Offshore wind plans must be sped up to meet energy security goals, green group warns

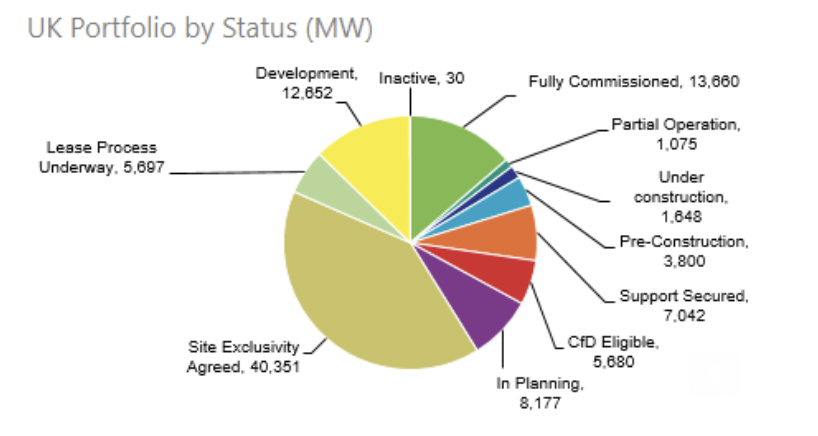

UK offshore wind pipeline has reached nearly 100GW – more than double its overall generation target to reach net zero and near ten times it current output from wind power, according to Renewable UK.

However, the trade body revealed only 13GW had been fully commissioned with less than 15 per cent of potential generation capacity under construction.

This raises questions over the planning process for offshore wind – with the energy source a a key pillar of the UK’s energy security strategy.

Downing Street is targeting a ramp up from 13GW to 50GW over the current decade – but forecasts for the time required to develop offshore wind turbines vary from seven to 11 years, due to the extensive commissioning process.

The Conservative Environment Network, a Westminster body backed by green Tory MPs, has called for planning laws to be streamlined.

Spokesperson Lynsey Jones told City A.M.: “There are still too many blockages to building more offshore wind, which we need to fix if we are to strengthen our energy security and maintain our position as a world leader in this industry.

“We need to accelerate the planning process, give renewable firms an investment allowance, and reform Ofgem’s remit to include net zero to accelerate clean British energy and stay competitive. Doing so will lower people’s bills, and create jobs, all while fighting climate change.”

UK faces competition for offshore wind plans

Renewable UK has called on the government to maintain the UK’s prominent position, in the face of competition from the US, which has brought in new subsidies to lure in investments.

The EU has since sought to match this with loosening subsidy rules and planning arrangements for new projects.

Chief executive Dan McGrail said: “It’s great to see the UK retaining a powerful position in offshore wind, second only to China. However, as our latest report shows, new markets are emerging fast in places like Australia and Brazil, so we can’t take our current status as a world leader for granted.

“The US and EU are offering massive financial incentives for developers to build renewable energy projects – while in the UK we’re being taxed more heavily than oil and gas companies. Unless we take bold action to attract billions in private investment, we risk being left behind in the years ahead – the money will simply go elsewhere and we’ll lose out on tens of thousands of jobs”.

The report revealed the UK remains the second biggest player in the market behind China.

In terms of global operational capacity, which is now 60GW, China is in the lead with 47 per cent (28.3GW), while the UK retains its position as the second largest with 23 per cent (13.7GW).

Overall, 90 per cent of the new offshore wind capacity which went operational in 2022 was in two markets: China (3.8GW) and the UK (3.2GW).

China and the UK are expected to retain first and second place until at least 2030.

However, the UK’s pipeline is now 8.5 per cent of the global total – which is the first time that it has fallen below 10 per cent, as new markets have emerged in Australasia and South America.

This reflects a boom in project developments, global pipeline now stands at 1,174GW across 1,417 projects in 38 countries – an increase of 508GW over the past 12 months.