Nor way! British gas prices soar as maintenance issues curb Norwegian flows

Gas prices have spiked across European benchmarks with maintenance issues curbing Norwegian gas flows to Britain, while festering concerns of supply shortages from Russia also powered commodity rallies.

UK Natural Gas Futures have soared 11.4 per cent while Dutch TTF Gas Futures have risen 5.4 per cent, with prices already elevated above market norms this year.

Norwegian flows to Britain dropped on Wednesday morning amid the start of maintenance at the giant Troll gas field and the Kollsnes processing plant.

While the UK unveiled its energy security strategy earlier this month, pledging further North Sea oil and gas exploration, the country remains highly dependent on overseas suppliers.

Norway is a key provider of gas to the UK, representing around 60 per cent of its imported gas volumes.

The underwater Langeled pipeline, which transports gas from the UK to Norway provides 25.5bn cubic meters of gas every year.

Nathan Piper, head of oil and gas research at Investec, told City A.M. that the situation was exacerbating already tight markets.

He said: “Despite reduced gas demand for heating across the UK seasonal maintenance in Norway reducing volumes is pushing prices higher. This is set against a backdrop of an already tight UK and European Union (EU) gas market with the potential for gas to be included in the next round of EU sanctions on Russia.”

Ole Hansen, head of commodity strategy at Saxo Bank argued there was no “short-term risk of gas shortages emerging”, and suggested the reduction from Norway is temporary and should not last for more than a couple of weeks, with the maintenance works being a season occurrence.

However, he warned that “we are nowhere near out of the woods just yet with EU gas for the next two winters showing no signs of easing”.

He explained: “Buying gas in spring and summer with the idea of selling it at a profit during the peak winter demand period is currently not working. In other words, gas inventories need to be built with gas trading at higher levels than the period where it will be sold to consumers during the winter months.”

EU ramps up pressure on Russia as it considers oil sanctions

Over the winter, steady flows of liquefied natural gas (LNG) have continued to balance supply, with the continent increasingly reliant on the energy source to meet consumer demand.

The West has ramped up sanctions on Russia following its invasion of Ukraine, and has begun targeting its energy supplies.

The US has banned all Russian fossil fuels, while the UK has announced plans to phase out Russian oil and coal imports by the end of the year.

Meanwhile, the EU has also banned coal imports, and is weighing up an oil ban – with the bloc still split over the measure.

This has raised the prospect of potential EU sanctions on Russian gas, with the trading bloc remaining Gazprom’s biggest buyer.

It relies on Russia for around 40 per cent of its natural gas supplies.

While Russia has insisted it is committed to global markets, the Kremlin has retaliated to Western measures with President Vladimir Putin signing into law requirements for overseas buyers to pay for Russian energy supplies in roubles.

Craig Erlam, senior market analyst at OANDA, said: “Flows from Russia to Europe remain the key source of concern, given Putin’s rouble demands and the bloc’s refusal to accept them. As it is, there has been no major disruption but traders will continue to monitor the situation very closely.”

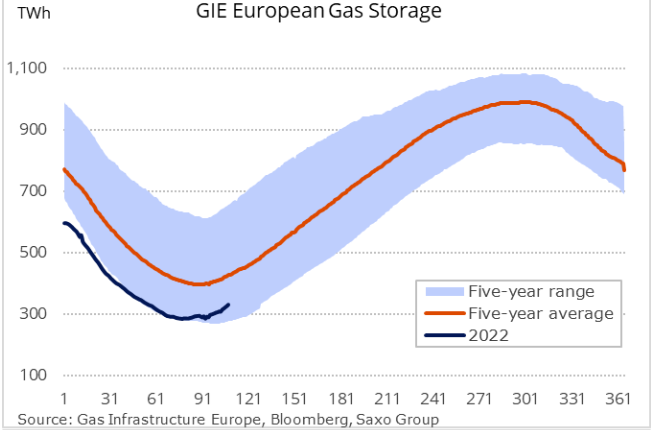

The EU has set requirements for its member states to ensure energy storage is topped up at 80 per cent of capacity by November 1.

EU gas storages were 29.2 per cent full as of April 18, data from Gas Infrastructure Europe showed.

Separately, research from Cornwall Insight suggests energy prices in the UK will remain in excess of £100 per megawatt hour (MWh) annually until 2030.

It expects prices to rise to £150/MWh in winter 2025, due to closures of nuclear power stations, delays to Hinkley C, and increasing high-cost peaking capacity.