OECD tells UK to ‘hold fire’ on new tech giants tax

The UK has been told by the OECD to “hold fire” on a new tax on big technology companies planned for April.

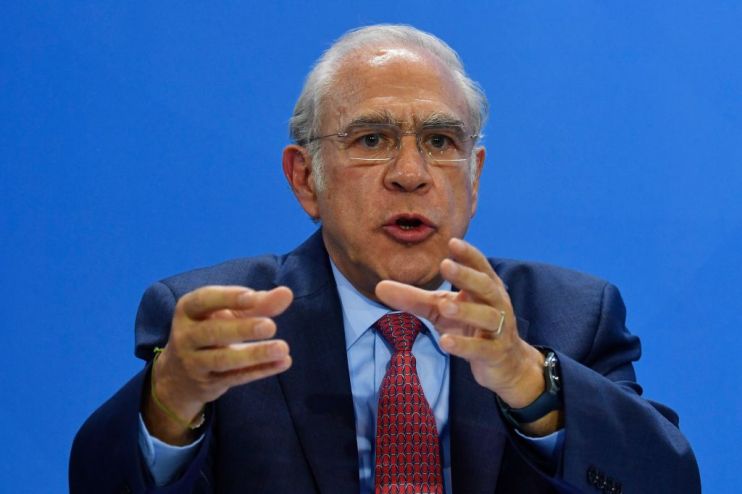

The secretary general of the organisation, which is tasked with brokering a global compromise on the issue of tech giants not paying enough tax, said there would be the risk of “a cacophony” if a worldwide agreement is not reached.

Angel Gurria told the BBC that if a solution was not reached, the result would be “cacophony and a mess”, with 40 countries going their own ways and “tensions rising all over the place”.

Gurria also said the British government should “absolutely hold fire” on its plans to levy a two per cent tax on the UK revenues of search engines, social media companies, and online marketplaces.

He said the UK should “contribute to a multilateral solution” instead of introducing the tax as planned in April.

A spokesperson for the Treasury said: “We’ve committed to introduce our Digital Services Tax from April 2020. It will be repealed once a global solution is in place”.

Gurria warning comes shortly after France agreed to delay the introduction of a new tax on multinational technology firms after the proposals sparked an angry response from Washington.

The US had threatened to impose retaliatory tariffs on $2.4bn (£1.8bn) of French goods including cheese and champagne after the tax was passed in July.

France will now delay the implementation of the new levy, a three per cent tax on French digital service revenues from companies with revenues of over €25m (£21m) in France and €750m worldwide, until the end of 2020.

French officials have repeatedly said that any international agreement reached on digital taxation by the OECD would immediately supersede its new tax.

Nearly 140 countries are set to meet at the OECD at the end of the month to lend their support to the biggest restructuring of international tax rules since the 1920s, in a bid to bring them up to date for the digital age.

Many tech companies have indicated their support for the tax system changing, with Microsoft president Brad Smith telling the BBC: “”it does make sense for big tech companies to pay appropriate taxes”.

Apple chief executive Tim Cook yesterday backed the OECD’s efforts to find a global solution to the issue.