Nokia’s fall after the patent license arbitration with Samsung shows investors overreact wildly to intellectual property news

When Nokia released information about the outcome of its patent licensing arbitration with Samsung, its share price fell by over 10 per cent within hours. This is not the first time that stock prices have reacted in an unpredictable fashion to intellectual property (IP) news.

The poster child for this mispricing was when GoPro stock fell by 12 per cent on the grant of a single Apple patent. While universally accepted, in retrospect, to be a gross over-reaction, it provided yet more evidence pointing to a simple fact: investors don’t have access to the kind of IP data they need if they are to digest news relating to intellectual property in a more measured fashion.

Further evidence came in the form of Kyle Bass, whose fund launched attacks on the patents owned by Shire, Biogen, Calgene and others last year.

The point here is simple. If the importance of patents is not understood, how can you measure the impact of losing one?

That is actually two questions, both of which are worth considering.

First, does this matter? My view is it matters now more than ever. For more than half of all listed companies, intangible assets account for up to 70 per cent of enterprise value – and for many companies a large part of this is attributable to patents. This is relevant to pharma/biotech and technology sectors, and equally to a range of others including media, automotive, fintech, defence and capital goods.

Read more: Unicorn or donkey? Forget mythical valuations to spot a good startup

Secondly, how can the information deficit be addressed? As so often is the case, the answer is in the data.

Don’t let people kid you that patents are for scientists and specialists only. There are many objective measures of quantity and quality that can support financial analysis.

Back to Nokia. The news was that as a result of the Samsung award, Nokia Technologies would increase its 2015 earnings to over €1bn (up from €578m in the previous year), and that there was at least another €1.3bn to come in the next couple of years.

Did this justify the dramatic repricing? Did anyone look at the underlying patent data? Alcatel-Lucent was never part of Nokia Technologies future (ALU’s portfolio is largely unrelated to Standard Essential Patents (SEPs)), so why does ALU take a hit?

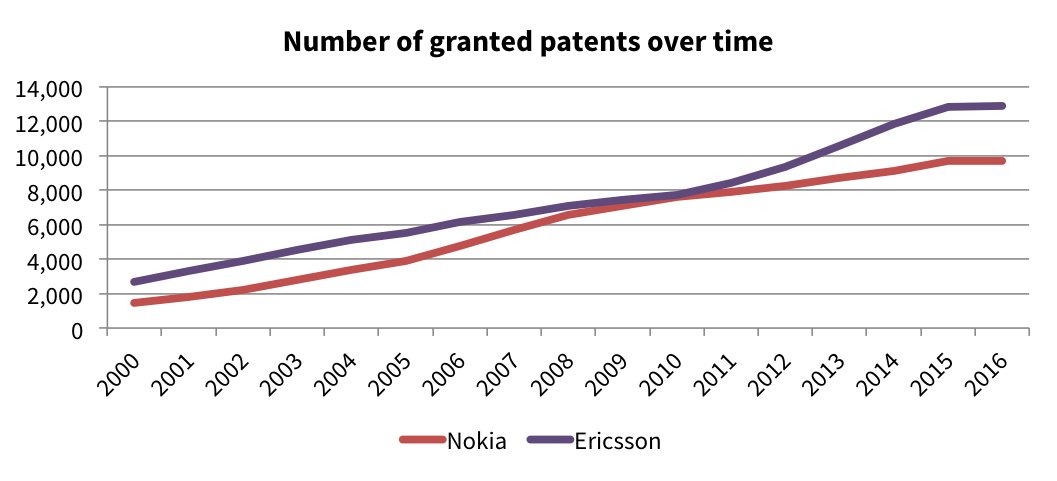

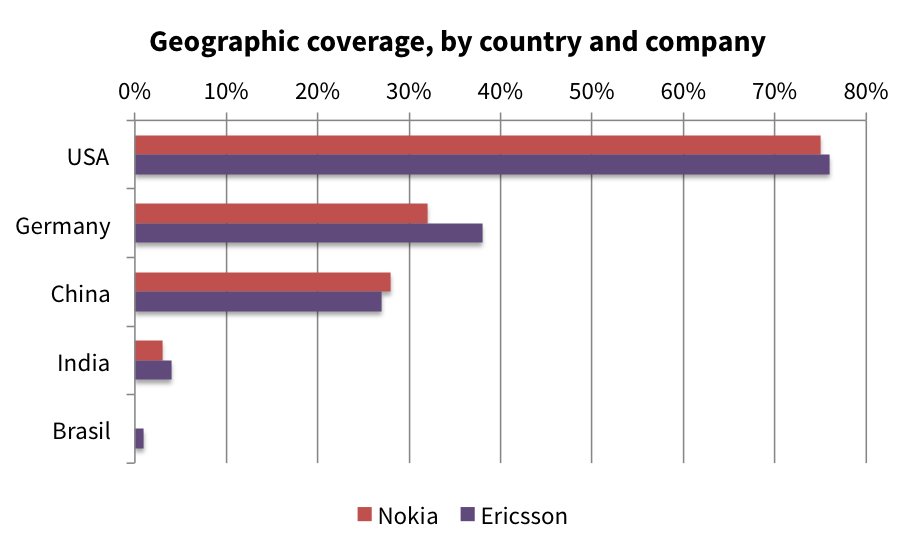

Compare Nokia’s patent portfolio with Ericsson’s.

Whether one analyses the two according to portfolio over time or on a geographic coverage basis, you can fairly conclude that they are similar.

This suggests that when Nokia finalises its arrangements with LG, Apple and others, it will end up in the same place.

On what basis do the markets conclude otherwise?

While it fair to say that the Nokia announcement could have been clearer, the investor community has the opportunity to engage with IP data in preference to the cycle of over-reaction and then correction which too often occurs in this area.

Let’s hope it does just that, sooner rather than later.