Octopus edges towards Bulb deal as judge confirms takeover date

Octopus Energy are inching closer to completing their protracted takeover of Bulb, after a High Court judge set a date for the deal to be finalised.

Justice Zacaroli has confirmed the acquisition can be completed on 20 December via the energy transfer scheme, despite legal challenges from rival suppliers.

Big Six firms Centrica, Eon and Scottish Power applied for a judicial review of the deal earlier this week, concerned over the perceived lack of transparency and Government funding involved in Octopus’ takeover.

The judge confirmed this was now the “only obstacle” for Bulb’s assets being transferred over to Octopus.

However, he also ruled out making a verdict on a potential judicial review.

This will have to be overseen by another judge in a separate case lodged with the administrative courts.

Such a review has to be tabled before the takeover date in less than three weeks.

Centrica, EON and Scottish Power declined to comment on today’s developments.

City A.M. understands Centrica are still set to pursue a judicial review.

The challenge comes with risks for the British Gas owner, which would have to compensate Octopus and Bulb’s administrator Teneo if the judicial review ruled in favour of the deal.

The Government approved the deal for Octopus to buy Bulb last month, and it was expected to be completed by the end of November.

The verdict was then delayed for three weeks after the rival suppliers successfully argued they needed more time to assess the arrangement.

This was then followed by this week’s developments, with the judge opting to set a date for the takeover.

Octopus welcomes takeover timeline

Octopus welcomed today’s decision, and argued it would save taxpayers and customers from further exposure to Bulb’s costly stint in administration

Octopus Energy spokesperson said: “The High Court has rightly given the green light for the transfer to go ahead in December. Taxpayers will be saved from millions – even billions – of costs which could have been incurred if the process was dragged out.

“This is positive news for Bulb’s customers and staff, and starts to bring to an end the huge financial exposures for government and taxpayers.”

Bulb has been de-facto nationalised for over a year, which the Office for Budget Responsibility estimates will cost taxpayers £6.5bn.

This makes it the biggest state bailout since RBS in the 2008 financial crisis.

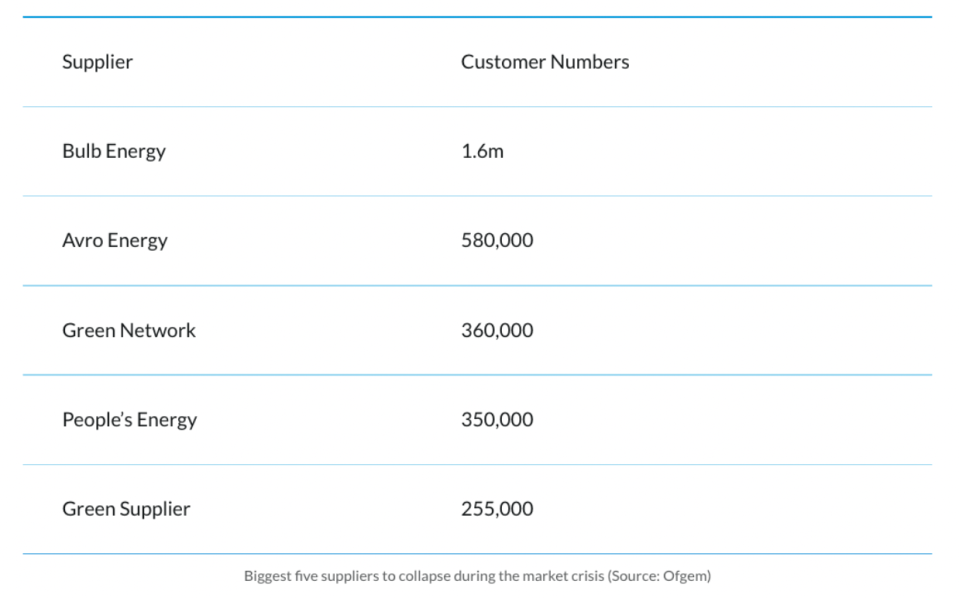

The energy firm is still the UK’s seventh biggest supplier and is home to 1.6m customers, and was the largest supplier to collapse during the energy crisis – which has seen the demise of 30 suppliers over the past 18 months.

It has been on life support since last November when it was exposed by its lack of sufficient hedging and collapsed amid soaring wholesale prices.

The legal uncertainty will not affect Bulb customers, who will remain protected by Ofgem and overseen by Teneo until any deal for a buyer is finalised.

The terms of Octopus’ takeover remain opaque, however City A.M. understands it includes a £100-200m, a profit-share deal and £1bn-plus in hedging support.

If Octopus complete the deal, they will become the third largest supplier in the UK behind EON and Centrica, with five million customers.