Octopus Energy faces £100m blow from market meltdown

Octopus Energy Group (Octopus) has warned it is facing a hefty bill from the energy crisis, as the price cap has prevented the supplier from passing on the impact of soaring wholesale costs to customers.

In its freshly published full-year results, the energy giant revealed it could lose up to £100m from the painful combination of the current consumer price cap and record wholesale prices, which has seen dozens of suppliers exit the energy sector and Bulb Energy (Bulb) enter de-facto nationalisation this winter.

Octopus has recently become the country’s fifth biggest energy supplier, scooping up 580,000 more consumers from fallen firm Avro Energy last year through the supplier of last resort process, but will continue to face severe headwinds over the coming months.

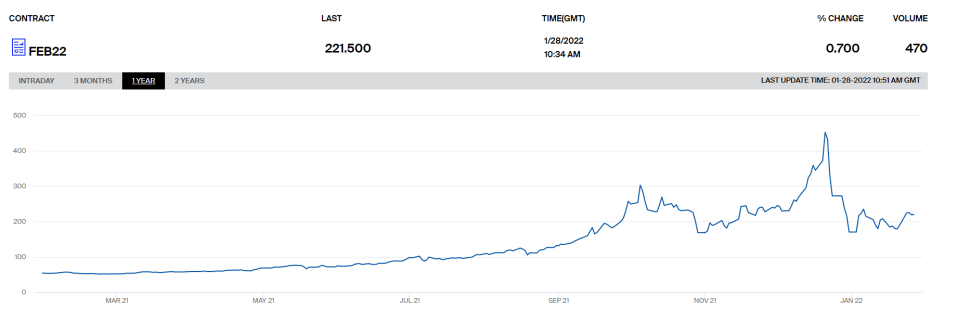

While Octopus is a provider of green power and relies on renewable sources, natural gas reflects more than a third of the UK’s energy mix and consequently influences power prices for the wider market.

Market regulator Ofgem is set to meet next month to establish the likely price hike, which is expected to see the consumer price cap soar from £1,277 per year for average use to potentially £2,000 per year.

When Bulb dropped into administration last November, it revealed wholesale prices meant it was forced to pay £4 per therm to provide customers with energy, but could only charge them 70p per therm in return.

Gas prices have dipped since then, but costs are still remain historically high with the UK spending an extra £20bn on procuring energy over the last calendar year compared to normal.

The market is also deeply vulnerable to potential shortages amid rebounding demand in Asia and brewing geopolitical tensions between Russia and the West over the future of Ukraine.

Octopus has also announced it is setting aside £2.5m in additional funding to help customers struggling to pay their bills, with the price cap widely expected to rise by as much as 50 per cent in April to reflect market conditions.

This follows the group’s chief executive Greg Jackson calling for the industry to spread out costs for consumers to reduce the burden on households this spring.

He is still open to the idea of Treasury support, but encouraged firms and the wider energy industry to find solutions to ease pressure on households.

This view was criticised by Utilita Energy founder Bill Bullen, who challenged the suggestion households can be insulated from market realities, and instead called for expansions to existing welfare payments.

The government is reportedly weighing up multiple options to reduce costs for energy users – varying from one-off £500 cash grants to full-scale loans and additional mechanisms for the industry to loan them public money in the case of any market shocks.

Jackson said: “2022 will be tough in energy, but we will fight for customer interests and work with government and industry to find solutions which may mitigate the issues for customers whilst doubling down on the investments in technology, growth and renewables which will help avoid such crises in future. “

Energy giant revels in rising revenues amid mass expansion

Alongside gloomy commentary on the current energy crisis, Octopus published its headline figures from April 2020 to April 2021.

It revealed that while the UK retail business posted a loss of £85m, its expansion and acquisition plans were powered by soaring revenues, which skyrocketed to £2bn over the 12-month window.

Octopus enjoyed a 62 per cent boost in its overall revenues, rising from £1.2bn, with revenue growth expected to follow the same trajectory over the course of the current financial year, doubling to nearly £4bn by April 2022.

The uptick in earnings reflects a period of mass expansion for the green energy provider, which increased its base of household consumers by 46 per cent over the latest reported 12-month window.

It acquired Octopus Renewables in March 2021, bolstering the group with a new £3.4bn portfolio of renewable energy asset, consisting of 300 projects across seven countries, for its generation arm.

Key technology investments also included the acquisitions of Configurable, Upside Energy (now KrakenFlex) and Smart Pea.

Nevertheless, the firm appears to have consolidated its upward trajectory.

While the results reveal its customer base had grown to 2.1m by last April, its most recent data shows it had 3.3m customers at the end of the 2021 calendar year.

Since its last set of results, it has become the fifth largest energy retailer in the UK in terms of customer base.

The group’s international retail arm saw a 14-fold increase, growing from 15,000 customers in January 2021 to 220,000 by January 2022.

Beyond Europe, Octopus has expanded its global footprint to the US and via a joint venture with Tokyo Gas to Japan.

Octopus has particularly benefitted from strategic investment from investors in new business arms and technology, which has increased the group’s year end net assets to a total value of £231m.

It has also been buoyed by extensive licensing deals for its technology platform, Kraken, across the wider energy market.

Kraken is now contracted to serve nearly 25m energy accounts globally through licensing agreements with rivals such as EDF, E.ON, Origin Energy and Good Energy.

Around 45 per cent of UK households are expected to run on Kraken once customer migrations are completed.

Octopus stretches tentacles into France

The energy group also revealed it has just snapped up French firm Plüm Energie, which is home to 100,000 customers.

Plüm Energie will join as Octopus Energy France, the eighth international retail operation in the group.

The move means that the group is now active in 13 countries, and follows a recent move into Italy.

Jackson said: “The move will help bolster our global buying power and enhance our tech, improving our ability to look after customers in the current market and beyond.”

Meanwhile, Octopus Energy Generation, which manages a three gigawatt renewable generation portfolio across seven countries in Europe, is planning to invest a further £25bn by 2030 in new solar and wind farms in the UK and around the world.