OECD downgrades UK growth forecasts as it warns of storm clouds ahead for the global economy

UK downgraded

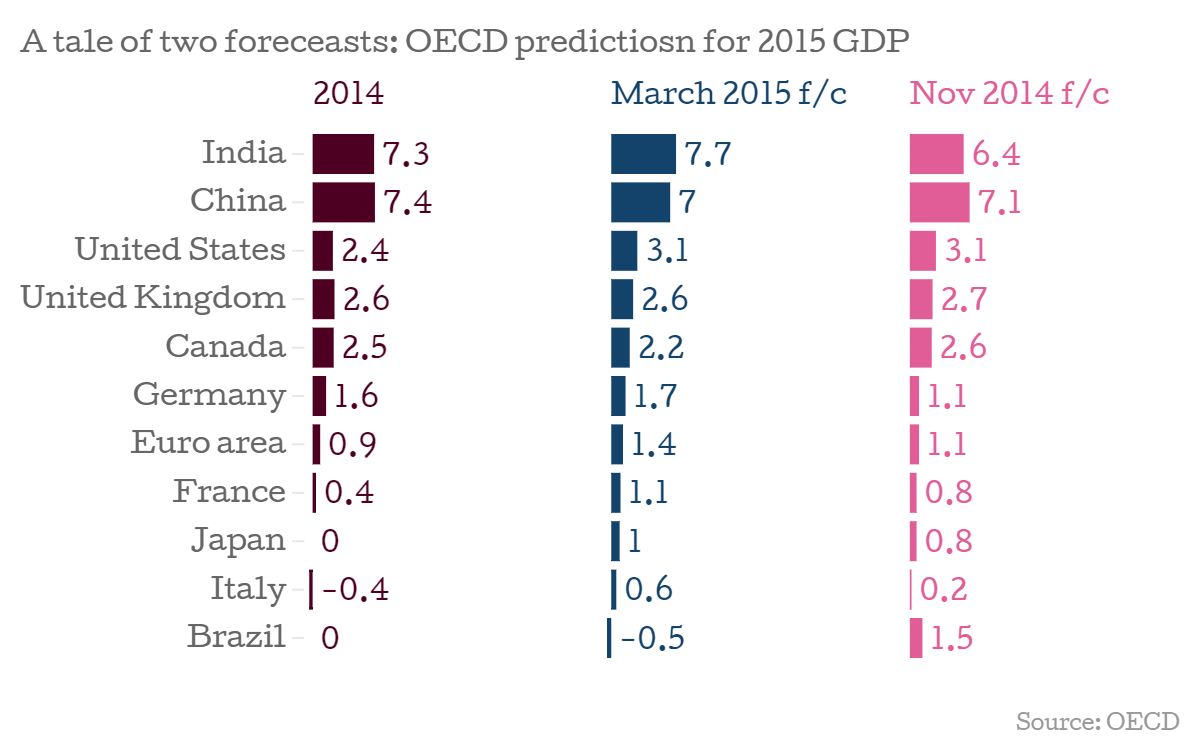

George Osborne may have spent his morning extolling the progress of the UK economy, but the Organisation for Economic Cooperation and Development (OECD) has downgraded its forecasts for the UK’s growth this year, dropping its expectations to 2.6 per cent, from 2.7 predicted in the November 2014 report.

The change brings the prediction in line with the Office for Budget Responsibility (OBR) forecasts, so will be unlikely to worry the chancellor too much.

Global expectations: Sunny spells with storm clouds on the horizon.

The outlook for the world economy is looking rosier as slumping oil prices and the European Central Bank’s quantitative easing programme boost demand and improve global conditions.

