OBR downgrades UK growth prospects as higher interest rates bite

The Office for Budget Responsibility (OBR) has slashed its growth forecasts for the UK economy over the next couple of years as higher interest rates bite.

In its latest Economic and Fiscal Outlook, the independent fiscal watchdog forecast that the UK economy would grow just 0.7 per cent next year before picking up to 1.4 per cent in 2025.

At its last forecasts in March, the OBR predicted that the UK would grow 1.8 per cent next year and 2.5 per cent in 2025.

After 2025, growth rises to 1.9 per cent in 2026, two per cent in 2027 and 1.7 per cent in 2028, both lower than the OBR’s March forecasts.

OBR forecasts for UK growth

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| OBR November forecast | 0.6 | 0.7 | 1.4 | 1.9 | 2 | 1.7 |

| OBR March forecast | -0.2 | 1.8 | 2.5 | 2.1 | 1.9 | – |

| Bank of England | 0.5 | 0.1 | 0.2 | 0.8 | – | – |

The downgrades reflect higher rate expectations for the coming years than when the OBR’s last forecasts were made in March. Back then, it thought that rates would peak at four per cent but the benchmark Bank Rate currently stands at 5.25 per cent.

It also reflects a higher starting point for the UK economy after the Office for National Statistics (ONS) made significant revisions to its assessment of the economy’s performance since the pandemic.

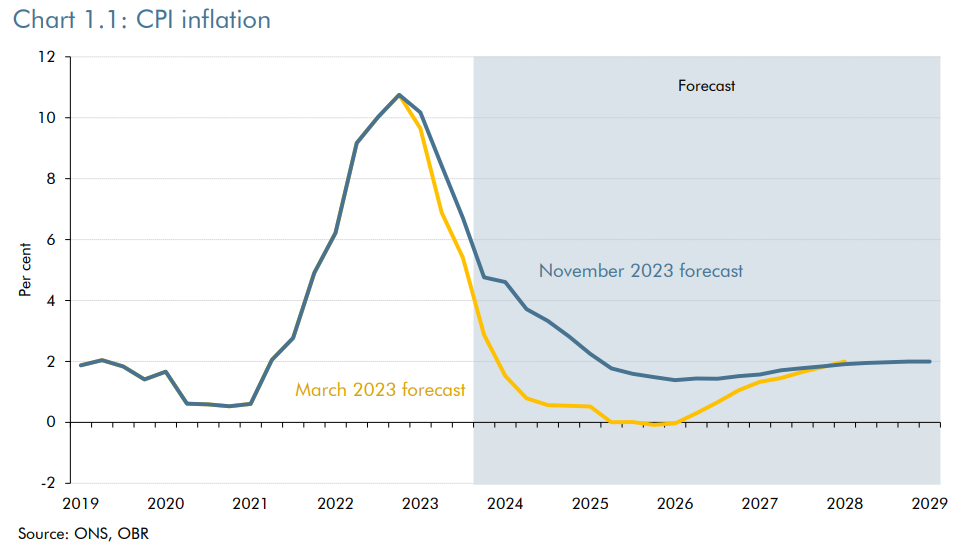

The expectation of higher interest rates comes as inflation is expected to remain more persistent than previously thought, not returning to its two per cent target until the first half of 2025. This was “more than a year later” than forecast in March, the OBR noted.

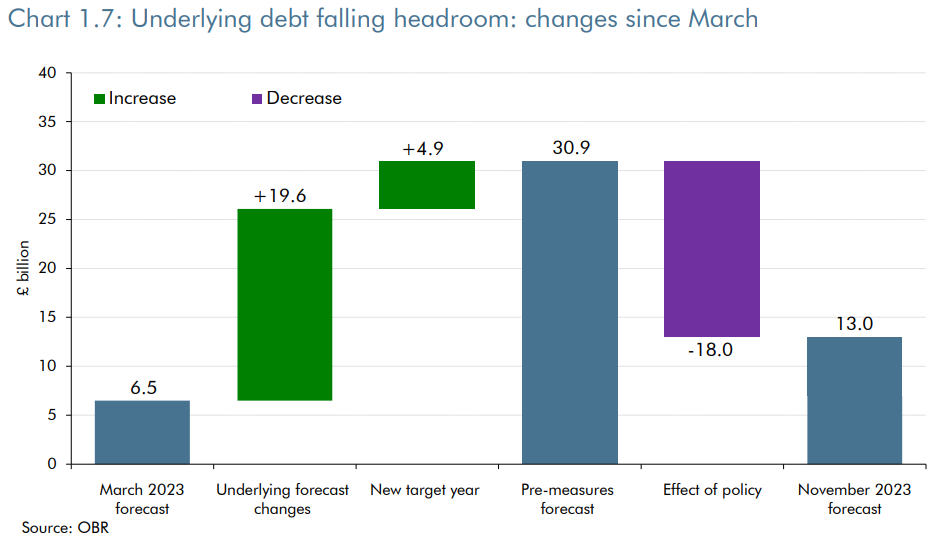

However, domestically driven inflation will also boost nominal tax revenues, which helps ensure the Chancellor meets his target of getting debt falling as a share of GDP in the fifth year of the forecast.

“More persistent, domestically generated inflation coupled with frozen tax thresholds raises premeasures receipts by £59.0bn by 2027-28, with just over half coming from higher income tax and NICs receipts,” the OBR said.

Combined with the Chancellor’s suggestion that departmental spending will remain largely unchanged despite the impact of inflation, higher tax revenue will reduce borrowing by £27bn in 2027-28 compared to the OBR’s March forecast.

The better-than-expected borrowing picture gave Hunt the fiscal space to deliver tax cuts for both businesses and individuals in the Autumn Statement.

The Chancellor cut National Insurance by two percentage points and made the full expensing of capital investment permanent, measures which cost almost exactly what the OBR had forecast the Chancellor had gained from the boost in tax receipts.

“Higher inflation has given him some extra tax receipts in the form of fiscal drag and he’s given it back to people in the form of a rate cut,” Richard Hughes, chair of the OBR commented.

The OBR forecast the announce measures provide a “modest boost to output of 0.3 per cent in 5 years,” although the full impact of the measures will not have filtered through by the end of the forecast period.

Even after the impact of the measures were taken into account, the Chancellor maintained £13bn in fiscal headroom – more than double the leeway he was afforded in March.