Nvidia: Another stunning set of results for ‘the only stock that matters’

Nvidia has revealed another stunning set of earnings, reporting record sales of $22.1bn in its fourth quarter, ahead of analyst estimates, in a sign that the artificial intelligence (AI) boom is far from over.

The US based chip designer said its fourth quarter revenue soared 265 per cent from a year ago, when it reported its highly anticipated results after the Nasdaq closed on Wednesday.

Most of this was from data centre revenue of $18.4bn, up 409 per cent year on year.

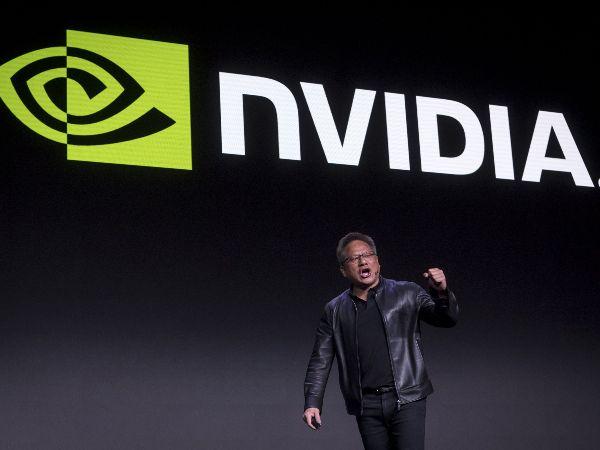

“Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations,” said chief executive Jensen Huang.

For the full year, his company recorded revenue of $60.9bn, up 126 per cent from 2023.

Shares jumped seven per cent in after hours trading immediately following the update.

Nvidia had guided fourth quarter sales to hit $20bn (£15.9bn), a major leap up from a year ago when it recorded revenue of $6.1bn (£4.8bn).

Analysts were also expecting another stellar earnings report as demand for Nvidia’s GPUs that power AI models has soared.

Hordes of countries and companies have been trying to get hold of as many chips as possible in the race for AI dominance.

“Nvidia is the only stock that matters for many investors at the moment,” according to Dan Coatsworth, investment analyst at AJ Bell.

A consensus of estimates forecast Nvidia to post a 240 per cent increase in revenue to $20.6bn (£16.3bn), driven largely by $17.06bn (£13.5bn) in data centre revenue.

Net income was expected to surge more than sevenfold to $10.5bn (£8.3bn) in the fourth quarter.

Although the stock has seen gains exceeding 200 per cent over the past year, it experienced a minor wobble on Tuesday as investors braced for potential disappointments in the results, locking in some profit.

Nvidia, which currently has over 90 per cent of the market share for AI GPUs, plans to release its next generation GPU called the B100 in 2024.