NY Fed increases short-term funding as US stocks brace for open

The Federal Reserve Bank of New York has ramped up the amount of money it provides in very short-term loans to the financial system in a bid to keep Wall Street steady amid a coronavirus-driven market rout.

The NY Fed today said daily overnight repurchase agreement (repo) operations will increase to $150bn (£115bn) from $100bn. The two-week operations on 10 and 12 March will also increase to $45bn from the current $20bn mark.

Big financial institutions fund much of their operations by borrowing money over very short time periods. But if these short-term money markets dry up – as they did in 2007-8 – it can put firms on Wall Street under extreme pressure.

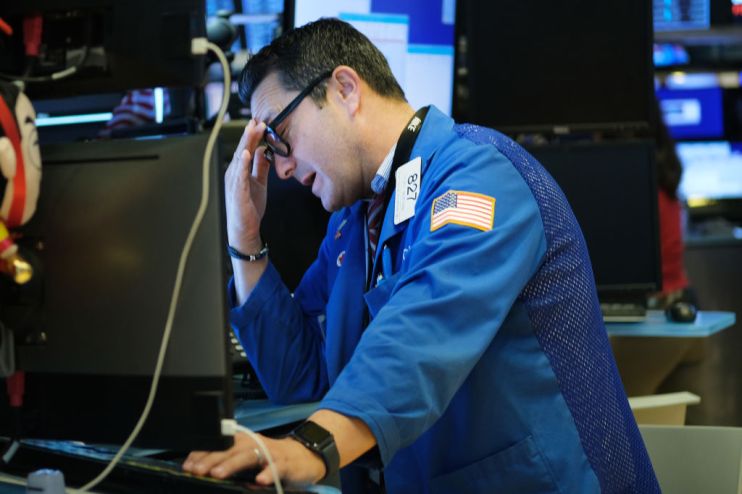

The US Federal Reserve’s moves come as it seeks to avoid a repeat of such a moment by ensuring there is adequate liquidity in the system and as Wall Street traders brace themselves for a steep stock market sell-off.

US stock futures fell as much as five per cent this morning as coronavirus panic gripped Asian and European stock markets, the lowest they are allowed to go before so-called “limit down” circuit breakers kick in.

Investors are increasingly betting that the Fed will slash interest rates once again after it cut them by 50 basis points (0.5 percentage points) in an emergency move last week.

According to CME Group’s Fedwatch tool, traders think a drastic 100 basis point cut is likely. The Fed’s target rate currently stands at one to 1.25 per cent.

Barclays analyst Joseph Abate said today’s move from the NY Fed was “meant to boost to confidence and prevent any future tightening in secured funding, rather than counteracting current pressure”.

He said it can “expand the level of bank reserves, immediately boosting market liquidity, without having to increase or shift its current bill purchases”.