Exclusive: North Sea firms urge Government to protect investment relief as windfall tax hike looms

North Sea oil and gas producers are pushing the Government to ensure investment relief is continued in line with any expansion of the windfall tax, warning that the industry is at risk of dwindling without a stable investment climate.

Industry sources told City A.M. that North Sea oil and gas firms have been in contact with the Government over the past few days, with senior executives urging the Government to keep the 80 per cent allowance to develop new projects and encourage further exploration in the UK.

They argued the investment relief was vital to maintaining confidence in the North Sea’s oil and gas sector amid political upheaval and frequent changes to the tax regime.

Investment relief within the Energy Profits Levy allows companies to receive as much as a 91p saving for every £1 they invest in domestic energy projects.

Pressure on Downing Street from the North Sea industry comes amid growing expectations the Energy Profits Levy will be toughened up and extended – this time to a fill a gaping £50bn fiscal black hole caused by borrowing and soaring inflation.

City A.M. understands the tax is likely to be extended from 2025 to 2028 and ramped up 10 percentage points from 25 to 35 per cent, as first reported in The Times.

It is still unclear whether investment relief will be expanded, to match the longer duration.

This would take the overall tax rate for oil and gas operators in the North Sea to 75 per cent, when combined with the special corporation tax rare of 40 per cent.

Labour has called for the windfall tax to be backdated until January – rather than May when it was first introduced – and for investment relief to be scrapped entirely.

The latest developments follow both Offshore Energies UK (OEUK) requesting an urgent meeting with Chancellor Jeremy Hunt, and a group letter from Brindex – which represents 20 independent oil and gas firms – which slammed any expansions of the tax as “disastrous” for the industry.

Government weighs up North Sea priorities

The Government is currently sounding out MPs over potentially toughening up the windfall tax with MPs ahead of the Autumn Statement next week, with the possibility of a smaller five percentage point rise also on the table.

It is grappling with the need to maintain Britain’s supply independence while also shoring up the nation’s finances and easing immense pressure on households dealing with soaring energy bills.

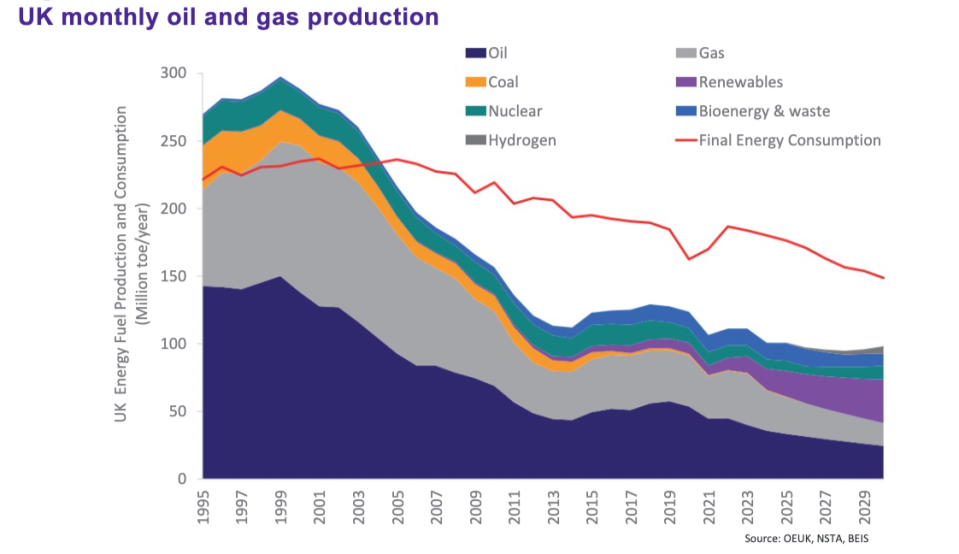

Currently, domestic oil and gas meets around half the country’s needs (45 per cent), and relies on Norway as its chief overseas partner (38 per cent).

Without further exploration and projects, the continental shelf will become a dwindling asset – with the Government pushing for further development of the sector in its energy security strategy, which was unveiled in April earlier this year following Russia’s invasion of Ukraine.

Development and exploration of the UK’s continental shelf feature prominently in the Government’s energy security strategy – which was unveiled in April earlier this year following Russia’s invasion of Ukraine.

The Government recently green-lit a new licensing round for oil and gas companies in British waters, with the bidding process overseen by the North Sea Transition Authority (NSTA) – and is set to divvy out over 100 licences covering 900 locations between now and the end of the auction in January.

The Climate Change Committee, Westminster’s independent advisory group, predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.

The UK’s continental shelf is a mature basin, and the NSTA has warned in its recent resources report that without further exploration, the country faces a cliff edge in production decline and increased reliance on imports.

OEUK has calculated that without renewed investment in fresh projects and developments, the country could be reliant on overseas partners for 80 per cent of its gas and 70 per cent of its oil – a supply security risk and a knock for the economy.

Energy net import costs have increased five-fold over the past 12 months, with the UK facing a £39bn bill for importing oil, gas and electricity between January and September, according to the latest Government statistics.

However, this has to be balanced alongside severe financial difficulties for households caused by rampant inflation and soaring energy prices – with oil and gas majors raking in record profits from a Kremlin-fuelled commodities boom.

Energy bills have climbed to £2,500 per year despite historic Government interventions, with Cornwall Insight forecasting the cap will rise to an eye-watering £3,702 per year in April when the support packages conclude.

Meanwhile, the Bank of England is forecasting the deepest recession in recorded history, beginning this winter, with inflation currently above 10 per cent.

OEUK has dubbed the latest hike a “supertax” and revealed its members were shocked by the latest reports of an expanded levy.

An OEUK spokesperson said. “Imposing sudden extra taxes will make it even harder for these companies to invest in UK energy production – both the gas and oil we need today, and the wind, hydrogen and other low-carbon energies we need to reach net zero by 2050.”

“Driving investment out of UK waters into other countries will increase reliance on imported energy, reduce the tax flow to the Exchequer, and make it even harder to increase our domestic production of lower-carbon energies.”

The Government has been approached for comment.