OBR: UK is already in recession and taxes on course for post World War II high

The UK is already in a recession that will burn a huge hole in the public finances, forcing the government to hike taxes to their highest level since just after the Second World War in the 1940s, the country’s fiscal watchdog warned today in forecasts published alongside Jeremy Hunt’s autumn statement.

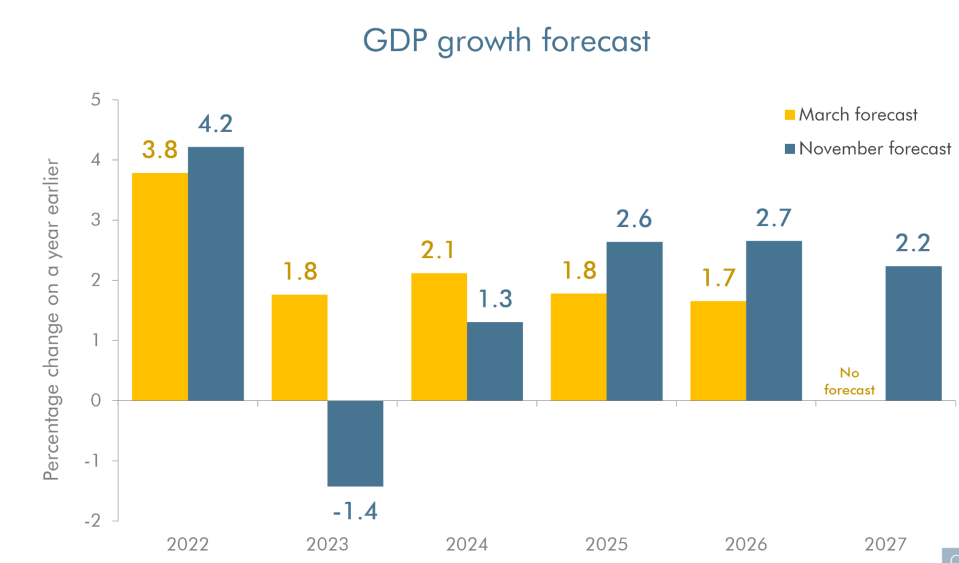

The Office for Budget Responsibility (OBR) has sharply downgraded its forecasts for the UK economy since its last projections just eight months ago in March.

Back then, the fiscal watchdog created by former chancellor George Osborne in 2010 reckoned the economy would grow 1.8 per cent next year. Now, it has warned of a 1.4 per cent contraction.

OBR expected modest growth in March 2022 forecasts

The anaemic growth outlook has weakened the UK’s finances, forcing Hunt into £55bn of tax rises and spending cuts to meet his fiscal targets.

Rising interest rates have also swelled the government’s debt interest bill, forcing Hunt into a big financial tightening. Even in five years, the UK will be repaying its creditors over £100bn, greater spending than “any single public service bar the NHS,” Paul Johnson, director of the economic think tank the Institute for Fiscal Studies, said.

The OBR reckons taxes as a share of the economy will peak at 37.5 per cent, the highest level since the end of World War II.

The recession “means taking difficult decisions. Anyone who says there are easy answers is not being straight with the British people,” Hunt said.

UK GDP will be just over two per cent smaller by the end of a year long recession, the OBR said.

Weaker growth is set to cut government tax revenues, forcing borrowing up to £177bn this year, up from just over the £99bn the OBR forecast in March. The debt pile will rise £140bn next year and climb a shade under £70bn in five years.

A historic living standards shock triggered by raging inflation is plaguing household and business finances, prompting a huge economic downturn.

Brits will suffer a seven per cent reduction in their living standards over the next two years, wiping out eight years of growth.

That hit comes despite the government retaining a slimmed down version of the energy bill support package. From April, the government will cap annual typical household energy bills at £3,000 instead of £2,500, paying electricity and gas providers the difference.

The scheme has been extended beyond next spring.

Those on means tested benefits will receive a £900 payment, while pensioners will get £300, designed to be offset against energy bill. People on disability benefits will get £150.

The meat of the public spending cuts do not kick in until after the next general election, which has to be held by January 2025. The treasury reckons government spending will fall around £30bn in real terms in five years, while taxes will jump £25bn in the same year as a result of Hunt’s budget.

Those fiscal tweaks mean the chancellor has hit his new targets of having debt to GDP falling and current borrowing below three per cent of GDP in five years.

The OBR’s warning chimes with projections by the Bank of England earlier this month, which warned the country is on course for the longest recession on record at two years, if rates top five per cent.

Taxes are on course for a post WWII high

Figures out yesterday revealed the consumer price index climbed to 11.1 per cent, up a whole percentage point from September and much higher than the Bank and City’s forecasts.

The OBR reckons inflation will average 7.4 per cent next year, up from four per cent in its old projections.

Lower economic growth reduces a government’s tax take as a result of consumers and businesses spending less.

Hunt announced a string of stealth tax rises that will rake in more money for the treasury due to high inflation bumping people’s wages and pushing them into higher tax brackets, a process known as fiscal drag.

Income tax thresholds have been frozen until 2027/28, a year longer than when the measure was first announced by prime minister Rishi Sunak in the March 2021 budget, raising an additional £1.26bn.

The level at which wealthy Brits begin paying the top 45 per cent rate of income tax has been cut to £125,140 from £150,000.

An existing windfall tax on oil and gas producers has been raised to 35 per cent from 25 per cent. Hunt also launched a new 45 per cent levy on electricity generators. The measures in total will raise £14bn.

Hunt said he has no “objection to windfall taxes if they are genuinely about windfall profits caused by unexpected increases in energy prices”.

Critics have said energy firms are profiteering from Russia’s illegal invasion of Ukraine pushing gas and electricity prices higher. Other argue one off taxes will disincentivise investment into UK renewable energy infrastructure.

The level at which employers start paying workers’ national insurance bills has been frozen, yielding nearly £6bn more in revenue for the treasury, while capital gains tax relief will more than halve to £6,000 next year and drop again in 2024 to £3,000.

Other measures included:

- Slashing the dividend tax free allowance to £1,000 from next year and then to £500 the following year

- Tax free inheritance tax threshold have been frozen at £325,000 for a further two years

- Cutting stamp duty relief in 2025

- Allowing councils to raise council tax steeply without holding a vote

- Scale down tax reliefs for research and development spending

A raft of government departmental budgets’ have been cut in real terms.