Octopus pushes for Bulb deal after approval delayed by rivals’ intervention

Further delays in the sale of Bulb Energy are not in the interests of customers or the British taxpayer, argued incoming buyer Octopus Energy.

Judicial approval for the takeover was pushed back as much as three weeks, following a legal intervention from three of its Big Five rivals.

Octopus recognised the judge wanted more to consider what is a complex technical legal case, but argued it was in everyone’s interests for there to be clarity over Bulb’s future.

A spokesperson said: “Continued uncertainty isn’t good news for Bulb staff or customers, or the taxpayer, so we hope this gets resolved in the next hearing.”

Octopus and Bulb had been hoping the sale would receive judicial approval in Birmingham High Court today – with Ofgem set to begin its next observation window for hedging supplies later this month.

However, the process was paused after British Gas owner Centrica, EON UK, and Scottish Power raised concerns over the deal.

Lawyers working on behalf of the rival energy firms raised concerns over the timeframe between the purchase being announced at the end of October and its impending approval.

Downing Street green-lit Octopus’ deal to buy Bulb – after supporting the fallen supplier for eleven torrid months under a special administration regime.

Its inglorious stint as a de-facto nationalised energy firm cost bill-payers as much as £4bn amid soaring wholesale prices – with Bulb unable to hedge like other suppliers.

Bulb deal raises concerns over transparency

The sale is being conducted through the Energy Transfer Scheme, the first of its kind, which will move Bulb’s assets into a new entity – before it will eventually be swallowed by Octopus.

City A.M. understands the deal to buy Bulb includes a £100m-plus lump sum to the Government, a profit-share deal involving Bulb’s 1.6m customers, and up to £1bn in hedging support – which would be paid back over time.

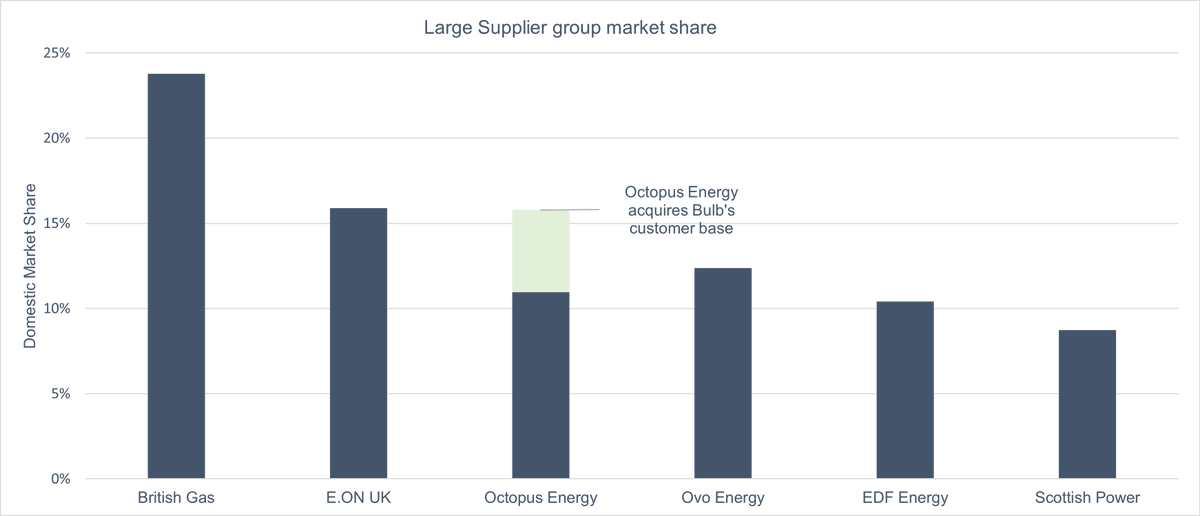

The deal would rescue Bulb customers from months of uncertainty, and crown Octopus’ rapid growth in recent years with a sixty per cent boost to its customer base, making it the third biggest supplier in the country with five million households on its books.

However, the terms around the profit-share deal and the hedging support are yet to be clearly outlined, including the potential interest rates and the percentages involved in any profit arrangements.

It is also not clear what size customer credit balances are held by Bulb – with The Guardian’s freedom of information request on the issue being snubbed on the grounds of commercial confidentiality.

Meanwhile, Ofgem’s report on the impact of the transaction on consumers is yet to be published.

Originally tweeted by Cornwall Insight (@CornwallInsight) on October 31, 2022.

Alongside a perceived lack of transparency, Octopus’ takeover of Bulb has reignited the debate over ringfencing customer credit balances.

One of its rivals told City A.M. last month that Octopus needed to guarantee ringfencing all of Bulb’s customers to prevent posing a risk to the market.

Scottish Power boss Keith Anderson recently wrote to former Business Secretary Jacob-Rees Mogg calling for the auction of Bulb to be scrapped and restarted, as first reported by Sky News.

In the letter, he told Rees-Mogg the proposed deal with Octopus could “distort competition” and was “not in public interest” due to the potential access to Government funding.

Octopus has been wary of the industry being bounced into hasty decisions to reform the market following a historic crisis.

It has consistently warned that ringfencing the entirety of customer credit balances could add as much as £30 per year to household energy bills – which are already at record highs.

Centrica, EON UK, and Scottish Power were all approached for comment.