Octopus edges toward Bulb takeover as £4bn saga nears its end

Octopus Energy (Octopus) is edging closer to taking over fallen rival Bulb Energy (Bulb), bringing to an end an 11 month saga and the biggest state bailout since RBS in 2008.

City A.M. understands Bulb’s administrators recommended Octopus’ purchase of the energy firm in a paper sent to the Department for Business, Energy and Industrial Strategy (BEIS) last month.

The Government and Bulb’s special administrator, Teneo Financial Advisory, are now preparing to sign a binding agreement to sell the company to Octopus Energy by the end of October, according to Sky News.

The news agency suggests the deal has a target completion date of December, and has the backing of industry regulator Ofgem.

The deal would confirm £4bn of losses for British taxpayers, a combination of both soaring wholesale costs and £1bn which Octopus is demanding to set up a hedging strategy for the new customers it is taking on.

This is the most expensive taxpayer support deal for a company since RBS faced collapse in the financial crisis.

Octopus would be expected to pay this back over a number of months, as market conditions hopefully ease.

The renewables-only supplier is expected to pay between £100-200m to take on Bulb’s customer base.

It will also take on a profit-share agreement giving the government a return for many years on earnings from Bulb customers.

Bulb takeover boosts Octopus’ ambitions

Bulb is home to 1.6m energy users, and remains the seventh biggest energy firm in the UK.

It became the first energy firm to drop into special administration last November, struggling with the lethal combination of soaring wholesale costs, poor hedging, and the constraints of the energy price cap.

Unlike other suppliers, it was deemed too large to enter the supplier of last resort process, where customers are ferried from fallen firms to other companies.

Instead, it was put on life support over winter, propped up by transfusions of taxpayer funds – which were exacerbated by the banning of a hedging strategy, meaning Bulb had to pay spot prices to meet people’s energy needs.

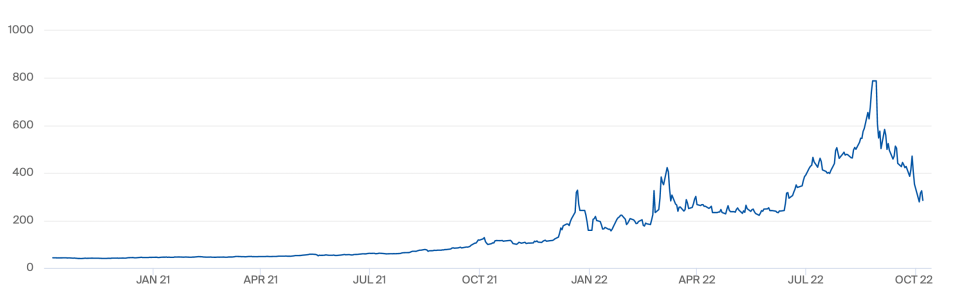

Wholesale gas prices have soared to record highs this year, with Russia’s invasion of Ukraine and subsequent Western sanctions and Kremlin-backed supply squeezes putting huge pressure on global markets.

This exacerbated a domestic energy supplier crisis, with 30 suppliers collapsing over the past 15 months amid rebounding post-pandemic demand and poor management strategies.

Ofgem has since announced a raft of reforms to the market including fit and proper persons tests, stabilisation charges and is currently consulting on ringfencing customer credit balances.

Earlier this summer, Octopus was left as the last bidder standing in the race to buy Bulb after British Gas owner Centrica and Masdar pulled out.

If it completes the deal, it will have over five million customers on its books, making it one of the biggest energy firms in the country.

A Government spokesperson told City A.M. : “The Special Administrator of Bulb is required by law to keep costs as low as possible. We continue to engage closely with them to ensure maximum value for money for taxpayers.”

Octopus and Teneo declined to comment.