North Sea oil and gas firms are struggling despite BP and Shell record profits, industry body warns

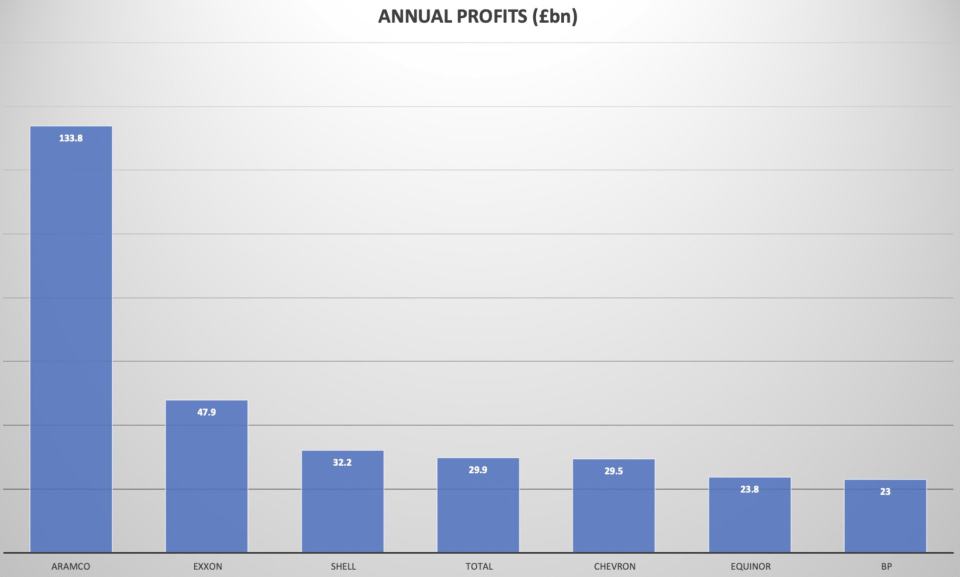

The record earnings of BP and Shell do not reflect the challenges most North Sea oil and gas producers face from the windfall tax, argued the UK’s leading offshore industry body.

Ross Dornan, market intelligence manager at Offshore Energies UK, told City A.M. that the bumper profits of energy giants have been generated from global trading following Russia’s invasion of Ukraine, with the UK footprint being less than ten per cent of their businesses.

This meant they could handle the impact of a windfall tax, while producers hedged in UK markets suffered huge hits to their finances – forcing them to drop projects which could boost generation and potentially ease energy bills.

He said: “Some of the global profits from and Shell BP are very eye catching but I think there has been a misunderstanding out there. Just because they’re UK headquartered on the FTSE as a PLC, I think people automatically assume that they’re making that money in the UK.”

Dornan also argued that the record oil and gas prices did not translate like-for-like in the UK industry, which was home to a declining continental shelf with tighter margins due to higher extraction costs and operating expenses.

“We need to make sure that we’re not trying to design our fiscal system in response to global profits, because those profits just simply aren’t accessible to the UK’s tax system. The reality on the ground here in the UK can be very different. We’re a more mature basin and we’re a bit more marginal than the global basins,” he explained.

The overall tax rate has risen from 40 per cent to 75 per cent in just 10 months for oil and gas companies after Rishi Sunak first unveiled the Energy Profits Levy as Chancellor last May, before it was hiked by Jeremy Hunt later that year.

This means the windfall tax has increased 25 to 35 per cent and sits on top of 40 per cent special corporation tax rate North Sea operators already pay.

While huge companies such as BP and Shell recorded vast profits in 2022 – suppliers have been pulling out of British projects after Chancellor Jeremy Hunt tightened the windfall tax.

An example of the disparity is Harbour Energy, which suffered a £1.3bn hit to its profits from the windfall tax, and has pledged to pivot from UK investments – where 85 per cent of its projects currently are

Meanwhile, companies such as Enquest and Total have pulled out of new developments in the North Sea – citing a poor investment climate.

Government considers changes to windfall tax as North Sea firms withdraw from projects

Hunt is now widely expected to bring in a price floor for the Energy Profits Levy, meaning the tax would only be active when oil prices were above ‘normal’ levels.

This follows concerns Equinor was considering pulling out of the mega Rosebank oil and gas field without reforms to the tax.

However, what constitutes ‘normal’ trading has yet to be agreed between government and industry.

Dornan argued investments and projects could become increasingly challenging for companies if oil prices slide from current levels.

He said: “When you start to move down towards $70 per barrel oil price, things become quite marginal within the UK. Many companies are hedged to even lower prices than the market rates. So, in the UK, it varies company to company, project to project, and asset to asset, but in many cases it’s marginal even at higher prices.”

As it stands Brent Crude is currently priced at $78.12 per barrel, after recovering from its slide earlier this month during the banking crisis, with WTI Crude trading at $72.96 per barre.

The energy expert’s comments follow OEUK’s publication of its Business Outlook report, which reveals nine out of 10 of North Sea operators are cutting back investment.

The companies cite a mix of high taxes, political uncertainty and inflation as key factors in their decisions.

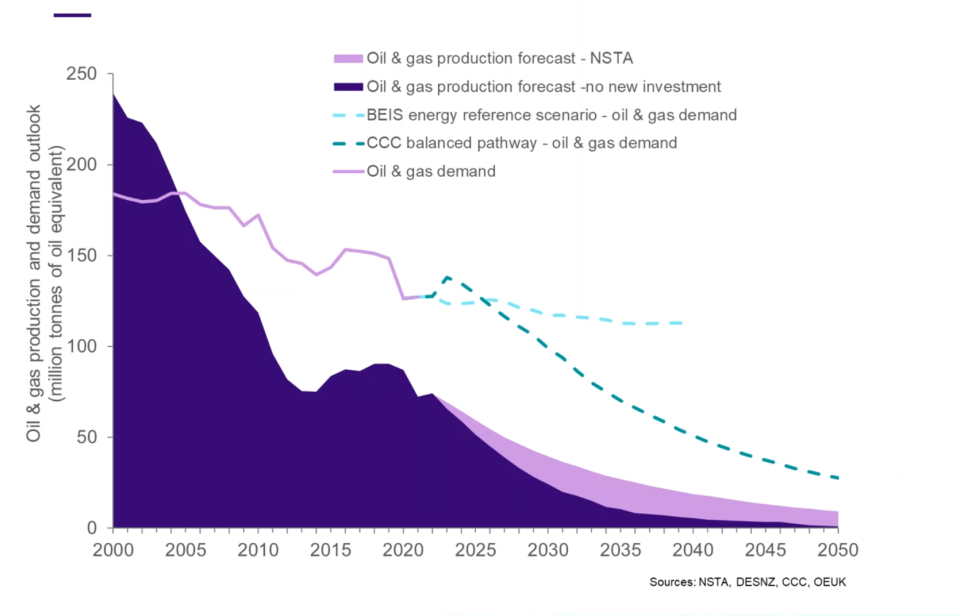

OEUK calculates that the North Sea could help power the UK for decades, but cuts in investment mean the UK’s potential oil and gas resources have immediately been downgraded, with 500m barrels less likely to be produced – enough to support the nation for six months (or same as one year’s North Sea output).

It warns that on current trends, imports will meet over 85 per cent of demand without new projects in the North Sea – with the UK already reliant on overseas vendors for half its supplies.

While production is set to fall regardless, to meet net zero goals, the speed of the drop-off in oil and gas development would accelerate and leave the UK highly dependent on LNG from overseas – which is highly carbon intensive.

In a vote of confidence for the industry, Harbour’s proposed development at Talbot gas field in the North Sea was approved by authorities yesterday.