Not-so-golden quarter: Retail footfall slumps in another disappointing year

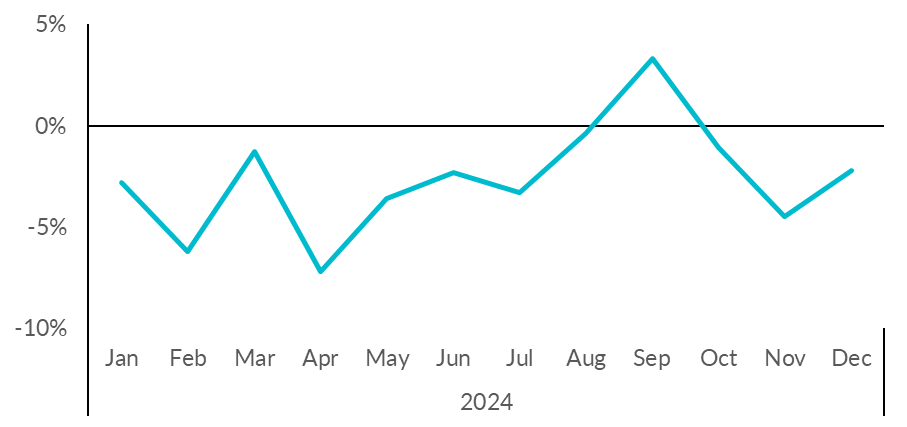

A dull December marked the end of yet another “disappointing” year for UK retail footfall as fresh data has revealed 2024 was the second year in a row to see a decline.

According to recent Sensormatic data by the British Retail Consortium, UK footfall fell by 2.5 per cent year-on-year during the three months to December, also known as the “golden quarter” trading period for retail.

The later timing of Black Friday this year meant that it aligned with December’s figures, rather than November’s, which resulted in slightly higher numbers than expected.

However, despite an increase in the number of consumers who headed to the shops in December, the numbers were not enough to end the year on a positive note.

Total UK footfall in December fell by 2.2 per cent year-on-year, which was up from a decline of 4.5 per cent in November.

In London, footfall saw a decline of 1.2 per cent, compared to a decline of 2.1 per cent in November.

“Lacklustre festive season”

High streets and shopping centres were hit the hardest due to changes in consumer preference and trends, Helen Dickinson, chief executive of the British Retail Consortium, said.

Dickinson added: “Even the golden quarter, typically the peak of shopping activity, provided little relief, with footfall down over the period.

“While the Black Friday weekend delivered more promising results, they were overshadowed by a lacklustre festive season.”

Consumer trends

The dual effects of the pandemic and the cost-of-living crisis, as well as the rise of technology on offer, have changed the way consumers are looking to shop.

As a result, a number of avid-shoppers have begun to look for more experiential shopping, which Dickinson said can be hard to offer due to a lack of investment in certain areas.

“Unfortunately, investment in town centres and high streets is held back by our outdated business rates system, which penalises town and city centres,” Dickinson said, emphasising the important of Government reform to business rates.

Dickinson added: “The Government’s proposals to reform business rates may ease the burden for some retailers, but it is vital that, ultimately, no shop ends up paying more in rates than before.

“With retailers facing £7bn in additional costs this year from increased tax and regulations, the changes to the business rates system must be made in way that supports retail investment and growth in the years ahead.”

Looking ahead, Andy Sumpter, Retail Consultant EMEA for Sensormatic, said innovation will be crucial for survival.

“Retailers will now need to look afresh to 2025 and chart a course to adopt innovative strategies to reverse this trend or maximise the sales potential of fewer visitors, finding new ways to make each store visit count,” Sumpter added.