Committee, as it assesses the pricing mechanism’s role in the deepening energy crisis.

Energy firms have struggled with the lethal combination of soaring wholesale cost, which increased five-fold last year and remain historically high, and the constraints of the price cap, which have prevented doomed suppliers from passing costs on to consumers.

The consequent market turmoil has resulted in dozens of suppliers collapsing this winter, with Bulb Energy (Bulb) also falling into de-facto nationalisation in the largest state-backed bailout since RBS in 2008.

The response so far from both the government and the energy watchdog has been to intervene further in the market, and to minimise the pain consumers will suffer from rising costs and volatility.

Following the annonced 54 per cent hike in annual energy prices last week, Chancellor Rishi Sunak unveiled a £9bn package to protect households.

This includes £200 rebates on energy bills to be paid off over five years, council tax savings of £150 for properties in bands A-D, and an expansion of the £140 Warm Home Discount scheme to three million households.

Meanwhile, Ofgem have announced planned reforms to their current practices. The regulator will now wade into the market during future market shocks with speedier updates to the cap, while it also seeks to review the cap every three months rather than every six.

An Ofgem spokesperson told City A.M.: “This is all in the interests of stabilising the market and making sure consumers and suppliers pay a fair price.”

It has also recently announced hedging controls and financial stress tests, to ensure the industry is sufficiently resilient to future market shocks.

However, there are growing fears that high gas prices could be baked into the market.

Cornwall Insight has warned prices could rise to £2,400 per year in October when the cap is next updated.

Emma Pinchbeck, chief executive of Energy UK, who is also speaking to the BEIS Committee today, has also warned the prices could rise this winter.

This would limit the ability of both Ofgem and the government to contain household costs through preventative measures.

Other leading figures in the energy sector expected to attend the session today include Stephen Fitzpatrick, founder of OVO Energy, and Jonathan Marshall, senior economist at the Resolution Foundation.

Industry voices pressure government to reform the price cap

The price cap was introduced through parliament, as part of the Domestic Gas and Electricity Act in 2018, as an intended safety net for consumers that do not regularly switch and remain on standard or default tariffs.

While the mechanism has sheltered millions of households over recent months from the reality of a market battered by rebounding demand, shortening supplies, and sustained geopolitical volatility, the costs of clearing up the consequent market carnage have been eye-watering.

Investec has warned households could be on the hook for £3.2bn, from the onboarding costs involved in the supplier of last resort (SoLR) process and Bulb’s fall from grace.

Ofgem has committed £1.8bn in public money to suppliers on-boarding consumers through the SoLR process, which has shipped over two million customers from doomed firms to surviving suppliers.

Bulb’s continued existence on life support – propped up by tranfusions of public funds, is expected to cost the households around £2bn.

Consumer choice has also been painfully compromised, with 26 suppliers ceasing trading since September.

Leading industry voices such as ScottishPower chief executive Keith Anderson, Utilita Energy founder and chief executive Bill Bullen, and John Penrose – the MP who first pushed for the price cap in the House of Commons – also believe the safety net should be reformed.

Think tanks such as the Adam Smith Institute and Institute of Economic Affairs have also slammed government meddling in the energy market.

Criticising the safety net, Dr Craig Lowrey, senior consultant at Cornwall Insight said: “The cap was never meant to be a permanent solution and today has shown that rather than protecting customers, the impact in the wholesale market over the last 12 months was simply deferred, leading to this significant increase announced today.”