Octopus Energy submits the only bid for collapsed supplier Bulb Energy after auction process

The Government is weighing up Bulb Energy’s (Bulb) future after the auction process for the fallen energy firm attracted just one bid.

Only Octopus Energy (Octopus) submitted a final offer for Bulb – as first reported in The Financial Times – after Masdar Energy (Masdar) and British Gas owner Centrica both pulled out of the running this month.

Masdar, an Abu Dhabi-based company, had been in discussions with the government but declined to make a bid.

However, they may still provide financing for Octopus’ bid.

Octopus is the UK’s fifth largest energy supplier, home to over three million customers.

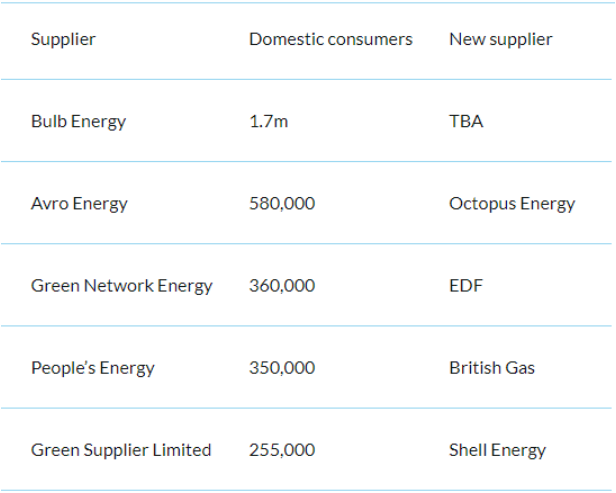

It has already picked up hundreds of thousands of customers through the supplier of last resort process, including Avro Energy’s entire customer base.

The Government has been keen to sell Bulb since it feel into de-facto nationalisation last November, but the collapse in bids means it is now in a weakened negotiating position.

Bulb became the first energy firm to fall into special administration last November, with the supplier struggling amid spiralling wholesale costs and the constraints of the price cap.

It was considered too large for the supplier of last resort process, which has seen over two million customers move from fallen firms to surviving suppliers.

Since then, Bulb and its parent company Simple Energy have been overseen by administrators Teneo and Simple Energy.

For the past eight months, it has been propped up regular transfusions of public funds – estimated at over £2bn – making it the biggest state bailout since Royal Bank of Scotland in 2008.

Alongside the operating costs, Bulb is gobbling up cash as a result of government rules that do not allow it to hedge — or buy in advance the energy it sells.

That has left it exposed to volatile gas prices, which have soared since Russia invaded Ukraine.

Despite the turmoil, it remains the UK’s seventh largest supplier, home to 1.7m customers, however there are concerns customers could flee to other suppliers following the crisis.

Bulb’s collapse exposes market crisis

City A.M. understands that there are “active and amicable” discussions between Bulb’s administrators, the Government and Octopus over the terms of a potential deal – which remain undisclosed.

Securing a deal by the this summer is still the aim, however it is unclear whether an agreement will be reached this month, as the sale of Bulb is complicated by its overall size and scope

There is also the existence of creditors such as the Sequoia Investment Fund, which is owed £55m by Simple Energy – Bulb’s parent company.

Overall, Bulb owes hundreds of millions of pounds to creditors, but it is unclear how many will be repaid.

According to The Financial Times, a ministerial meeting was held last Friday to discuss options for Bulb, which could still include dividing up its customers between other suppliers or handing incentives to Octopus to take them on.

The Government could still decline Octopus’s bid, although it is keen to sell the business amid the rising taxpayer costs.

Meanwhile, energy specialist Cornwall Insight expects consumer price cap is expected to rise to £3,244 per year in October, and £3,363 per in January, when energy demand is at its peak in the cold winter months.

The price cap is currently at a record £1,971 per year.

Currently, households are paying £94 a year to cover the cost of failed suppliers but this is expected to rise to £164 a year once the price of Bulb’s administration is eventually spread across customer energy bills, according to analysis from Citizens Advice.

The charity has criticised Ofgem’s handling of the crisis, slamming the watchdog for not intervening earlier against poorly-managed energy firms.

Last month, the National Audit Office also criticised Ofgem for allowing shareholders and founders of bust firms to escape sanctions while households suffered the costs of supplier failures.

Teneo, Octopus and Bulb declined to comment.

The Government have also been approached by City A.M..