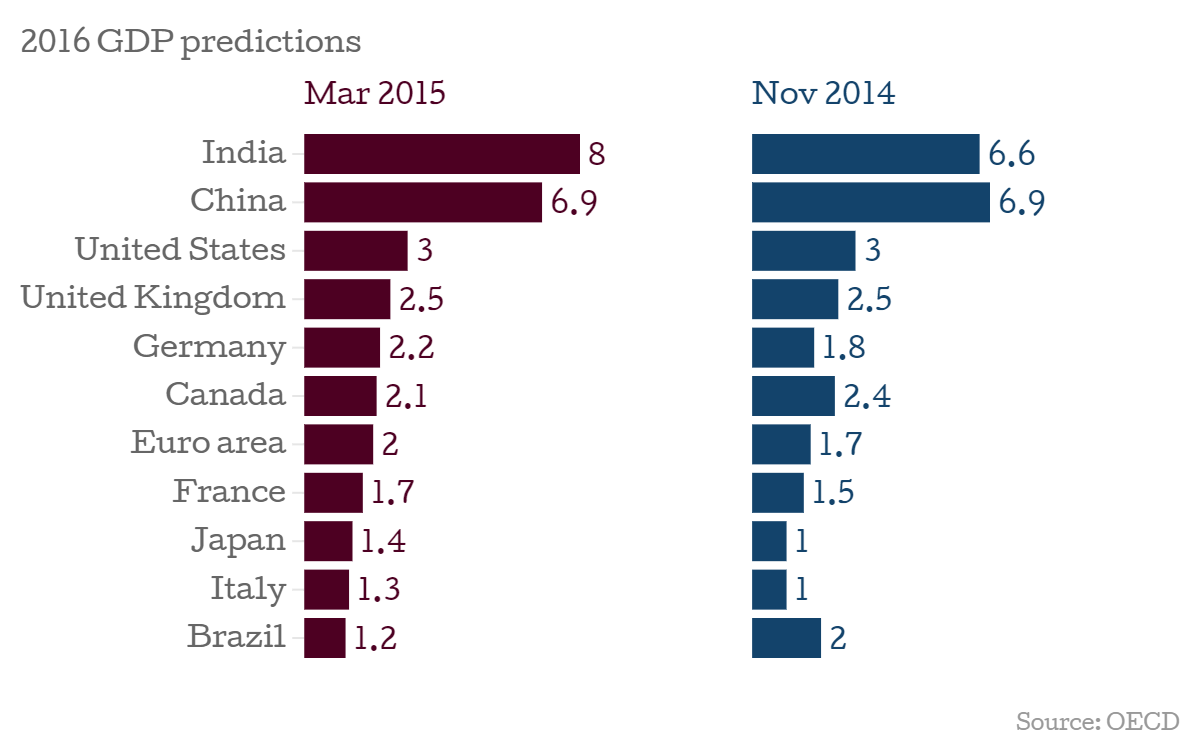

Here are two charts, showing the revised GDP growth rates, both for 2015 and 2016.

According to the OECD, the economic calm could be the prelude to a storm, as the potential for adverse conditions gathers on the horizon. The OECD believes the favourable conditions offer the opportunity for Europe and Japan to:

get back to somewhat stronger growth rates, and on balance the most recent indicators are encouraging.

For India and China, growth in the former looks set to outpace expansion in the latter, with India’s GDP predicted to increase by 7.7 per cent, compared to seven per cent for China.

Clouds on the horizon

The first storm cloud looming over the global economy is “abnormally low inflation,” but the organisation is also worried that monetary policy should be avoided as the only way of tackling adverse conditions. It said:

Abnormally low inflation and interest rates create a growing risk of financial instability with risk-taking and leverage driven by liquidity rather than fundamentals. Moreover, projected growth rates remain too low to fully repair and activate labour markets.

While central bank policies remain the centrepiece of the recovery, the exclusive reliance on monetary policy to manage demand should be avoided to mitigate these risks. A more balanced approach to policy is required with fiscal and, especially, structural policies providing synergistic support to monetary policy.

In short

A slight uptick seems to be the result of action on adverse conditions, rather than a more solid recovery. The UK’s downgrading is disappointing, but a tenth of a percentage point won’t be enough to lose the Conservatives any sleep on budget day.